Bitcoin: Panic May Just Begin (BTC-USD)

solar seven

Bitcoin (BTC-USD), the most popular cryptocurrency in the world, as well as cryptocurrencies in general, has seen increasingly negative news coverage over the past couple of months. The cryptocurrency market created people millions and billions in value after it rose from a near-penny stock level to over $50,000 per Bitcoin at its peak a few quarters back.

Since then, although some tout it as a safer way to trade financially, an increasing number of hacks and fraud allegations have taken place and shine brightly in the news worldwide. The problem with this, I think, is twofold:

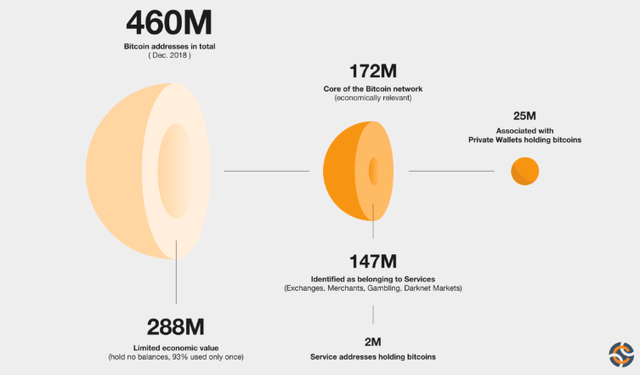

The first is that while those who use Bitcoin, estimated at around 106 million people, largely (60%) trust the system, they represent only less than 2% of the global population. Only 17% of Bitcoin users trust the world’s governments, showing that while it may be touted by some as a good alternative to global currencies and more and more businesses allow you to use Bitcoin and pay in real time, it’s still not adapted by a significant population.

Active Bitcoin Accounts (chain light)

This means that there is still a problem with the hypothetical path forward for Bitcoin or cryptocurrencies in general, which is broad scale adaptability and use, which may be the only way to make it stable enough to be considered anything close to a viable long-term global currency. This means, I believe, that we will continue to see volatility in the cryptocurrency system for years to come, which will further deter new entrants into the system.

The second is that, in addition to not having a growing user base, current users do not wholeheartedly support the alternative currency system, making it more of an unsupported commodity in people’s portfolios. This means that, I think, it will be one of the first things to be sold if and when we go into some kind of recession, which I think we will soon.

With the mass (relative) layoffs in the technology sectors, which is where a significant portion of Bitcoin holders come from, people who have invested and potentially made quite a bit of money will think about and eventually sell some of those investments to fund their lives while they applying for a job.

These two factors mean that I believe that there is not much of a bottom in the cryptocurrency market where people will buy and that there is a ceiling within a year where we expect a recession or decline. But that’s not all.

The other short-term problem

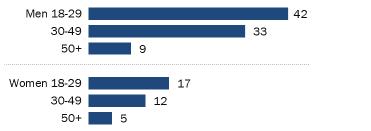

There is also a third group of Bitcoin (and other NFT-style entities) – young people. This phenomenon has certainly paid off for some, but for the most part it has not resulted in any significant change in these people’s lives. But due to the fact that a good number of these young people who are putting all the money they have into these cryptocurrencies and NFTs because of influencers who are doing these different “investments” – they don’t necessarily have an alternative to these if they need money.

Cryptocurrency trading (Pew Research Center)

For those who have some cryptocurrency like Bitcoin in their portfolio, which can be anywhere from 1% to 50% of their holdings, they usually have a steady job and other savings and cash flow to cushion any serious inflows. But if Bitcoin and various non-fungible tokens crater more than they already have – they will probably panic sell due to their downside tolerance being much lower.

What a crash can mean

If, as I believe, Bitcoin and most cryptocurrency markets have a ceiling and that the selloff we have seen in recent months will scare off many retail investors who hold large amounts of Bitcoin and other cryptocurrencies – we are probably only at the beginning of this downturn.

The problem here is, given that the system of Bitcoin is supported by nothing but the faith of one person buying from the other – the bottom here is most likely much lower than if we enter a bear market in the “regular” stock market. There are going to be holdouts in the cryptocurrency system, especially those who hold Bitcoin as only a small part of their overall financial holdings, which could mean it will take them longer to hear the news as it gets worse before they sell.

This means that not only do I think we’re in for a shock to the system soon, but also that the risk here is much greater than the “regular” stock market given that there is theoretically no bottom compared to a company like, say, Apple ( AAPL), which will still take in a certain amount of revenue and earn a certain amount of cash and have real book value, even in a deep recession.

So what now?

While shorting something like Bitcoin is absolutely insane, even if it were an easy way to do it, the price, as it has done before, can rise by hundreds of percentage points in a few days or over a weekend, and leave short position deep, deep in red.

But as someone who has had Bitcoin and other cryptocurrencies as a small part of their overall portfolio: I think it’s time to take it down even further and avoid it for now. That’s because it can become a slippery slope/snowball.

What I mean by that is that there are millions of people out there with a significant portion of their money in Bitcoin, cryptocurrencies, and other NFT-style things, which if the price of those assets eventually goes down by 50% to 90% will watch their net worth of the value of their holdings fall. This could, I believe, cause a real spending crisis if the value of said portfolios falls.

So this could become a snowball effect where people sell some of their Bitcoin after losing 50%, which causes the price to fall further, which then causes them to sell the rest, or all, at a loss that will lead to financial hardship and their expenses will go down. Which will then hurt the economy and make even more people look at selling their non-tangible assets etc.

Given these factors, I have become very bearish on Bitcoin and the outlook for cryptocurrencies and NFTs in general and will be avoiding Bitcoin for some time.