Bitcoin is one of the greatest American inventions

Not everyone has heard of SHA-256, but I believe it is one of the greatest American inventions of the 21st century.

Developed by the National Security Agency (NSA) in 2001, SHA-256 is a secure hashing algorithm that, among many other things, is used by your iPhone to encrypt data, including the unique facial features that many of you use to unlock your phone . .

It also makes Bitcoin encryption possible. I won’t bore you with the details – you can read more about the algorithm here – but SHA-256 has never been hacked or compromised, making Bitcoin one of the most secure protocols on earth.

This is precisely why Satoshi Nakamoto, Bitcoin’s pseudonymous inventor, chose to build the digital asset on top of it. Satoshi wrote in 2010 that SHA-256 “could last for decades unless there is a massive breakthrough attack.”

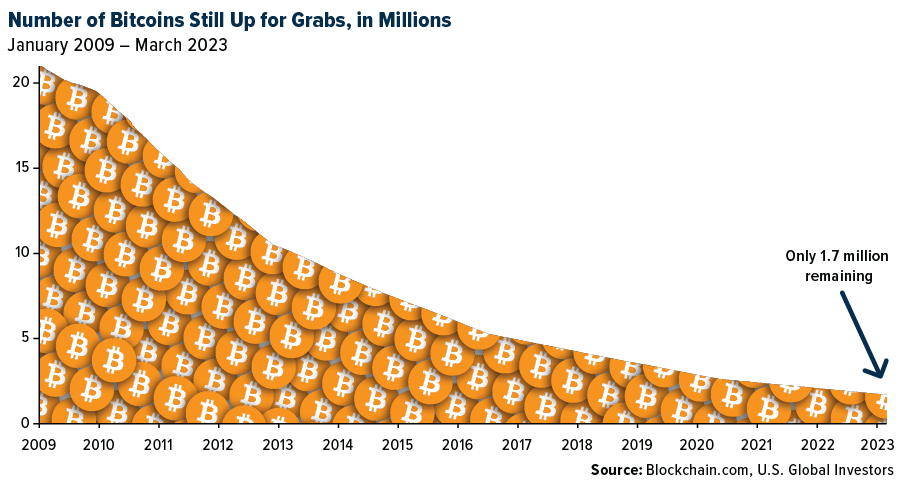

That’s good news, as Bitcoin is designed to be mined and held for decades to come – and beyond. The very last available bitcoin is expected to be produced sometime in the year 2140. As of this writing, nearly 92% of every bitcoin that will ever exist has already been mined, meaning approximately 1.7 million are still out there.

Set the record straight

So why am I telling you all this? Mainly to set the record straight on Bitcoin.

First of all, Bitcoin is an American invention, despite the Japanese-sounding pseudonym of its creator(s). This is important because there are still people who believe it was designed specifically to destabilize the dollar and the traditional monetary system.

That couldn’t be further from the truth, although many proponents believe Bitcoin could one day replace fiat currency. Even the Bank of International Settlements (BIS), one of the most vocal critics of Bitcoin, has issued guidance for central banks to potentially hold digital assets as reserve currencies.

I’m sure you’ve noticed that there’s been a lot of negative press about “crypto” since at least last summer, first with the implosion of Terra/LUNA and the bankruptcies of crypto lending firms Celsius and Voyager Digital. Then of course came the massive fraud scandal involving Sam Bankman-Fried and his crypto exchange FTX.

Last week, crypto bank Silvergate announced it would close its doors, and New York-based Signature Bank, also crypto-friendly, was shut down by regulators on Sunday.

Because of its association with crypto, Bitcoin’s price has suffered as a result of these setbacks, even though it has nothing to do with the companies in crisis, and even though the proof-of-work (PoW) protocol makes it far more secure than proof -of-stake (PoS) coins like the now worthless LUNA.

Bitcoin is the only crypto-asset officially considered a commodity, according to the US Commodity Futures Trading Commission (CFTC), citing the PoW protocol. All other coins and tokens may very well be classified as securities.

Part of the digital transformation

Like facial recognition, artificial intelligence (AI), mRNA vaccines and other modern technologies, Bitcoin itself is neither “good” nor bad. Instead, it is a key component of the ongoing, rapidly accelerating digital transformation.

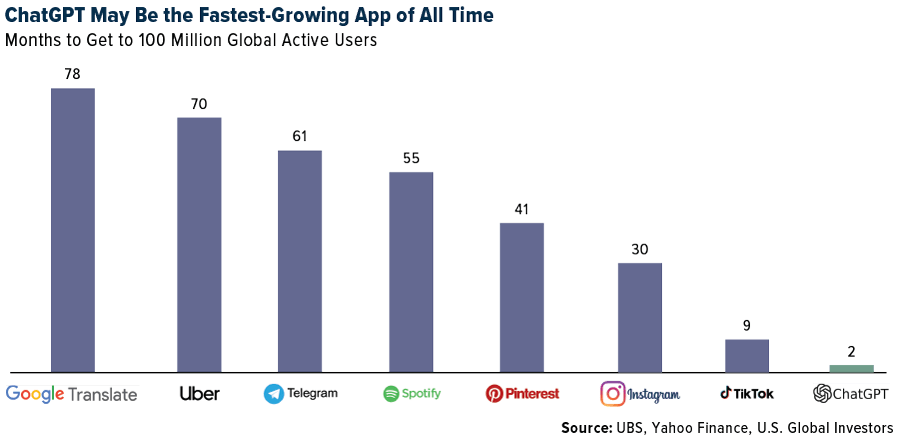

I think the lightning-fast adoption of ChatGPT is a testament to this hyper-acceleration. AI chatbot, developed by OpenAI, may be the fastest growing app of all time. Launched in late November 2022, it reached 100 million active users, including Holly Schoenfeldt, in just two months, significantly beating other popular apps such as TikTok, Instagram and Pinterest. Last month, ChatGPT received a staggering 1 billion visits to its website, according to Similarweb.

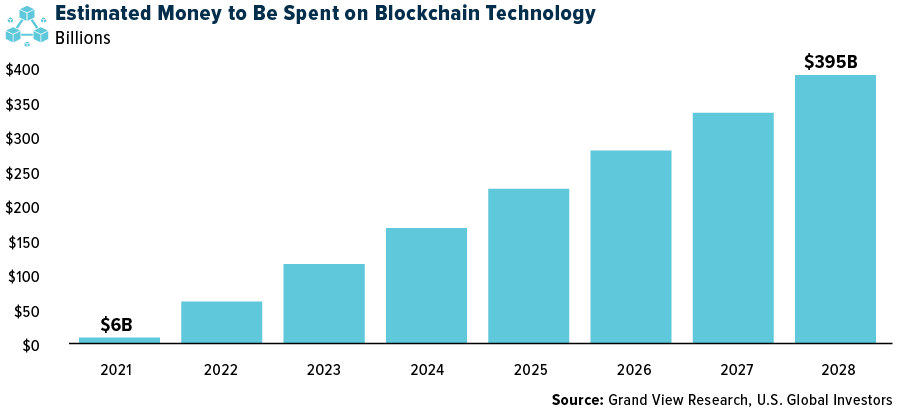

Take a look below. Spending on blockchain technology is expected to expand more than 65 times from 2021 to 2028, when it could reach $395 billion, according to a research firm. Because of its superior security features, Bitcoin will be used to validate everything on these blockchains, which I believe will increase its value exponentially. As I often say, follow the money.

A decentralized asset like gold and silver

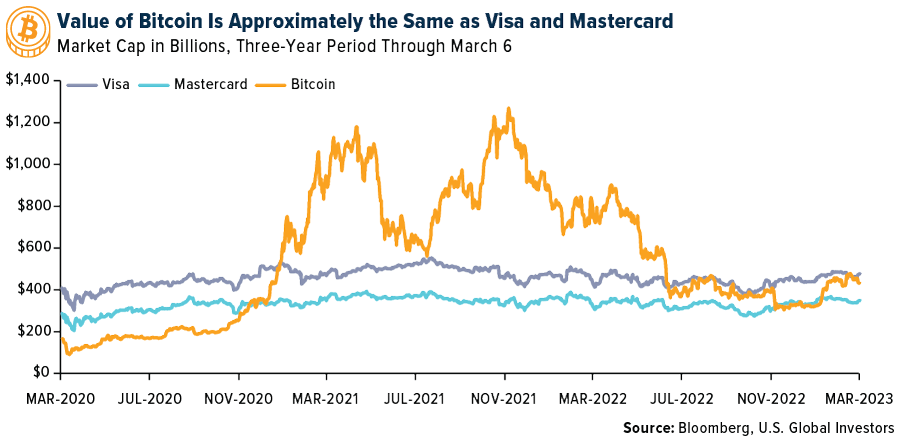

Speaking of money, Bitcoin’s market cap now rivals Visa and Mastercard, which have millions of users and decades of name recognition. Bitcoin is decentralized, meaning it has no CEO, no board members, and no marketing budget. And yet its total value is roughly on par with the two largest credit card companies. When trading at $55,000 and $65,000, Bitcoin’s market cap completely surpassed the market cap of Visa and Mastercard.

As big as Bitcoin is, it is nowhere near the market capitalization of gold and silver, two more decentralized assets. Gold’s total global value is currently just over $12 trillion, about the size of five apples, while silver is about 1 trillion dollars, and is right between Alphabet and Amazon at today’s prices.

To me, this bodes well for Bitcoin, whose market cap is around $433 billion right now. For the digital asset to have the same value as silver, each bitcoin would need to be priced at $60,000, which it has achieved before and is likely to do again.

For it to have the same value as gold right now, Bitcoin would need to trade at an eye-watering $630,000.

Is it feasible? Some people think so. Billionaire investor Tim Draper believes Bitcoin could reach $250,000 by the end of this year. Cathie Wood says it could go as high as $1.5 million in seven years.

I will refrain from making my own price prediction, but I will say that as the digital transformation progresses, I expect Bitcoin’s price to rise alongside it.

All expressed opinions and given data are subject to change without notice. Some of these opinions may not be appropriate for every investor. By clicking on the link(s) above, you will be directed to a third party(ies). US Global Investors does not endorse any information provided by this website(s) and is not responsible for its content.

The inventory can change daily. Inventories are reported as of the end of the last quarter. None of the securities mentioned in the article were held by any accounts managed by US Global Investors as of 12/30/2022.