Bitcoin Price Prediction As $10 Billion Trading Volume Flows In – Are Whales Buying?

Bitcoin (BTC), the leading cryptocurrency in the world, fell to the $28,000 level from the $28,300 level on Thursday. Bitcoin’s previous rally to the upside slowed after gaining 20% in March, its biggest month since January.

Bitcoin hit a high of $29,173 in March, but it was a short-lived peak. Meanwhile, the Ethereum price fell from $1,941 to $1,870 on Thursday. However, it increased by 10.6% in March and by 56% this year.

Although traders appear to be hesitant to place strong bids in BTC as investors awaited the release of the US non-farm payrolls data, which is set to be released later in the day.

However, the US release of non-farm payrolls data is likely to significantly affect the cryptocurrency market as it is considered a leading economic indicator.

If the US non-farm payrolls data shows that the US economy is creating jobs at a healthy pace, this will be seen as a positive indicator of the overall health of the economy. Thus, investors are likely to gain confidence in the economy and increase their investments in various assets, such as cryptocurrencies such as Bitcoin.

Conversely, if the data reveals weaker-than-expected job growth, it could lead to reduced investor confidence and a sell-off in various asset classes, including cryptocurrencies.

Furthermore, upgrading Ethereum to a more efficient proof-of-stake algorithm is likely to affect the cryptocurrency market, including Bitcoin and Ethereum.

If this upgrade is successful, it will push more people to use Ethereum, increasing demand and increasing the price of the cryptocurrency.

The global cryptocurrency market is falling amid investors fearing government action.

The global cryptocurrency market has been doing well in recent months, reaching a value of $1.20 trillion. However, it fell to $1.18 trillion soon after as traders felt uncertain about the crypto future.

Investors are concerned that the government may take further measures against the crypto market, leading to volatility in the market. Investors pay close attention to news or events that may affect their investments.

The instability of the banking sector boosts Bitcoin’s performance.

As we have previously stated, Bitcoin has performed very well in 2023 and the reason for this can be attributed to several factors, including instability in the banking sector.

As the banking industry experienced turmoil, many investors began to see Bitcoin and other cryptocurrencies as more attractive alternatives to centralized monetary systems.

Thus, the instability of the banking sector has played a major role in Bitcoin’s impressive performance in 2023. This trend is likely to continue as more people seek secure and decentralized financial options.

The grayscale discount is restored – eyes on the BTC price

We all know that Grayscale Bitcoin Trust (GBTC) had a rough end to 2022, with sister company Genesis Trading filing for bankruptcy. This caused the GBTC discount to climb to almost 50%, meaning the trust was trading at a much lower price than BTC’s spot market price.

Interestingly, GBTC has recovered in 2023, with the discount slowly but steadily shrinking during the first quarter of the year. As of April 5, the discount was at 36.9%, which is a significant improvement from the high of nearly 50% in December 2022.

However, closing the discount gap was seen as a good indicator for Bitcoin as it shows that investor confidence in GBTC is returning. This is important because GBTC holds over 600,000 BTC with the Coinbase Custody service, and uncertainty surrounding trust last year caused the Bitcoin price to suffer.

Thus, the recovery of the GBTC discounts suggests that the crypto market is on the rise again, and investor interest in Bitcoin is gradually increasing. Therefore, this news is a positive development for Bitcoin as it can increase investment and growth in the cryptocurrency market.

Bitcoin price

The ongoing battle between optimistic bulls and pessimistic bears persists as Bitcoin remains confined within a limited trading range between $27,600 and $28,900.

According to technical analysis, the BTC/USD pair is showing a bearish trend. Still, it may face resistance near the $28,250 level.

If Bitcoin manages to break through this resistance level, its value could rise to $28,900 or potentially $29,250.

Conversely, if a descending path prevails, significant support is expected around the $26,500 and $25,500 marks.

Buy BTC now

Top 15 Cryptocurrencies to Watch in 2023

To stay updated with the latest ICO projects and altcoins, it is advisable to regularly consult the expert-curated list of the top 15 cryptocurrencies to watch in 2023. This will help ensure that you stay well informed about new trends and opportunities in the crypto market.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

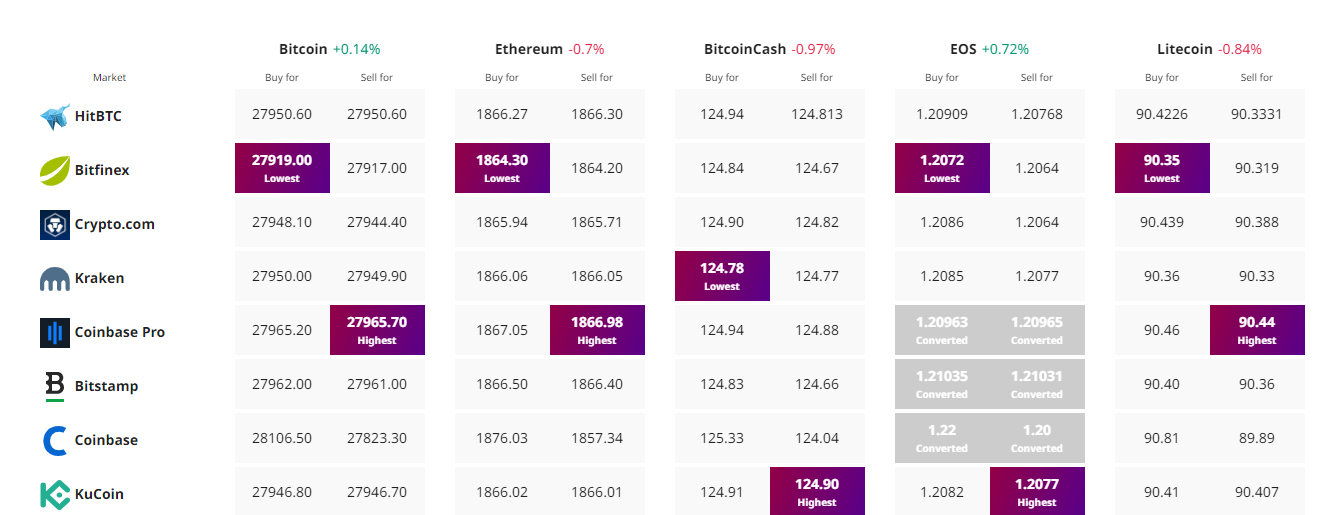

Find the best price to buy/sell cryptocurrency