Bitcoin Recovery: Yes, it can be done – and legally, too

You have been lied to. Don’t worry, but you’re not alone. It’s one of those cases where if a factoid is repeated enough times by enough people, our mammalian brain will take the cognitive shortcut of simply believing the factoid given that apparently many others have accepted it as truth as well.

But today, one of the biggest assumed truths about digital currency has finally been dispelled: Bitcoin is now recoverable.

Wait, what? Yes, you heard that right, lost or stolen bitcoins can now be recovered through a legal process, breaking one of the most fundamental principles that “crypto” advocates everywhere have been shouting from the top of their soapboxes for the past 12 years.

But how is this possible?

Well, truth be told, it has always been technically possible. The problem was practically getting all the block producers to enforce the rules and do so in a way that is compatible with existing legal systems. Just doing the technical part without legal backing would be no different from theft.

Last week, the Bitcoin Association for BSV, an open, non-profit organization for Bitcoin advocacy, released software called Blacklist Manager, which can manage the coordination between miners (those who produce blocks) to enable the freezing of coins by court orders issued by the government and digitized by a registered notary service.

This means that if one has been a victim of digital currency theft, a legal process to claim the stolen coins can be undertaken, which ends up with the coins being frozen on the blockchain and unable to be moved. This is similar to features available to centralized ledgers like Tether or XRP, which often freeze accounts based on a reported hack.

Up until this point, virtual currency advocates have always believed that the ability to freeze native tokens to a public blockchain is impossible due to the decentralized nature of the system, but today that has been proven false. The problem was never about decentralization making it impossible for coins to be recovered or frozen. It was really just a matter of coordination among the block makers. This software allows the coordination to be done easily and automatically by the miners.

When faced with the fact that this kind of “supervisory monitoring” is possible by some technical proponents in the past, the response from the larger digital currency community has always been that thousands of independent parties run non-mining nodes on the Internet. would prevent miners from trying to coordinate a task of freezing coins. This is simply because the passive nodes would self-censor themselves outside the legal chain and refuse to forward transactions changed by the miners in this way.

This threat has never been followed through in practice, and in addition the premise has always seemed a little weak in theory, similar to the idle threats of someone standing on a ledge threatening to jump.

In the end, a threat to jump and “remove oneself” from a system is just a form of boycott, which any good capitalist understands as a valid way to object to certain behavior. And like a boycott, it only works when enough of an economic majority moves together to exercise the boycott.

Thus we can see why such empty threats in the past by BTC movements like the “UASF” group have spent so much time and energy publicizing and influencing the public mind to draw more people to their cause. They even went so far as to turn Bitcoin from a system maintained by the miners who support the network to a system where the ‘users’ were now in control. (Very Marxist thinking).

Ultimately, the only threat they pose is the threat of public backlash in social media channels, which affects miners’ bottom lines by tarnishing their online reputation among potential customers. This threat only affects miners because they are in such close competition with each other that no one can risk losing ground to their competitors.

“IT’S A TRAAAP!!!” — Some space fish, in a space film, about some space wizards.

In the end, it was all basically a psyop, engineered by those who were to make the most of the belief that Bitcoin transactions, and even THEFT, are irreversible, untraceable and therefore – a money free-for-all without the intervention of the state.

Like many stories involving utopias, this utopian dream was a dystopia in disguise, as anyone who has read Orwell will recognize. While we were told not to trust the government’s ability to freeze coins, we were told not to question a company that doesn’t even have a registered office to freeze an entire blockchain because of what they arbitrarily deemed a hack .

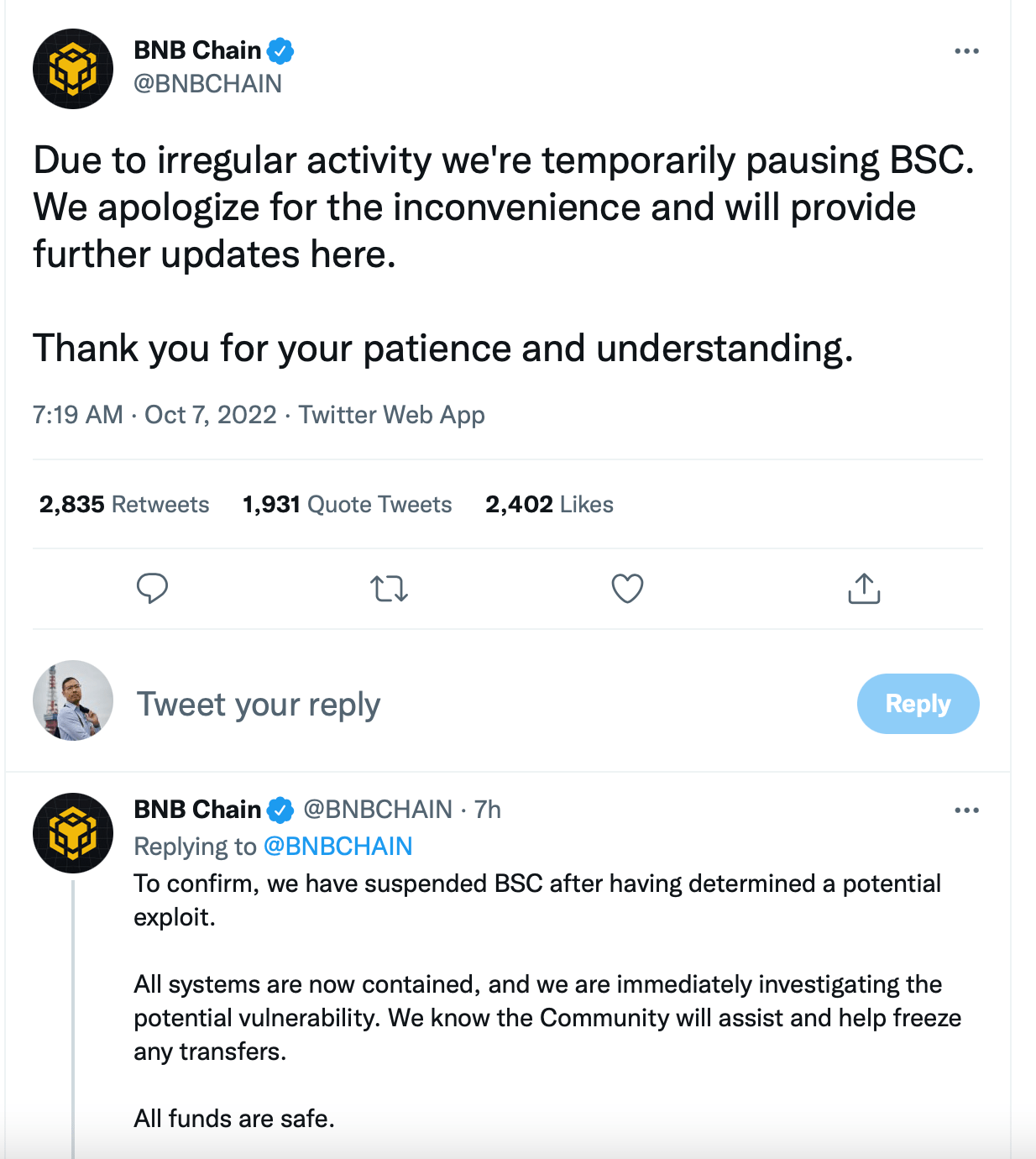

Source: Twitter October 7, 2022: Binance account on losing control of 400mUSD funds on their BSC chain

So while some exchanges and projects have no problem taking the law into their own hands (which they assume the public believes are safer hands than the government’s), they are quick to criticize the government and the courts for having the same power to stop movement of stolen coins. Hypocrisy? Indeed, but why?

If we all believe that theft and crime should not be rewarded, then we should all be able to agree that the proceeds of crime cannot be allowed to move freely. In fact, if there was a magic button to “withdraw” the proceeds of crime and return the stolen coins to their rightful owners, it should be hailed by all as the best thing to happen to the digital currency economy.

Indeed, that is exactly what this innovation led by the Bitcoin Association is – the magic button.

It is a wonder why there is so much backlash from certain parties who claim this is a massive hit for “decentralization1.” One is forced to consider whether those pushing back against anything that would prevent the use of digital currency for criminal activity might be those who benefit from such activity themselves. I am again reminded of the story of the wisdom of King Solomon, who had to decide which of the mothers was the baby’s true mother.

It was the one who was willing to give it up for it to live. True motives always emerge when there is something to lose…

Jerry Chan

NOTES:

[1] Is decentralization even a real thing? Or just another buzzword? To be explored in a future article.

See: BSV Global Blockchain Convention panel, Blockchain Venture Investments: Driving Utility for a Better World

width=”562″ height=”315″ frameborder=”0″ allowfullscreen=”allowfullscreen”>

New to Bitcoin? Check out CoinGeeks Bitcoin for beginners section, the ultimate resource guide for learning more about Bitcoin – as originally envisioned by Satoshi Nakamoto – and blockchain.

![Can polygon [MATIC] pull quantities for this NFT marketplace… Can polygon [MATIC] pull quantities for this NFT marketplace…](https://www.cryptoproductivity.org/wp-content/uploads/2022/08/MATIC-IMG-1000x600-120x120.png)