Bitcoin Price Prediction When BTC Hits 9 Month High – How High Can BTC Go?

As Bitcoin reaches its highest level in nine months, many are wondering how high the cryptocurrency can go. With a market capitalization of over $1 trillion and an increase in demand, as investors seek a safe haven amid economic uncertainty, Bitcoin’s price has skyrocketed in recent months.

This has led many to wonder if the cryptocurrency is in the middle of a sustained bull run or if there is reason for a correction.

US banking crisis: impact on financial markets and cryptocurrency prices

Last week, the precipitous collapse of three banks, namely Silvergate, Silicon Valley Bank (SVB) and Signature Bank, highlighted the fragility of the conventional banking sector. Analysts have identified adverse market conditions and inadequate risk management as major contributors to the collapse of SVB and Silvergate.

SVB’s fall had far-reaching implications for the global banking industry. Credit Suisse, the second-largest Swiss banking institution, was also hit, facing a severe crisis that necessitated a $54 billion bailout from the Swiss central bank.

With the banking crisis unfolding, investors are turning to cryptocurrency as a reliable alternative. As fears of a potential global financial crisis escalate, the value of BTC/USD has continued to rise.

The connection between the Federal Reserve and BTC

The Federal Reserve’s overnight balance sheet data revealed that roughly $300 billion had been injected into the economy to address the financial crisis, sparking a new upward trend.

This action effectively reversed months of liquidity withdrawals under the Federal Reserve’s quantitative easing (QT) policy, and experts expect the reintroduction of quantitative easing (QE).

The recent reversal of the Federal Reserve’s quantitative easing policy, which had been in place since 2021, has bolstered BTC/USD bulls, who are now looking to push the price higher.

In addition, growing concerns about a global banking collapse have reduced the likelihood that the Fed will implement a 50 basis point rate hike. Instead, Reuters predicts that the Federal Open Market Committee (FOMC) may only raise the federal funds rate by 25 basis points at its upcoming meeting on March 22.

Inflation and interest rate hikes by the Federal Reserve can have a significant impact on the value of Bitcoin. When the Fed’s interest rate decision becomes uncertain, the dollar index tends to decline.

Currently, the dollar index is at 103.86 and could continue to decline, which could be beneficial for BTC/USD as a falling US dollar could lead to an increase in Bitcoin’s value.

Binance CEO: BTC Resilient to Inflationary Pressures

On March 18, Binance CEO Changpeng Zhao took to Twitter to praise a fundamental feature of Bitcoin technology. He emphasized the cryptocurrency’s ability to withstand inflationary pressures, a quality that traditional fiat currencies lack.

In his tweet, Zhao pointed out that, unlike fiat currencies, Bitcoin cannot be printed out of thin air by anyone, and mining is a key function of its creation.

Zhao’s comments came in response to reports that the US government had issued a $300 billion bailout “out of thin air” following the collapse of three major banks in the country.

In the past 24 hours, BTC/USD has crossed $27,500, according to data from market monitoring website CoinMarketCap. This price level is one of the highest BTC/USD has reached in the last nine months.

Bitcoin price

On March 18, Bitcoin began trading at $27,350. In the last 24 hours, its value has increased by 2.75% and is currently trading at $27,416. BTC/USD has been experiencing fluctuations, reaching a high of $27,605 and a low of $27,053.

Furthermore, the value of Bitcoin has increased by more than 35% in the past week, with the latest news of bank failures and concerns about potential interest rate hikes playing a significant role in increasing its value.

Bitcoin’s price saw a sharp decline after a brief period of consolidation around $26,500. This led to a short-term negative trend as it fell below the $25,000 and $25,500 support levels.

As of Saturday, the BTC/USD pair is trading with a strong bullish bias, but it is facing immediate resistance near the $27,750 level. A bullish breakout above this level could propel the Bitcoin price towards the $30,750 milestone.

However, if the $27,750 level proves to be a resistance point, a sell-off could occur, potentially driving the price down to $25,200 or even $23,020.

Buy BTC now

Top 15 Cryptocurrencies to Watch in 2023

Industry Talk has put together a curated list of the top 15 cryptocurrencies to watch in 2023, with insights from the experts at Cryptonews. Whether you are an experienced crypto investor or new to the market, this list provides valuable information on promising altcoins that could have a significant impact on the industry.

Stay updated with new ICO projects and altcoins by checking back regularly.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

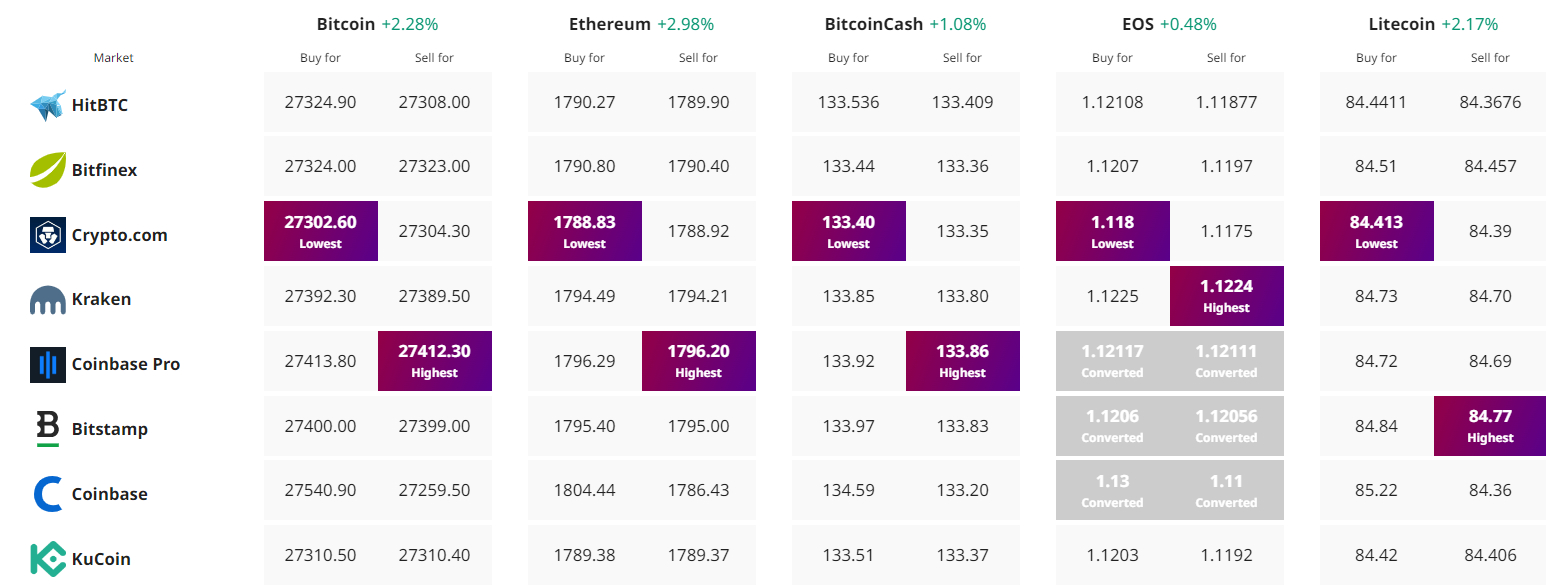

Find the best price to buy/sell cryptocurrency