Bitcoin long-term holders hold 78% of the supply, the highest ever

On-chain data shows that long-term owners of Bitcoin now hold 78% of the total circulating supply, the highest value the metric has ever seen.

Bitcoin long-term owners are sitting on 78% of the total supply

As pointed out by an analyst on Twitter, the divergence between the long-term owners and the short-term owners is at its greatest right now. The long-term holders (LTHs) and the short-term holders (STHs) are the two main holder groups into which the entire Bitcoin market can be divided.

The STHs include all investors who purchased their coins within the last six months, while the LTHs include those who purchased their BTC earlier than this threshold amount.

Statistically, the longer investors hold their coin, the less likely they are to sell at any time. Thus, the LTHs generally tend to keep the coins dormant for longer periods than the STHs. Because of this reason, the LTHs are also often referred to as the “diamond hands” of the Bitcoin market.

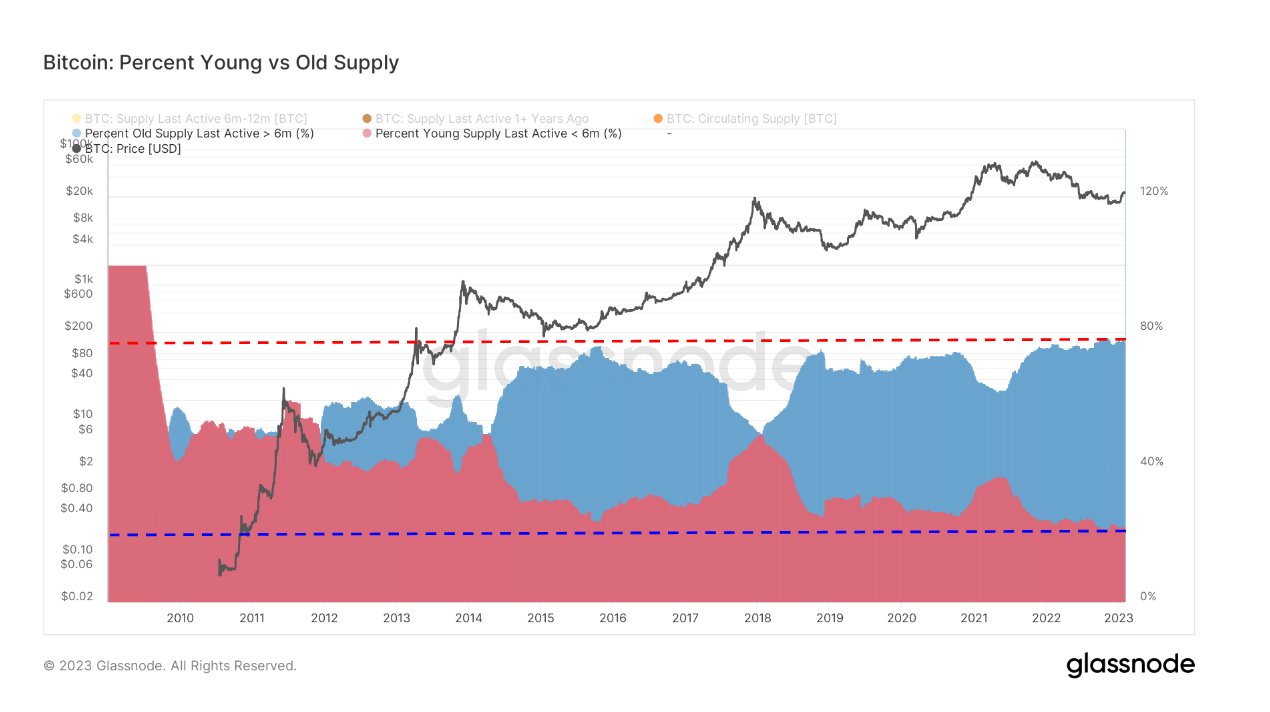

Now, the relevant indicator here is “percent young vs old supply”, which measures what percentage of the total circulating BTC supply is currently held by the STHs (the “young” supply) and what is held by the LTHs (the ” old” supply).

Here is a chart showing the trend of this Bitcoin calculation over the entire history of the cryptocurrency:

The two supplies seem to have diverged away from each other in recent months | Source: Glassnode on Twitter

As shown in the graph above, the percentage of the total Bitcoin supply held by the LTHs has only continued to rise for a couple of years now, suggesting that there has been a growing shift towards a HODLing mentality among investors in the market .

While this has been happening, the percentage contributed by the STH supply has naturally shrunk, since the value is simply calculated by subtracting the LTH percent supply from 100.

A recent brief decline was observed after the collapse of the crypto exchange FTX, suggesting that the crash was capable of shaking even the strongest hands in the market. However, it did not take long before the owners regained their focus and the offer again began to climb upwards.

After this last accumulation of the cohort, the proportion of the supply they have reached a value of 78%. The STHs make up the remaining 22% of the offer.

From the chart, it is clear that this divergence between the two Bitcoin supplies is at the highest level ever at the moment. This means that the selling pressure from most of the supply should be at an all-time low now, as it is likely to remain dormant for extended periods with the LTHs.

Such a supply shock in the market could be bullish for the price of Bitcoin in the long term.

BTC price

At the time of writing, Bitcoin is trading around $23,500, up 2% in the past week.

Looks like BTC has continued to consolidate in the last few days | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, Charts from TradingView.com, Glassnode.com