Bitcoin Price and Ethereum Down 5% Amid China Lockdown

The leading cryptocurrency, Bitcoin, failed to break a descending triangle pattern and fell over 3% to $16,160 amid an increased level of R&D in the market.

Likewise, the second most valuable cryptocurrency, Ethereum, has followed Bitcoin’s lead, falling sharply by nearly 5% to $1,171.

Crypto market cap update

Global crypto market capitalization fell over 2% to $815.32 billion the previous day, sending major cryptocurrencies into the red early on November 28. In the last 24 hours, the total crypto market volume grew by 22.10% to $41.69 billion.

DeFi’s total volume is currently $2.60 billion, accounting for 6% of the total 24-hour crypto market volume. The total volume of all stablecoins is now $38.85 billion, accounting for 93% of the total 24-hour volume of the crypto market.

Let’s take a look at the top 24-hour altcoin winners and losers.

Top Altcoin Winners and Losers

Celo (CELO), Apecoin (APE) and UNUS SED LEO (LEO) are three of the top 100 coins that gained value in the last 24 hours. The CELO price has risen by more than 34% to $0.6970, the APE price has grown by more than 13.5% to $3.70, and the LEO price has increased by almost 7%.

Aptos (APT), Trust Wallet Token (TWT) and Lido DAO (LDO) are three of the top 100 coins to lose value in the last 24 hours, with APT losing over 5.5% to trade at $4.65, TWT is down 4% to trade at $2. Meanwhile, LDO’s price is down over 3% to trade at $1.09.

China Lockdown triggers sell-off in global markets

Cryptocurrencies fell on Monday amid a round of investor jitters in global markets spurred by protests in China against Covid restrictions. Protesters outraged by strict covid-19 rules called on China’s strongman leader to quit.

It was a rare rebuke as officials in at least eight cities sought to quell demonstrations Sunday that posed a direct threat to the ruling Communist Party.

Dissatisfaction with President Xi Jinping’s famous zero-Covid policy nearly three years into the pandemic has sparked a wave of civil disobedience on the mainland not seen since President Hu Jintao took office a decade ago.

The world’s second largest economy is also feeling the effects of the covid-19 regulations. The protests, which began on Friday and have spread to cities including the capital Beijing and dozens of university campuses, are the broadest expression of dissent against the ruling party in decades.

Shanghai protesters calling for Xi’s resignation and an end to one-party rule were dispersed by police pepper spray, but they returned hours later.

A reporter witnessed protesters who had been arrested being taken away in a bus as the police again dispersed the demonstration.

What does China have to do with the crypto drop?

China, as the world’s second largest economy, has a significant impact on global financial markets; as a result, investors are looking for a safe haven to park their investments.

Stocks and cryptos are not considered safe havens, which is why we are seeing bearish price action today.

However, as China’s situation improves and the protest ends, we may see a strong bullish reversal in Bitcoin and other currencies.

Let’s look at Bitcoin price prediction.

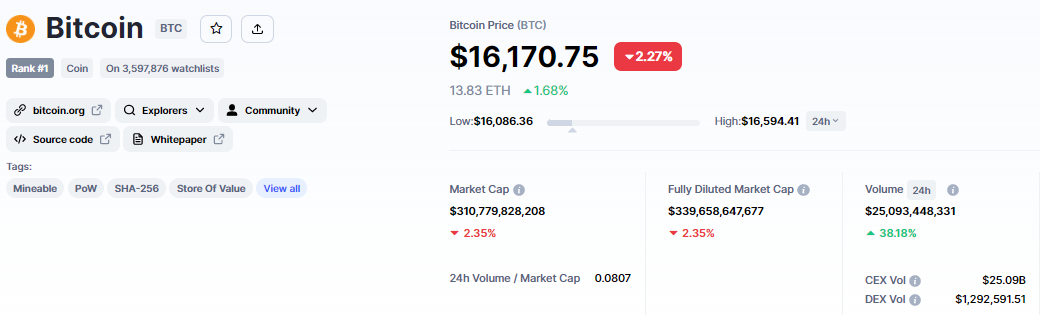

Bitcoin price

The current Bitcoin price is $16,174 and the 24-hour trading volume is $25 billion. Over the past 24 hours, the BTC/USD pair has fallen nearly 2.5%, while CoinMarketCap currently ranks first with a market cap of $310 billion, down from $318 billion yesterday. It has a total supply of 21,000,000 BTC coins and a circulating supply of 19,218,643 BTC coins.

BTC/USD is trading bearish on Monday after being rejected below the $16,600 resistance level, which was extended by a downtrend line. Bitcoin has formed a descending triangle pattern during the 4-hour time frame, which usually drives a selling trend.

Bitcoin is currently trading at $16,150 and is descending towards an immediate support level of $16,000. According to this, Bitcoin’s next support level is at $15,650, which is being extended by a double bottom support level.

Leading technical indicators, such as RSI and MACD, are in a sell zone, indicating that there is significant selling pressure. The 50-day moving average is raising resistance at $16,450, indicating that the downtrend is likely to continue.

If buyers enter the market, a bullish breakout of the $16,450 level could send Bitcoin to $17,000 in just a few days.

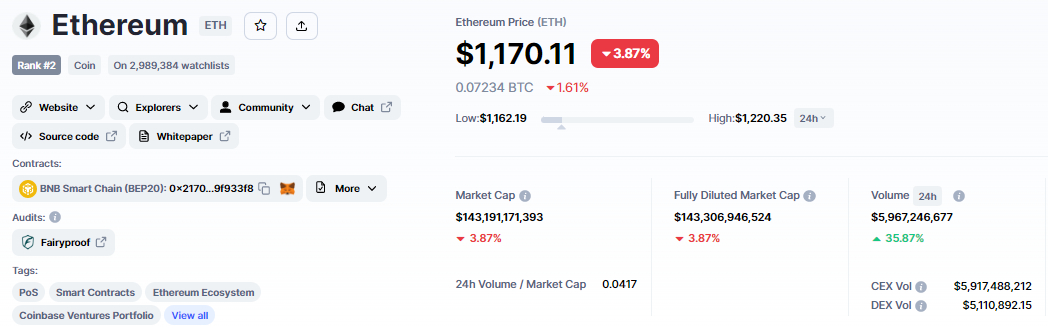

Ethereum price

The current price of Ethereum is $1,170, with a 24-hour trading volume of $5 billion. In the last 24 hours, Ethereum has lost almost 4%. CoinMarketCap is currently ranked number 2, with a market cap of $143 billion. It has a circulating supply of 122,373,866 ETH coins.

During the 4-hour time frame, Ethereum has formed “three black crows”, indicating a strong selling trend. ETH/USD has broken through an ascending channel that had supported the pair at $1,210 and is now acting as resistance.

At $1,175, Ethereum has crossed below its 50-day moving average, signaling a strong sell signal. On the downside, Ethereum’s immediate support is at $1,150, which was extended by a previous low on November 23.

The RSI and MACD indicators are also in a sell zone, suggesting that ETH may target the $1,115 support level.

On the upside, the major resistance level for ETH remains at $1,185 and a break above this could take it to the $1,235 level.

Pre-sale cryptocurrency with huge potential gains

Dash 2 Trade (D2T)

Dash 2 Trade is an Ethereum-based trading intelligence platform that provides traders of all skill levels with real-time analytics and social data to help them make better informed decisions. The platform will go live in the first quarter of 2023, providing information to investors to help them make proactive trading decisions.

After raising $7 million in just over a month, Dash 2 Trade, a crypto trading intelligence and signals platform, has piqued the interest of investors. As a result, the D2T team has decided to abandon the project at stage 4 and reduce the hard cap goal to $13.4 million.

Dash 2 Trade has also been a success, with two exchanges (LBank and BitMart) promising to list the D2T token once the presale is over. 1 D2T is currently worth 0.0513 USDT, but this will rise to $0.0533 by the end of the sale. D2T has raised more than $7 million so far by selling more than 82% of its tokens.

Visit Dash 2 Trade now

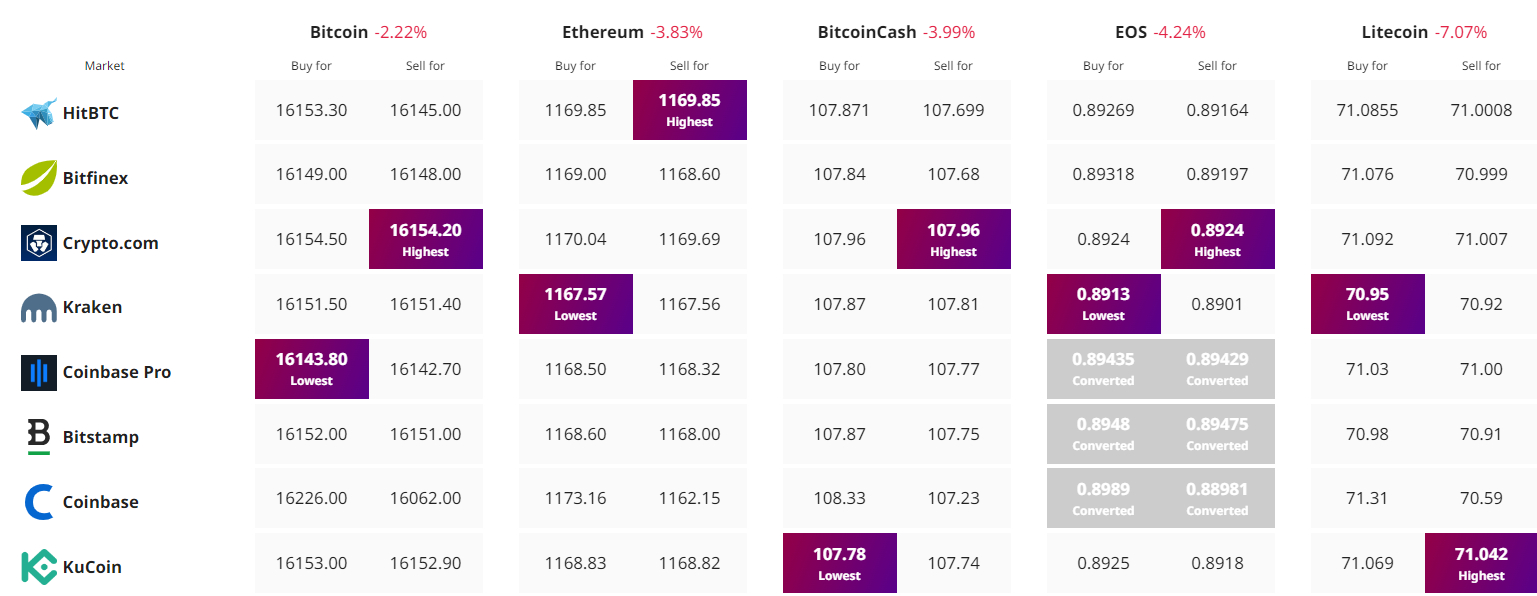

Find the best price to buy/sell cryptocurrency