Bitcoin stakeholders with over $1,490,000,000 in BTC at high capitulation risk, research firm Glassnode warns

The leading research firm Glassnode warns that a certain group of Bitcoin holders who together own almost 1.5 billion dollars in BTC are in danger of capitulating.

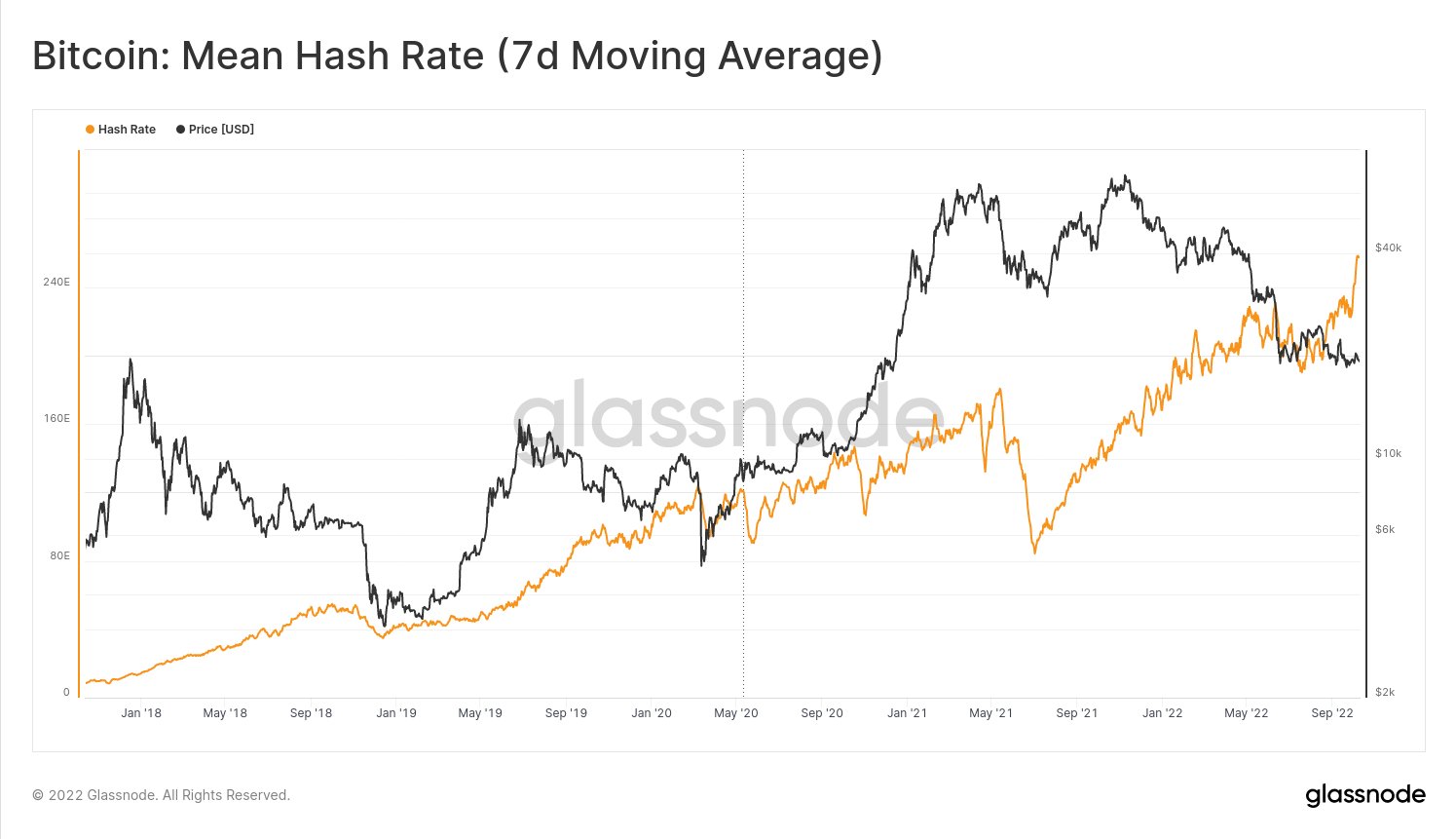

Glassnode says Bitcoin’s hash rate, which measures the processing power of the royal crypt’s network, is at an all-time high.

While a higher hash rate indicates an increasingly robust network that is more secure against an attacker, Glassnode says that an increase in network hash power puts BTC miners in a financially precarious situation.

“Bitcoin Difficulty has adjusted to a new all-time high due to a rapid increase in the network’s hashing power. This increases the BTC cost of production, putting additional stress on miners.”

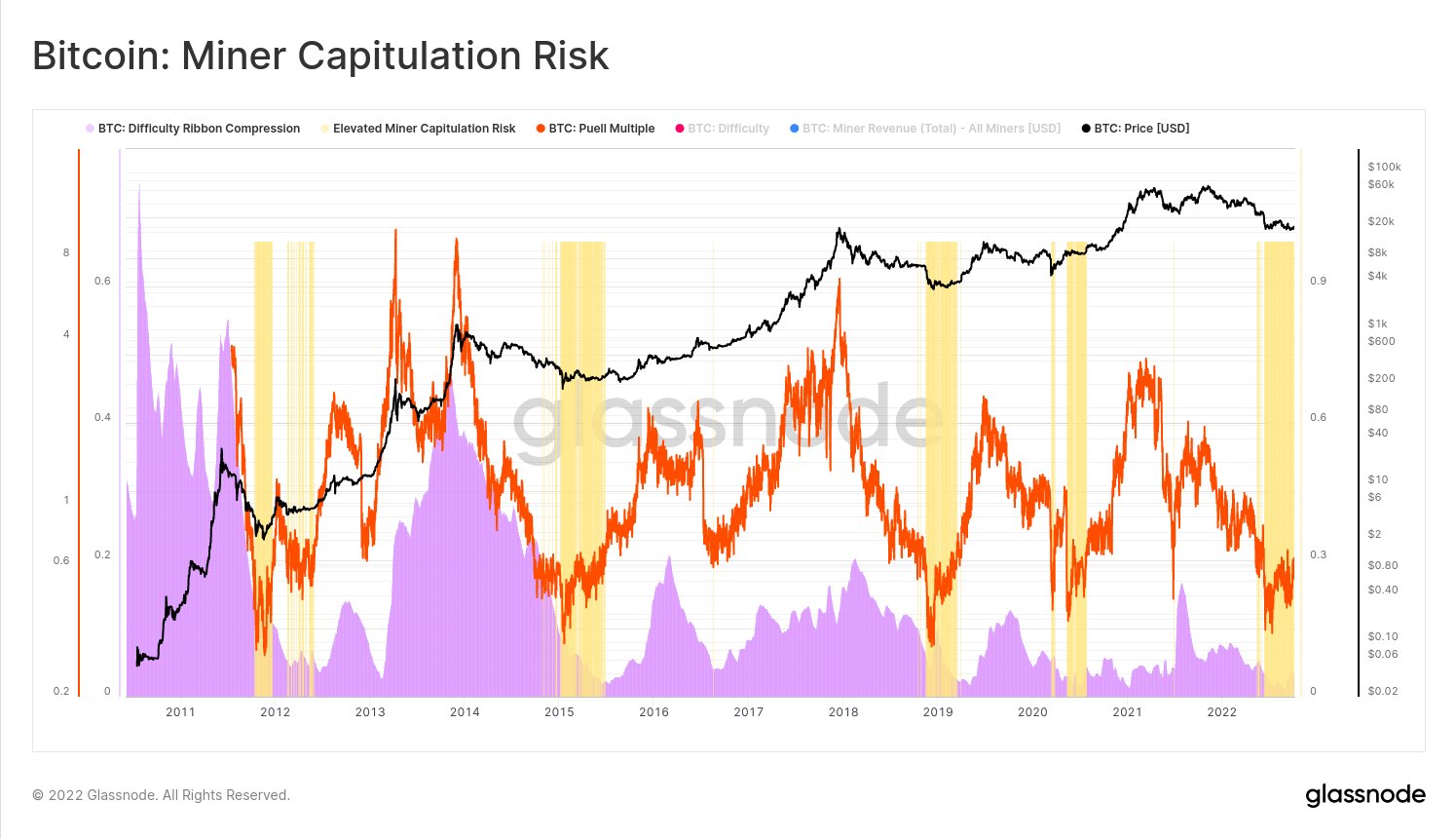

According to the research firm, the estimated cost of producing Bitcoin from mining operations is now stands to $19,300, above BTC’s current price of $19,067. Glassnode says that the combination of increased production costs and low BTC price suggests that miners are at high risk of capitulation.

“This culminates in higher Miner Capitulation Risk, which we capture in a tool that tracks Puell Multiple and Difficulty Ribbon Compression.

When both metrics are low, it indicates an elevated risk of Bitcoin miner capitulation.”

Puell Multiple is a metric that looks at BTC miner earnings, while difficulty band compression is an on-chain indicator that uses simple moving averages of Bitcoin network difficulties to determine the impact of miner selling pressure on the kingcrypt price.

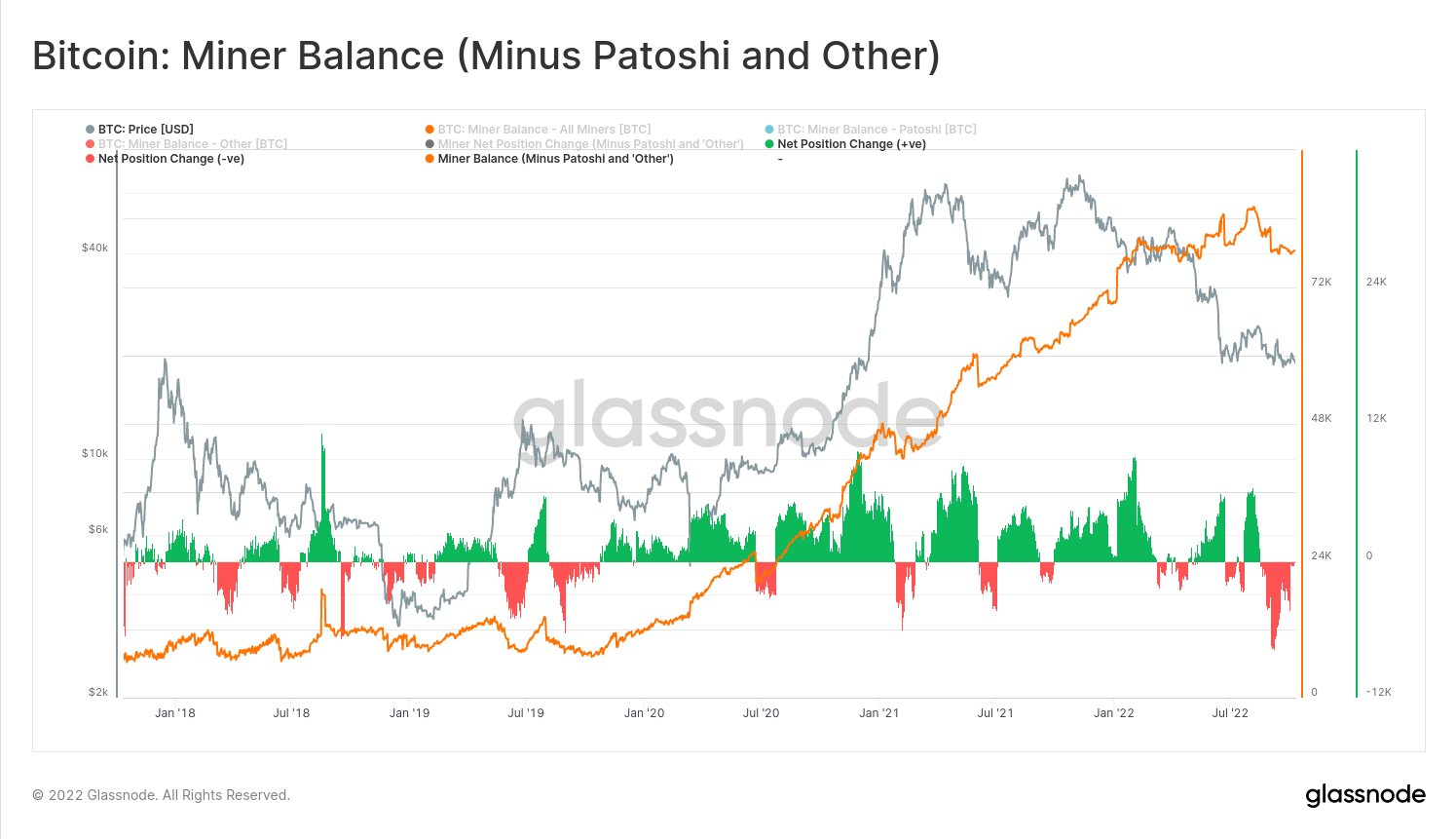

Glassnode also highlights that in recent months, BTC miners have been actively selling off their stash.

“Bitcoin miners currently hold around 78,200 BTC ($1.49 billion) in their coffers, which have increased in total since mid-2019.

The past few months have been the most notable slowdown in mining growth in the past three years.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/Jorm S