Bitcoin price: here’s what a closely watched technical indicator suggests

Bitcoin (BTC/USD) remains above $21,000 on Monday morning, after going through the weekend without breaking the psychological $20,000 barrier.

But after hitting lows of $20,700 over the weekend and intraday lows of $20,900 so far today, the benchmark crypto could still see fresh losses. Bitcoin’s 24-hour performance is -1.3%, while for the week it has lost more than 12%.

Looking for fast news, hot tips and market analysis? Sign up for the Invezz newsletter today.

Bitcoin’s bearish outlook

Risk-off sentiment across risk markets continues after last week’s negative bars for equities and crypto, with renewed fears over the US Federal Reserve’s likely push for another 0.75% rate hike.

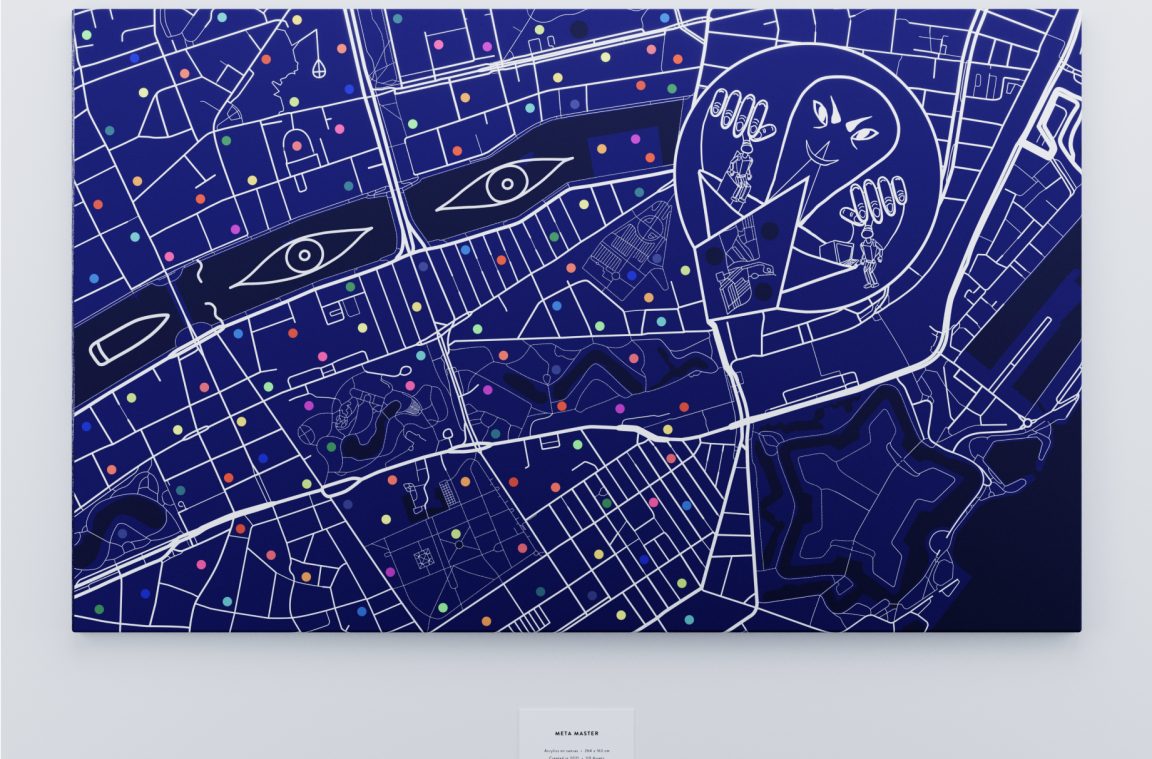

A look at the daily chart shows that the moving average convergence divergence (MACD) has turned negative.

The closely watched indicator, which technical analysts use to gauge potential momentum direction, has the short-term outlook for BTC in the bearish zone. The MACD, as shown in the chart above, remains below the signal line, with the bearish crossover seeing sellers push Bitcoin from peaks above $25,000 last week.

The 50-day moving average also provides immediate resistance after the price broke down in a -10% return on August 19.

The monthly Relative Strength Index (RSI) indicator also hints at possible downside for Bitcoin, compared to the metric’s outlook in previous bear markets.

“It is the first sign that the Monthly BTC RSI 2015 & 2018 Bear Market Bottoms area (green) is turning into new resistance. If this trend continues, this could mean further downside in Bitcoin’s price over time,” noted crypto analyst Rekt Capital in a chirping on Monday.

Pseudonymous cryptoanalyst Alt Crypto Gems also sees a possible flip below current support. Pointing to the 4-hour chart and the appearance of another bearish indicator, the analyst believes BTC/USD could fall to support levels near $16,000.

Bitcoin fell to a low of $17,600 in mid-June amid bear market turmoil, making today’s levels crucial. In particular, on-chain and technical analyst Cauê Oliveira noted last week that the levels of “maximum pressure” for Bitcoin could be around the $14.5k -$10k zone.

Invest in cryptos, stocks, ETFs and more in minutes with our preferred broker,

eToro

10/10

68% of retail CFD accounts lose money