Bitcoin MVRV Triple Ribbon Forms Again Bearish Cross

On-chain data shows that the Bitcoin MVRV triple band has once again formed a signal that has led to an average decline of 30% in earlier instances this year.

Bitcoin MVRV Triple Ribbon shows bearish signal formation

As pointed out by an analyst in a CryptoQuant post, the recent trend in the BTC MVRV triple band may suggest that the crypto will soon observe another local drawdown.

Before looking at what “MVRV” is, it’s best to first take a look at the two main types of capitalization methods for Bitcoin.

The first value, the common market value, is calculated by multiplying each coin in circulation by the current BTC price (or more simply, it’s just the total number of coins in circulation, multiplied by the price).

Where the second capitalization model, the “realized cap” differs, is that instead of all coins being weighted against the last value of the crypto, each coin is multiplied by the BTC price that was there at the time of the coin’s last movement.

Now MVRV is just the ratio of these two Bitcoin caps (market divided by realized). Historically, this calculation has indicated when the value of BTC has been undervalued, and when it has been overvalued.

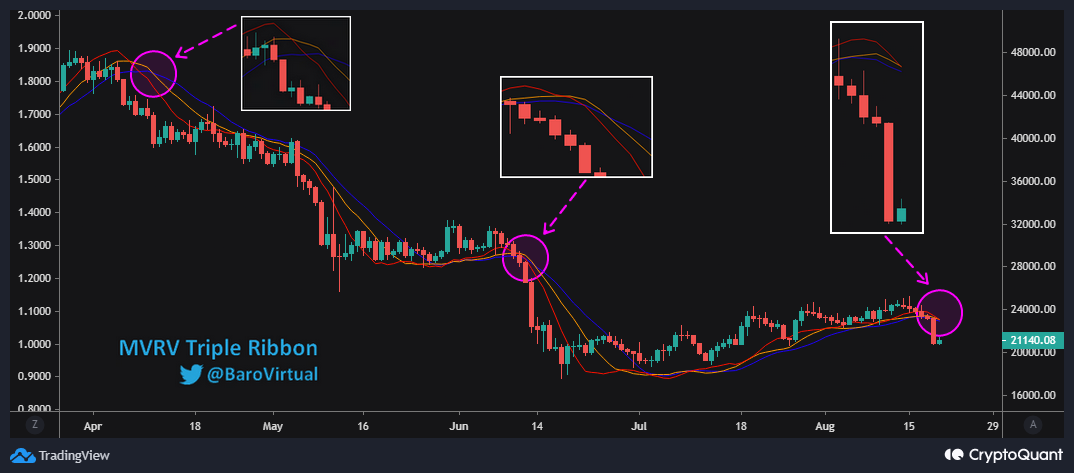

Here is a chart showing the trend of three different MVRV moving averages (10-day, 15-day and 20-day) over the past few months:

Looks like the 10-day MA curve is passing under the 15-day MA line | Source: CryptoQuant

These three moving averages of the indicator together form the “MVRV Triple Band.” And as you can see in the graph above, the trend in this triple band has had some interesting implications on the Bitcoin price in recent months.

Whenever the 10-day MA has crossed below the other two MAs, the price of the crypto has observed a sharp decline in the short term.

In this year so far, each of these MVRV triple band crossings has resulted in an average decline of 30% in the value of BTC.

From the chart it is clear that this pattern again seems to be forming for the indicator. If this is indeed the same signal as the previous events, Bitcoin may face more falls in the near future.

BTC price

At the time of writing, Bitcoin’s price is hovering around $21.2k, down 12% in the last week. Over the past month, the crypto has lost 9% in value.

The chart below shows the trend in the price of the coin over the last five days.

The value of the crypto seems to have plunged down a few days back | Source: BTCUSD on TradingView

Featured image from Thomas Bonometti on Unsplash.com, charts from TradingView.com, CryptoQuant.com