Bitcoin value falls below $30,000

Bitcoin’s value in recent days has seen a correction from the local peak of $31,000, touched on April 14, to the current $28,000.

Meanwhile, many BTC belonging to wallets linked to the now-defunct Mt. Gox cryptocurrency exchange returned to the network after being dormant for 10 years.

What’s up?

Full detail in this article.

Bitcoin’s value falls below $30,000: more than 2,000 BTC associated with Mt. Gox return active

Bitcoin has struggled to hold its price above $30,000.

Over the past 3 days, Bitcoin’s value has fell 8.25% while it waits to find a support zone within the $27,000 to $28,000 range.

Nothing serious apparently in a market as volatile as cryptocurrencies, given and considering that from the middle of last week BTC was up more than 35%.

Meanwhile, a very interesting detail stands out to the eye in this price correction phenomenon.

According to on-chain data, one address transferred multiple Bitcoin values 60 million dollars after being inactive for 10 years.

In detail, this is 2,071.5 which has been dormant since December 19, 2013.

The most striking thing, however, is the fact that these Bitcoins belong to an address linked to Mt. Gox saga.

Also, the same address is linked to two wallets that made a transaction of 10,000 BTC last summer after 9 years of inactivity.

The news has been making the rounds among Bitcoin protocol supporters and crypto news outlets.

Blockchain researcher Taisiathe administrator of the Telegram channel “GFISchannel”, believes that these addresses may be connected to the hacking of the defunct crypto exchange that caused some 850,000 BTC disappear, the highest number recorded in a cryptocurrency cyber heist.

According to on-chain analysis expert Taisa, the wallet in question could belong Jed McCaleboriginal owner of Mt. Gox and founder of Ripple.

If this indiscretion is confirmed, it will be a scandal for the crypto community, since McCaleb sold Mt. Gox in 2011 to Mark Karpelès and after 3 years the latter company declared bankruptcy.

How did McCaleb come into possession of these BTC and why is his address linked to the exchange hack? What if he was the one who hacked Mt.Gox?

Did the value of Bitcoin fall due to the sale of these BTC?

Many people think so the sale of 2,071.5 BTC which remained dormant for several years caused a fall for Bitcoin’s value.

However, this probably wasn’t the trigger for BTC retracement.

If we compare the size of the movement of these funds with the trading volume of Bitcoin in the last 24 hours, we realize the big difference in the magnitude of these numbers.

In fact, $60 million does not compare to the $21 billion traded on the last trading day.

Much more likely to cause the price drop were other factors, for example negative effect generated by unstaking of ETH after the Shapella update.

Or, as mentioned above, is the fall in the value of Bitcoin should not be explained by any particular eventbut simply because there has been more selling than buying, and this has led to a drop in prices in a market that is so volatile and so illiquid at this time.

What is certain is that the sale of the more than 2000 BTC related to MT. Gox is not the cause of these recent moves.

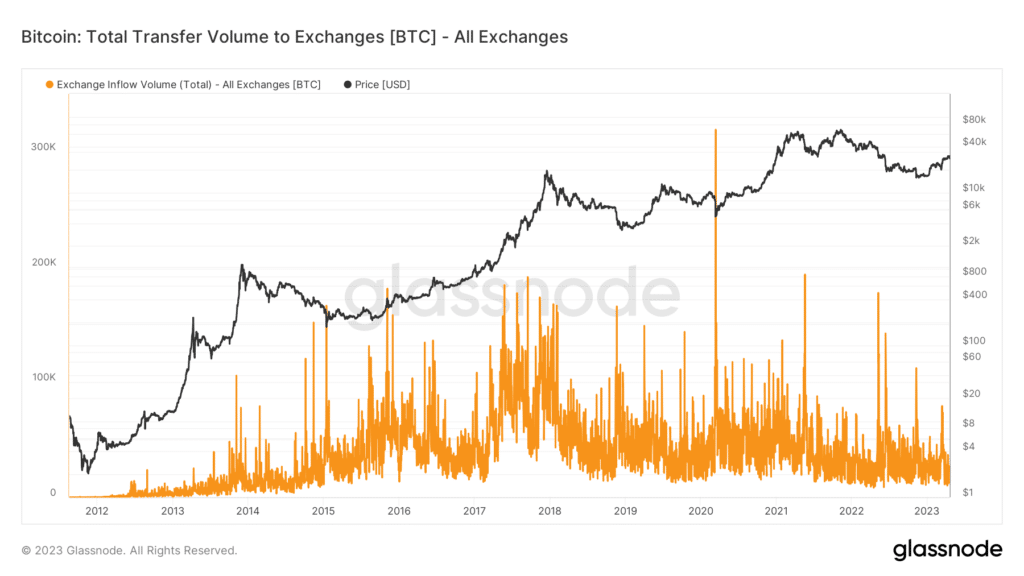

In support of this, it is interesting to note that the recent influx of Bitcoin poured into all exchanges is decidedly low compared to days when deposits exceeded 150,000 BTC threshold.

On April 19, the day when the switch of dormant Bitcoin took place, there was one decidedly low inflow on the stock exchangesunder 25,000.

This means that the news did not cause massive selling on the stock exchanges.

How many BTC were trapped inside Mt. Gox?

Before we touch on this sensitive point, let’s take a step back in history.

For those who don’t know, Mt. Gox was one of the first and largest crypto exchanges in the 2010-2014 era, handling over 70% of the trading activity on Bitcoin and all other cryptocurrencies.

At that time, there were not many crypto service providers, therefore Mt. Gox the “safest” and most convenient choice for investors.

In February 2014, the biggest hack in crypto history happened, theft 850,000 BTC from the interchange, although Mt. Gox had also been subjected to other attacks in 2011.

The stock exchange is owned by Mark Karpelès declared bankrupt and a long legal battle began between creditors and bankruptcy attorneys.

After 7 1/2 years, the repayment plan began for users who had funds on Mt. Gox before it was hacked.

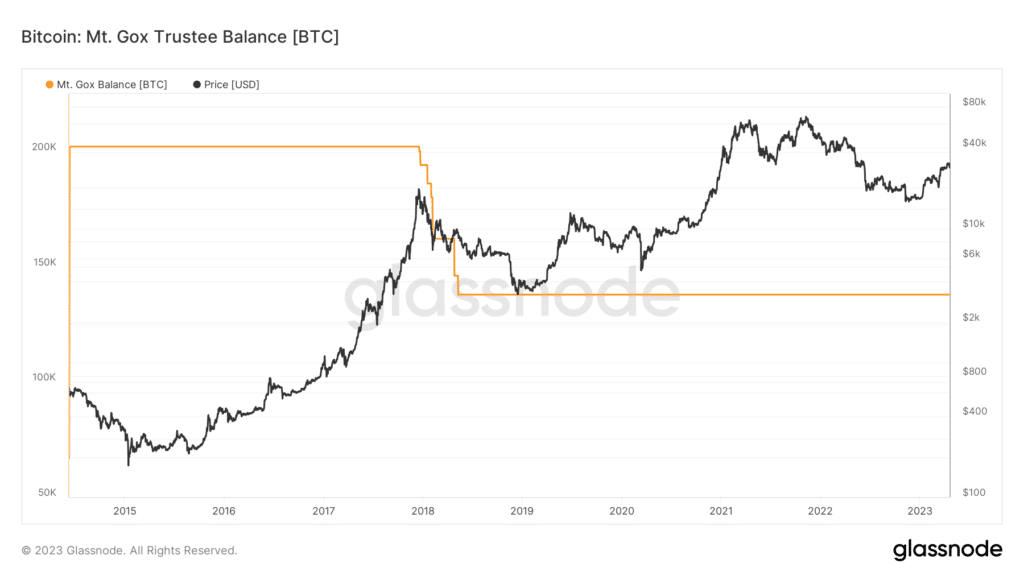

Meanwhile, 202,105.97 BTC has been recovered and partially sold to return the lost amount to investors.

To date, there are 137,890.98 BTC left in Mt. Gox saga that will be liquidated over time.

The remaining 64,214.99 BTC was sold by Mt. Gox Trustee between December 2017 and May 2018.