Bitcoin: whale boom after FTX crash

The failure of FTX appears to have caused a full-scale whaling race to grab Bitcoin and Ethereum.

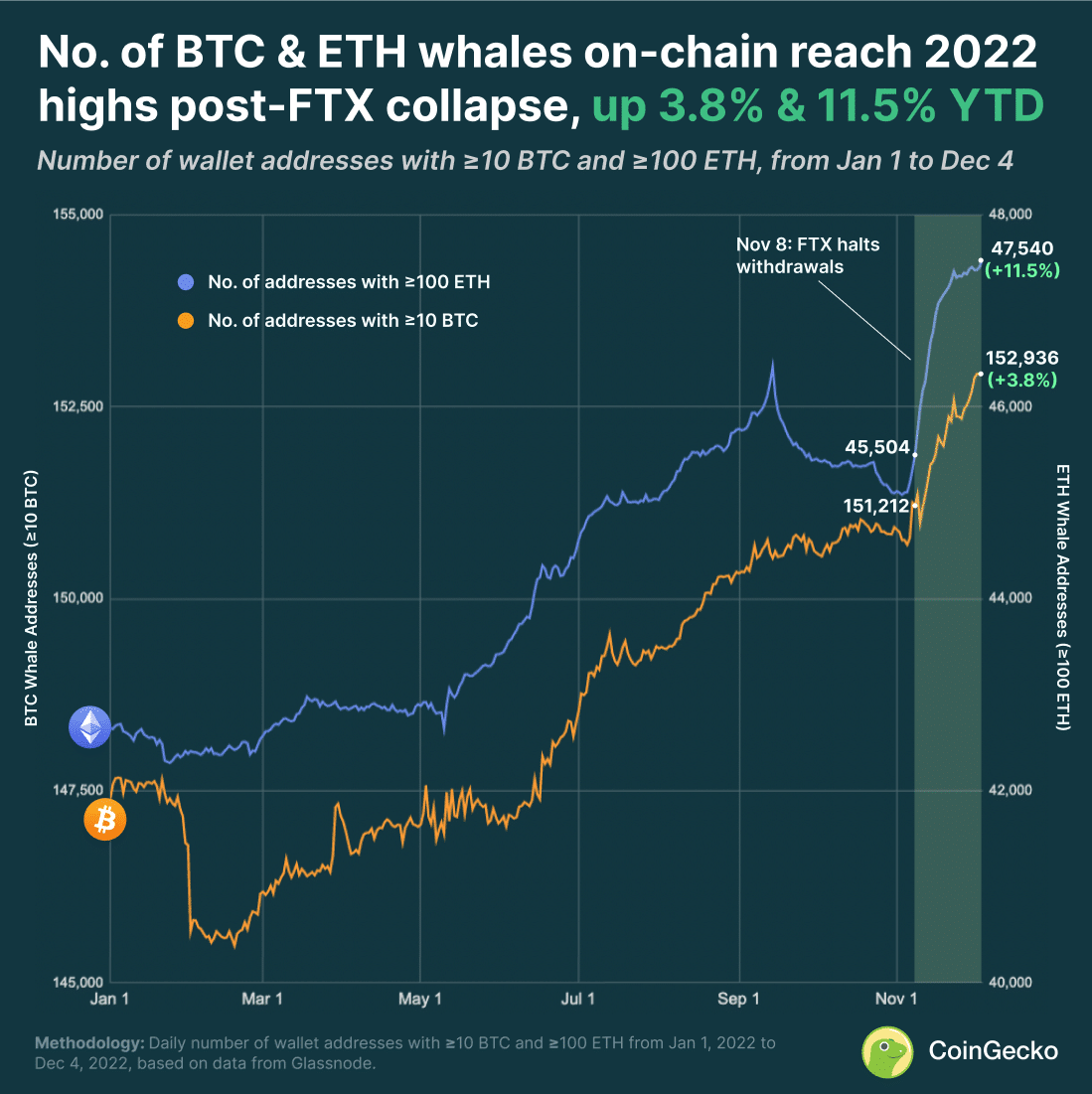

This is shown by CoinGecko’s recent study “How Many Crypto Whales Have BTC or ETH On-Chain?” which shows a clearly telling graph.

The graph of Bitcoin whales after the collapse of FTX

Two curves are shown in this graph

The orange represents the change over time in the number of existing addresses on the Bitcoin blockchain by more than 10 BTC.

To be fair, 10 BTC is too few to qualify as whale addresses, but it gives an idea of how the largest Bitcoin owners behave to the exclusion of small retail investors.

The purple curve, on the other hand, represents the change over time in the number of existing addresses on the Ethereum blockchain with more than 10 ETH.

It is immediately noticeable that from February this year these two curves started to increase. This dynamic shows that the whales probably started to gather as early as March, when the price of BTC was just under $40,000.

In fact, between May and June, this growth had stopped, probably related to the fear caused by implosion of the Terra/Luna ecosystem and the failure of Celsius, Voyager and 3AC.

By July, however, growth had started again, up to a temporary annual peak between September and October.

While between late October and early November, a reversal occurred, with whales abandoning BTC and ETH when Bitcoin’s price was around $20,000.

But then came the cover.

The failure of FTX and the accumulation of Bitcoin

Right around the time of the beginning of the collapse of the price of FTT, i.e. the FTX token, these two curves really started to rise.

As soon as Bitcoin’s price fell well below $20,000, the number of whale addresses began to rise rapidly and significantly, until the end of November.

As for Bitcoin’s curve, the number of public addresses with at least 10 BTC at the end of October was just under 151,000, while by the end of November it had skyrocketed to nearly 153,000.

From the February low of 146,000 to the end of October, there had been a 3.4% increase in eight months, while the increase in November alone was 1.3%.

In percentage terms, the increases on ETH’s purple curve are even greater, with a 5.8% increase from February to March, and a 5.5% increase in November. However, a first peak had already occurred at the beginning of September, so that the growth from that point was only 2%.

The cumulative increases in this parameter during 2022 turn out to be 3.8% for Bitcoin and 11.5% for Ethereum, with today’s values also being the annual highs.

Specifically for Bitcoin, the high is now 152,936 addresses with more than 10 BTC as of December 4, with 5,541 more addresses since the beginning of the year.

The reasons

According to CoinGecko, there could be several reasons behind this dynamic.

The first they cite concerns those whales who, after the collapse of the centralized FTX exchange, began withdrawing their money from centralized exchanges and moving it to self-custodial wallets. This would explain how quickly this phenomenon occurred in November.

But CoinGecko also cites another possible reason, namely the buying of BTC and ETH by whales to boost Bitcoin and Ethereum wallets, taking advantage of falling prices.

Although the first of these reasons clearly justifies the November boom, it does not, however, justify the earlier growth. In fact, especially with regard to Bitcoin, nothing similar happened when Celsius and Voyager failed.

So the phenomenon as a whole is probably mostly due to the second reason, on an annual basis, although the first in November may have played a bigger role.

The timing

CoinGecko traces the beginning of FTX collapses back to November 6, which was the day Binance’s CEO posted the tweet announcing that he would be selling all of their FTT tokens. At that time, the number of Bitcoin whale addresses was 150,792.

When FTX stopped withdrawals two days later, they had already increased by 420, most likely due to BTC withdrawals from exchanges.

On November 10, this number had fallen slightly to 150,988, likely due to the collapse in Bitcoin’s price, but by November 23 it had risen to 152,583.

So the biggest growth there was after Bitcoin’s price hit annual lows on November 10th, and not during the FTX collapse. It is also worth mentioning that there were days when many feared that other centralized exchanges could also fail.

CoinGecko points out that the number of Bitcoin whale addresses in November increased at least 4 times faster than the annual average. In fact, after the FTX collapse, it increased at an average daily rate of +64 addresses per day from November 8th to December 4th, while the overall average during 2022 was +15 addresses per day.

For ETH, it went from +14 to +75 addresses per day.

Moreover, it remains clear that those who take their tokens from exchanges to store them on a self-storage wallet are most likely doing so to store them in the medium to long term, i.e. without the goal of reselling them soon.