Bitcoin Price Prediction As Huge $75 Billion Trading Volume Flows In – Are Whales Buying?

The global cryptocurrency market has managed to halt its previous losing streak and gained some ground, with Bitcoin and Ethereum leading the charge. Bitcoin, the world’s oldest and most valued crypto, climbed above the $25,000 mark early Friday morning, while Ethereum pulled bids around the $1,700 level.

Other popular altcoins, including Dogecoin, Ripple, Litecoin and Solana, also landed in the green.

Bitcoin’s price has increased by more than 5% in the last 24 hours and is currently trading above $25,600. This increase, along with other cryptocurrencies, has pushed the total crypto market cap above $1 trillion, making investors more confident.

Despite this, some analysts are skeptical and believe this could be a bull trap driven by positive sentiment, especially as trading volumes remain low.

The recent collapse of SVB and Silvergate banks has created liquidity concerns in the market, prompting clients to shift their focus to digital assets. According to Apptopia, cryptocurrency app downloads have increased by 15% following the collapse of major bank stocks.

Investors seek to diversify their portfolios and reduce risk, which has brought attention to the goal of introducing a cryptocurrency to address the flaws of the old financial system.

As for Ethereum, which is currently the second largest cryptocurrency by market capitalization, there are expectations that it will reach its all-time high of $2,000. The current rise in the ETH price has been mainly driven by the use of Ethereum’s blockchain technology in decentralized finance (DeFi) and non-fungible tokens (NFT).

In addition, the upcoming Ethereum Improvement Proposal (EIP) 1559 upgrade, scheduled for July 2021, is expected to limit the Ethereum supply and could cause a supply crisis, potentially driving the price even higher.

The Swiss National Bank bails out Credit Suisse, but uncertainty remains

The Swiss National Bank lends 50 billion dollars to the insolvent investment bank Credit Suisse. For now, the measure appears to have averted the dire situation of a European banking crisis. Still, uncertainty remains as the COVID-19 epidemic and geopolitical tensions continue to affect the global economy.

Thus, this news of the Swiss National Bank’s $50 billion loan to Credit Suisse did not have a significant impact on Bitcoin (BTC) prices.

Cryptocurrency Market Sees Bullish Run As Bitcoin Dominance Continues

The cryptocurrency market is currently experiencing an increase in value, with Bitcoin and Ethereum leading the way. Investors remain optimistic about the potential of cryptocurrencies to disrupt traditional banking institutions.

As the total market capitalization of cryptocurrencies exceeds $1 trillion, it is clear that investors are increasingly interested in cryptocurrencies and their potential.

It will be interesting to see how the cryptocurrency market performs in the coming months, given the market’s concerns about liquidity and potential interest rate cuts.

It is important to note that the US may reduce interest rates in the latter part of the year to give the banks protection. This action can prompt investors to create new long-term positions and increase capital inflows into riskier assets.

Bearish US dollar underpins BTC

The recent decline in the US dollar has had a significant impact on the prices of Bitcoin (BTC) and Ethereum (ETH). This decline came as authorities and banks took steps to ease the stress on the financial system following the collapse of two medium-sized banks.

As a result, most major currencies, including BTC and ETH, have bounced back and are currently trading above the $25,000 and $1,700 levels respectively. This bullish trend is expected to continue as investors seek alternative investments amid a weakened dollar.

The upcoming Federal Reserve monetary policy meeting is also expected to play a significant role in market movements. Some investors are hoping that the Fed may take a more cautious approach with its rate hikes, which could further ease stress on the financial sector and potentially increase interest in cryptocurrencies.

Overall, the fall of the US dollar has been a key factor in driving the prices of BTC and ETH higher. As the world looks for new investment opportunities, cryptocurrencies are becoming an increasingly popular choice, and this trend is expected to continue as the financial system faces ongoing challenges.

Bitcoin price

After a brief consolidation at $26,500, the price of Bitcoin has fallen sharply and has been on a short-term downtrend since breaking below the $25,000 and $25,500 support levels.

However, if the price can close above $25,200, it could trigger another uptrend above $26,000, with a crucial resistance level in the $26,500 zone.

Breaking through the $26,000 level could pave the way for a potential climb towards $27,500.

Bitcoin may experience another decline if it fails to break through the $25,200 resistance level.

Currently, the $24,000 level provides near-term support, with further and stronger support at the $23,500 area and the 100-hour simple moving average not far behind.

However, if the price falls below $22,600, selling pressure is likely to increase, and if losses continue, the price may fall below $22,000.

Buy BTC now

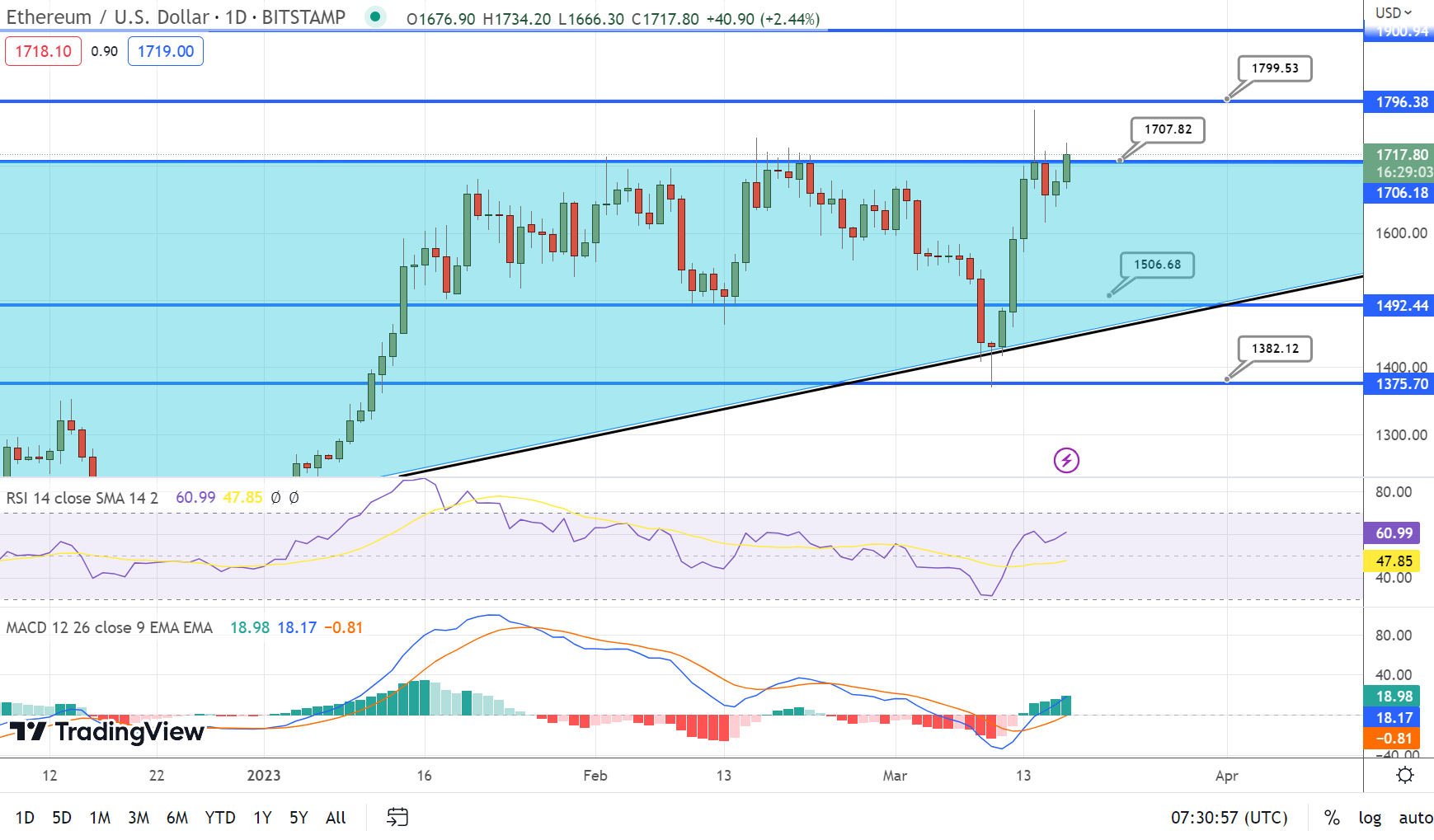

Ethereum price

Once Ethereum broke through the $1,600 barrier, the price began to climb significantly. However, to reach a positive zone comparable to Bitcoin, ETH had to break through the crucial $1,700 barrier zone.

Finally, the price broke through the $1745 barrier and traded towards $1800. The price peaked near $1,784 before experiencing a pullback to the negative.

If Ethereum fails to break through the $1,745 level, we may witness another drop in price. In the near term, the trend line and the $1,695 price point will likely serve as early support for the market.

Buy ETH now

Top 15 Cryptocurrencies to Watch in 2023

Check out Cryptonews’ Industry Talk team’s carefully curated list of the top 15 altcoins to watch in 2023. The list is regularly updated with new ICO projects and altcoins, so be sure to visit often for the latest updates.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

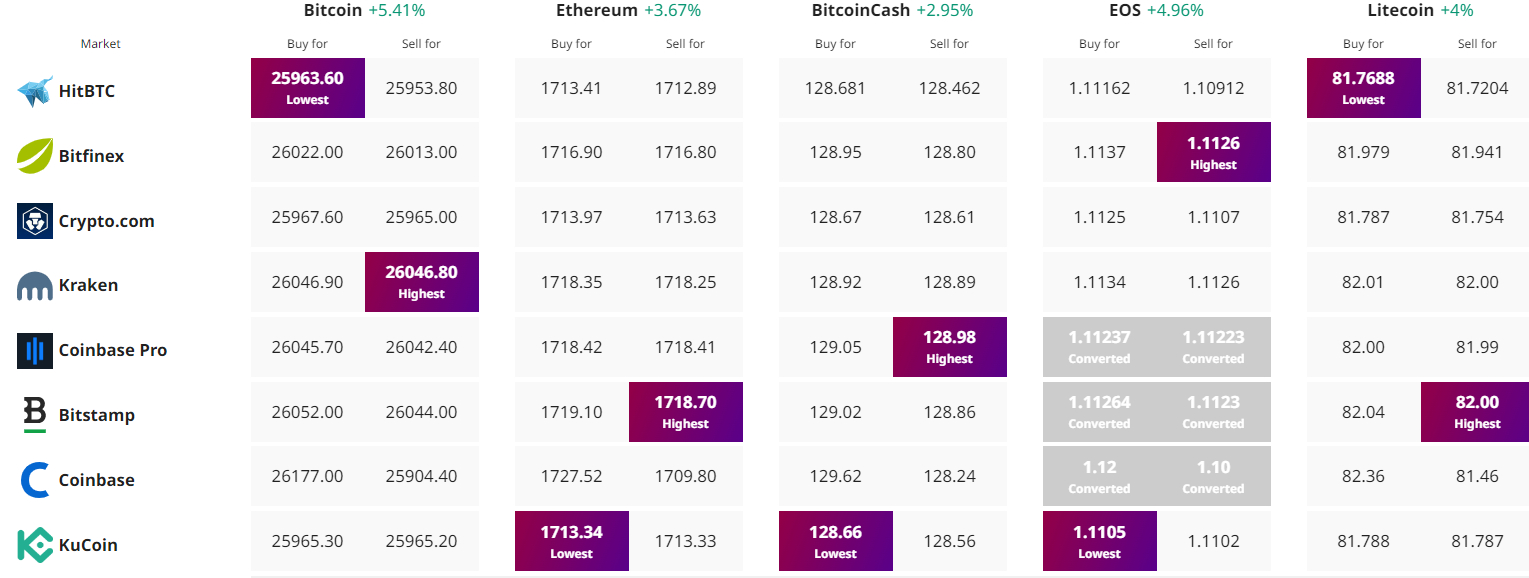

Find the best price to buy/sell cryptocurrency