Bitcoin Price Prediction As BTC Attempts To Break Out To $23,000 Level – Can BTC Recover?

Bitcoin (BTC) and Ethereum (ETH), two of the most popular cryptocurrencies in the world, have not been able to stop their losses and are still trading in the red below $23,000 and $1,600 respectively.

Traders are hesitant to make strong bids ahead of a critical week of economic developments in the US. This week will see the release of wage statistics and comments from US central bank Jerome Powell, making it a defining moment for the market.

BTC has had trouble rising above the $22,800 level, and if the bears succeed in pushing the price below today’s level, the next support level will be $21,480.

The second largest cryptocurrency, Ethereum, has also seen a lack of trading activity around the $1,500 mark, indicating hesitancy among buyers and sellers.

Risk-Off Market Sentiment

The global cryptocurrency market has been in a downward trend in recent weeks, with prices falling across the board. The main reason for this decline is the bearish market sentiment, which has had a negative impact on the price of Bitcoin.

However, this current market condition may also have an effect on the supply of BTC. As people lose confidence in the market, they may choose to sell their Bitcoin holdings, increasing supply and driving prices down further.

There is a glimmer of hope amid the current decline in Bitcoin and Ether prices. If investors consider the Silvergate suspension a minor setback rather than a major negative event, the current bearish trend may not last long.

It is worth noting that Bitcoin and Ether have a significant market value and are closely related. Therefore, any positive outcome for one cryptocurrency can have a favorable impact on the other.

The growing interest of major financial institutions in Bitcoin and Ether is another factor that may contribute to their price increase.

Over the past few months, many major financial institutions have expressed interest in investing in Bitcoin or offering Bitcoin-related services to their customers. This increased institutional demand for Bitcoin and Ether may lead to the increase in their values.

Regulatory crackdown undermines BTC

The intense government crackdown on cryptocurrencies has led to a decline in the prices of bitcoin and ether. As cryptocurrencies operate in a legal gray area, governments around the world are still struggling to regulate them. The strong government crackdown on cryptocurrencies is causing a drop in demand for Bitcoin and Ether.

This can lead to increasing concern among investors and traders, as well as increased volatility and fear of legal consequences.

Governments and regulatory bodies may introduce policies that restrict or prohibit the use or trading of cryptocurrencies, which may reduce the demand for Bitcoin and Ether and lead to a decrease in their values.

Moreover, investor sentiment may turn negative as they sell their holdings due to a lack of confidence in the future prospects of cryptocurrencies, driven by regulatory actions. This could lead to a drop in cryptocurrency prices.

In summary, investors should closely monitor any potential cryptocurrency regulatory violations, as it could significantly affect the values of Bitcoin and Ether.

Bearish US Dollar – Eyes On Fed’s Testimony

On Tuesday, the US dollar remained cautious in anticipation of Federal Reserve Chairman Jerome Powell’s testimony. The US dollar index, which measures the greenback against six major currencies, fell 0.077% to 104.170, after a 0.26% decline overnight.

The index has fallen 0.6% for the month, after rising 2.6% in February.

Investors are looking ahead to February employment data, due out on Friday, but their primary focus is on Federal Reserve Chairman Jerome Powell’s testimony before Congress on Tuesday and Wednesday.

The Fed had raised interest rates by 25 basis points at its last two meetings after significant increases the year before. However, strong economic data in February has led to concerns that the central bank may resume larger moves.

Meanwhile, the cautious stance of the US dollar could help the crypto market regain some of its momentum.

Bitcoin price

As of now, Bitcoin’s live price stands at $22,465, with a 24-hour trading volume of $15.6 billion. Over the past 24 hours, Bitcoin has seen an increase of 0.37%. With a market capitalization of $433 billion, Bitcoin holds the number 1 position on CoinMarketCap’s ranking.

It has a circulating supply of 19,310,450 BTC coins and a max supply of 21,000,000 BTC coins.

According to technical analysis, the BTC/USD pair is currently in a consolidation phase, trading within a narrow range of $22,000 to $22,500.

A breakout from this area, either to the upside or downside, can lead to significant price movement in the Bitcoin market.

In the event that the BTC/USD pair surpasses the $22,500 level, it could trigger a bullish breakout, potentially driving the Bitcoin price towards the $22,800 or $23,250 levels.

Conversely, if the support levels around $22,000 or $21,750 are sustained, it could lead to a rebound.

Buy BTC now

Ethereum price

The current price of Ethereum (ETH) is $1,573.86 USD with a 24-hour trading volume of $4.9 billion. Ethereum has seen an increase of almost 1% in the last 24 hours. Ethereum is currently ranked #2 on CoinMarketCap with a live market cap of $192 billion.

Looking at the technical side, the ETH/USD pair is currently trading in a tight range between $1,550 and $1,580 levels.

If Ethereum’s price falls below the $1,560 level, it may find support at the $1,500 mark. Nevertheless, it is worth noting that there is significant resistance at $1620 or $1680 levels, which could limit further price declines.

Buy ETH now

Top 15 Cryptocurrencies to Watch in 2023

You can check out Cryptonews’ Industry Talk team’s carefully curated list of the top 15 altcoins to watch in 2023. This list is regularly updated with new ICO projects and altcoins, so be sure to visit it often to stay updated with the latest the development .

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

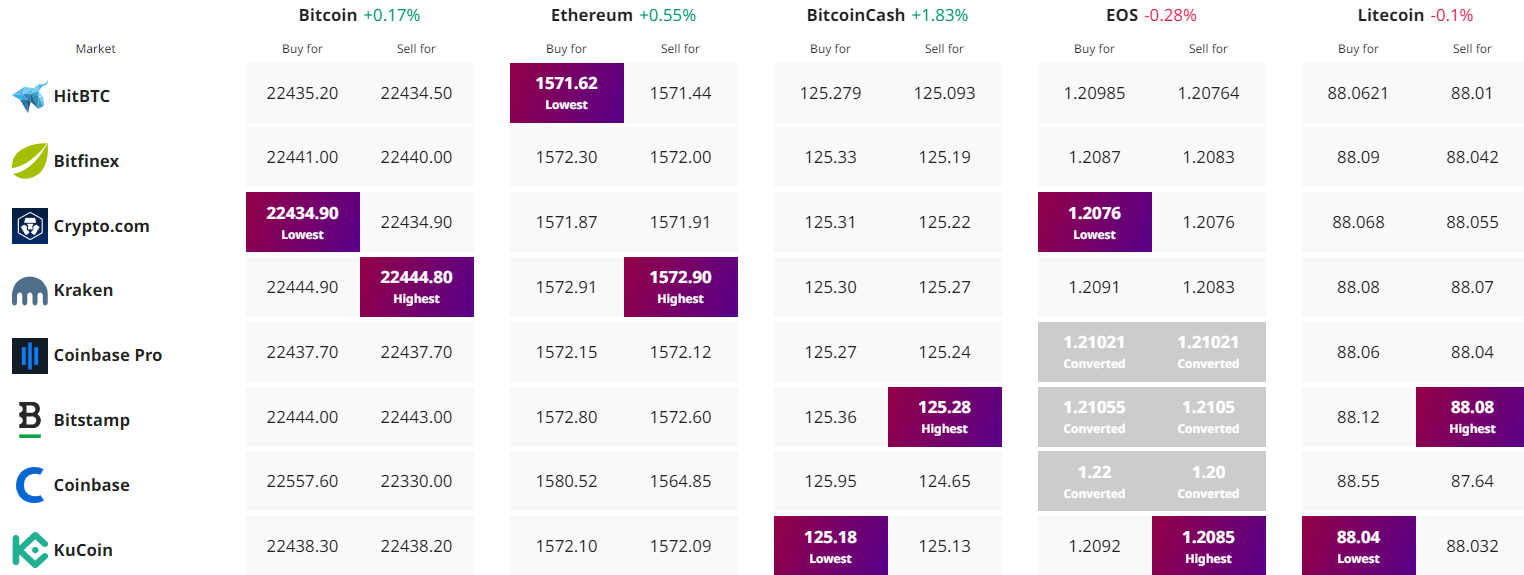

Find the best price to buy/sell cryptocurrency