Bitcoin Miners ‘Just’ Sold This Many Coins In July: Making A Difference?

Bitcoin miners have been dumping their HODLings for the past few months. As previously reported, a new generation of “forced” Bitcoin sellers entered the picture in May and June, and the intensity of the selling has weakened since then.

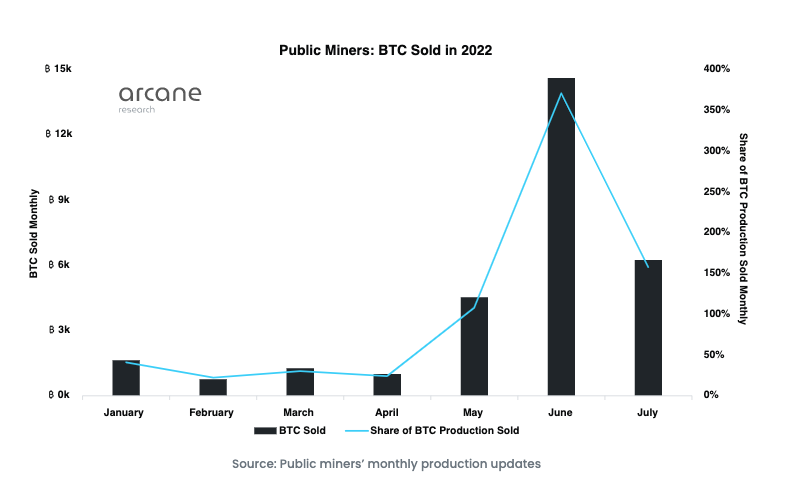

The latest data from Arcane Research showed that public miners “only” sold 6,200 BTC in July. As illustrated below, the same is less than half the amount they sold last month. However, according to the analytics and research platform,

“Even after this decline, July was still the second highest BTC sales month of 2022 for the public miners, indicating that they are still in a difficult financial position.”

Well, the same selling bias has also been rolled over to August. Per data from CryptoQuant, the cumulative mining reserve was 1.8649 million on August 1st. However, press time reflected a depleted value of 1.86048, suggesting that more than 4,400 coins had already been sold in the first half of August. If miners continue to sell with the same momentum, it is likely that this month’s numbers will surpass last month’s.

It should be noted that Arcane’s report only focuses on public miners, while CryptoQuant’s data considers all miners.

Why Are Bitcoin Miners Selling?

Miners usually dispose of their holdings to cover expenses in times of liquidity problems. But lately the situation has been a little different. Public miners sold 158% of their bitcoin production in July, making it the third month in a row where they sold more than 100% of their production.

Selling more than what is produced on its own indicates that miners are still under pressure. According to Arcane Research, one of the main reasons Bitcoin miners sold was to avoid margin calls. Elucidating the same, the analysis and research platform’s report noted,

“Miners with significant BTC or machine-backed debt positions were forced to sell BTC to avoid margin calls.”

Public miners also have “significant upcoming expenses” for their “massive” expansion plans. To finance the same, they have again sold.

“The public miners’ expansion plans are several months into the future, and they are selling some bitcoin now to get their bank accounts ready for future payments in dollars.”

Future prospects

Bitcoin’s hashband has been flashing light green circles lately, indicating that miner capitulation is in play. To go through this phase, they must continue to sell their HODLings.

Despite miners sending their holdings to exchanges, Bitcoin recovered in July. So now the sell-off is unlikely to cause much of a dent unless the macro sell-off, which involves other participants such as investors, begins.

As for what to expect next, the author of Arcane’s report noted,

“I expect selling pressure to continue at between 100% and 150% of production unless something significant happens to the bitcoin price. This equates to between 4,000 and 6,000 BTC per month.”