Bitcoin long-term owners have shed 150k BTC since the LUNA Crash

Data shows that the total supply held by Bitcoin’s long-term holders has decreased by 150k BTC since the LUNA crash.

Long-term owners of Bitcoin have dumped a noticeable amount over the past few months

According to the latest weekly report from Glassnode, BTC LTHs have seen a sustained decline of 150k BTC since the crash in May.

“Long Term Hold” (or LTH for short) is the Bitcoin cohort that includes all those investors who have held their coins since at least 155 days ago, without selling or moving them. Holders who sell earlier than this threshold are called short-term holders (STH).

LTHs are generally the most resolute investors in the market, and large sales from them therefore do not happen too often. In general, the longer a holder has held their coins (that is, the older the LTH has become), the less likely they are to sell at any time.

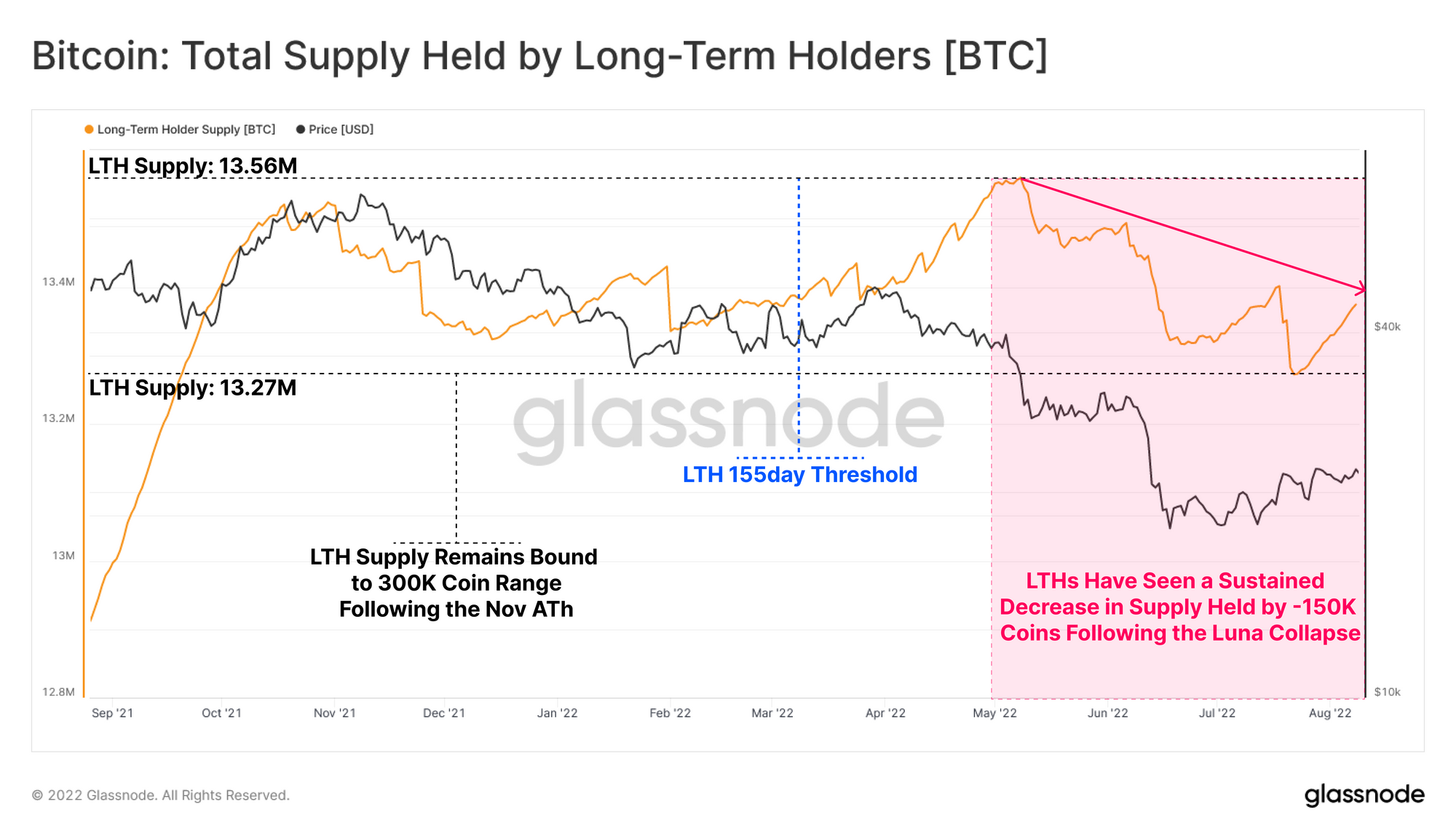

Here is a chart showing the trend in the total Bitcoin supply held by these LTHs over the past year:

The value of the metric seems to have been trending downwards in recent months | Source: Glassnode's The Week Onchain - Week 33, 2022

As you can see in the graph above, the Bitcoin supply owned by LTHs seems to have been moving mostly sideways since around November of last year.

The indicator peaked during the month of May this year, but since then the metric’s value has been on a steady decline.

The beginning of this selloff from the LTHs appears to have been around the LUNA and UST collapses, an event that triggered a market-wide crash in crypto.

The report notes that the current 155-day long-term holding threshold is in March, when the price of Bitcoin observed its first relief rally to $46k since the decline from the all-time high.

While the latest sale from the LTHs only amounts to 150,000 BTC, which is quite small compared to their total supply of around 13.4 million BTC, the report explains that the LTH reserve does not need to be significantly reduced for the cohort to go through a capitulation event.

Related Reading: Frightening Advance Notice? Ether options are overtaking Bitcoin as the best crypto to trade

In previous such capitulations, LTH supply has decreased only slightly, with the weakest investors eliminated and stronger accumulation filling in for them.

BTC price

At the time of writing, Bitcoin’s price is hovering around $23.4k, down 4% in the last week.

Looks like the value of the crypto has been going down in the last few days | Source: BTCUSD on TradingView

Featured image from Dmitry Demidko on Unsplash.com, charts from TradingView.com, Glassnode.com