Bitcoin is dead (again) | Seeking Alpha

D- None

We are now just over a week away from arguably the biggest crypto disaster of the year. And that says something because 2022 has been quite terrible for crypto followers and Bitcoin (BTC-USD) advocates. We are now 53 weeks past Bitcoin’s cycle peak of just under $69,000. Since then, we’ve seen the fall of Terra (LUNC-USD), the collapse of the Celsius Network (CEL-USD), and too many insolvencies between the lending and mining companies to list. FTX (FTT-USD) probably hit the hardest because of how big it got. Stadium naming rights, endorsement deals, high-profile ambassadors, millions of users and high exchange volume; it stings to a great extent and is a black eye on the industry.

But with some time to digest it all, it’s important that we don’t conflate the failures of a centralized company in the financial world with the failure of decentralized crypto networks. They are not the same. With the exception of Terra, which was highly centralized in its operations, every other collapse in the crypto industry this year has been by a centrally controlled and managed operation. The calls for regulation are going to be loud. In my opinion, whatever knee-jerk decision comes out of the regulatory body won’t matter – regulations wouldn’t have stopped FTX. But for the sake of this article, I want to explore the idea that Bitcoin is somehow doomed due to the fall of a centralized exchange. So far, nothing could be further from the truth.

Is Bitcoin Dead?

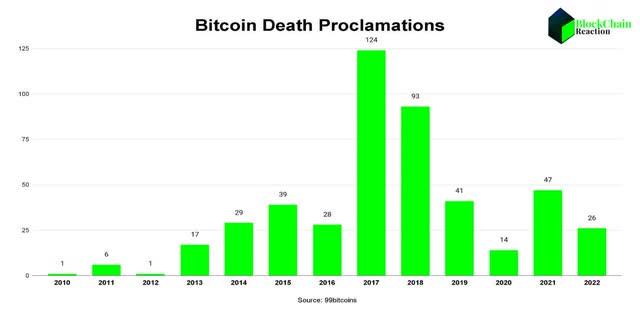

Spoiler, it isn’t. There is actually a website dedicated to tracking the number of times a well-known media outlet or writer has declared Bitcoin dead. So far, Bitcoin has been declared dead 466 times since 99bitcoins started tracking submissions from 2010.

99bitcoins/BCR

If we look at the deaths by year, we can see two remarkable things; the first is that there were far more proclamations of Bitcoin’s demise in 2017 than there were in 2021. The second thing we notice is that there were far more death calls when Bitcoin peaked in 2017 than when it bottomed in 2020. Even after a new high several multiples above the 2017 peak in 2021 we see far fewer obituaries in 2021 and even fewer in 2022. However, 99bitcoin’s obituary tracking is not a perfect science because it is submission-based. Something that might be a little more actionable might be search data. What do real people really think? We can get a sense of sentimental investor sentiment by looking at Google Trends:

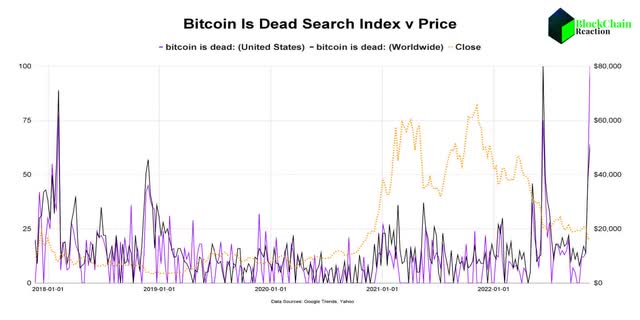

Bitcoin is Dead Index (Google Trends, Yahoo/BCR)

This chart shows the “Bitcoin is Dead” search index for both the US and the entire world. They mostly follow closely together. When we overlay Bitcoin’s price, we can see that the peaks in the “Bitcoin is Dead” search indexes are actually closer to bottoms than peaks. Furthermore, in the last bull cycle, there was the immediate increase in death searches in January 2018, followed almost a full year later by another peak in the search index “Bitcoin is Dead” after a major capitulation. While the peaks from this cycle look a little different, we are in our second peak now. History indicates when people stop wondering if Bitcoin is dead, that’s when the bull will begin.

Network activity

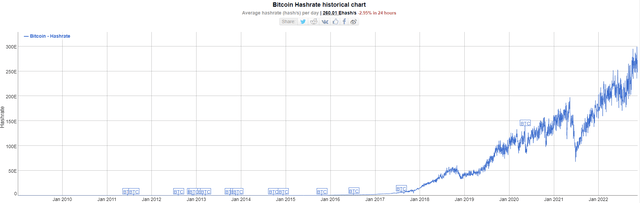

Despite all the chaos surrounding the collapse of FTX and the terrible feeling, Bitcoin doesn’t care. It just keeps making blocks, and the hashrate keeps hitting new highs seemingly every week:

BTC Hashrate (Bitinfocharts)

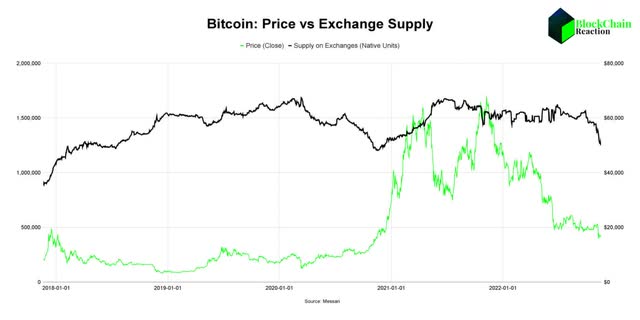

To reiterate, this is a measurement of the computing power committed to securing the network. If Bitcoin were dead, we would see this figure collapse. It does the opposite. Also, if Bitcoin was dead, we would probably see BTC inflows to exchanges for dollar conversions instead of exchange outflows. We see outflow:

BTC exchange balance (Messari/BCR)

Whether you’re in the Bitcoin-only camp or not, the FTX collapse seems to have spawned new self-storage maximalists. The supply of BTC on exchanges has plunged from 1.56 million at the end of September to 1.26 million today. The exchange supply balance has not been this low since 2020 when the BTC price rally really started to accelerate. To be clear, I’m not suggesting we’ll see a big price increase anytime soon. This time, we don’t have the same macro setup as we did in 2020. But if Bitcoin was dead, we’d see more of it coming to exchanges instead of leaving.

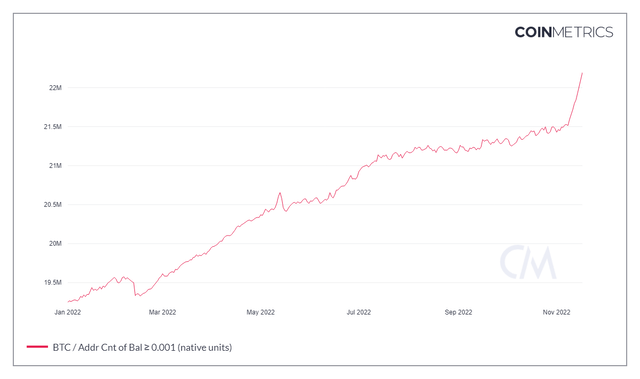

0.001 BTC Minimum Balance (CoinMetrics)

Non-zero BTC balances are fast approaching 44 million wallet addresses. We can also see similar growth trends among a wide range of address balance minimums. In the chart above, we can see addresses with at least 0.001 BTC, or about $16.5, have increased from 21.5 million on November 8th to 22.2 million today – a 3% increase in just 10 days. This is a good indicator that even holders with a lower stack value understand the point of self-storage.

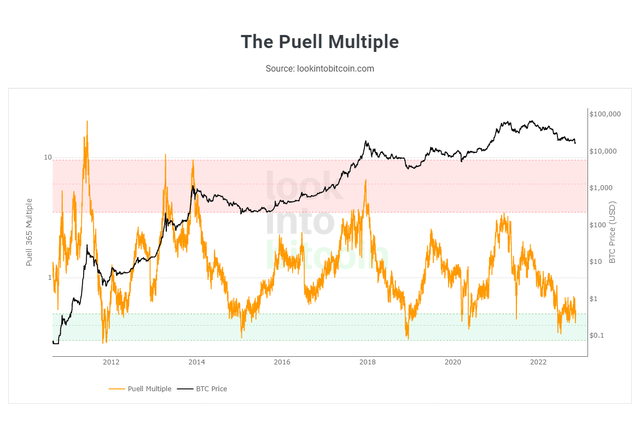

Puell Multiple and NVT Valuation

One of the ways we can try to guess where Bitcoin’s price will go is with the Peull Multiple. What this chart measures is Bitcoin’s daily issuance measured in dollars and dividing that number by a one-year moving average of the issuance value.

Puell Multiple (LookIntoBitcoin)

Usually when we see the multiple find the green zone, it means there is more pressure on miners to sell the issue. The multiple has been in the green for essentially 5 consecutive months. When the multiple is so depressed for so long, it has usually been an indicator that the bottom is near or in and miners no longer need to sell issuance to pay the bills. History doesn’t repeat itself, but it can rhyme.

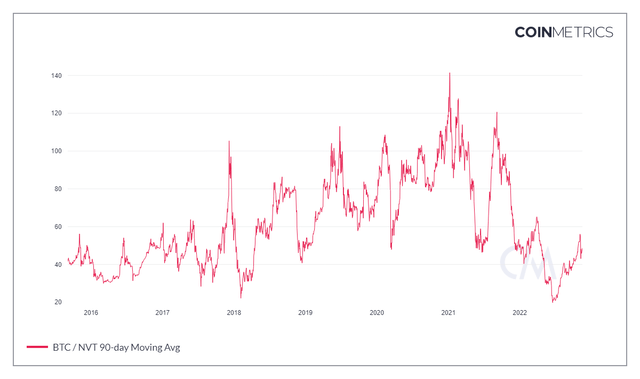

NVT 90 Day MA (CoinMetrics)

Something else to consider is the NVT ratio or net worth in relation to transactions. This ratio was created by Bitcoin analyst Willy Woo and has often been a strong buy indicator when the ratio is very low. What this ratio aims to show is the valuation of Bitcoin based on how much it is used for transactions.

During the June selloff, the NVT ratio actually went below 20 – something that didn’t happen after the 2018 selloff and was actually the lowest the ratio had been since 2011. None of this means that these ratios can’t go lower, but if one wants to be strategic with buying, buying when the ratio is as low as it is now has given good results in the past.

Risks

The biggest risk for Bitcoin is criminalization by decree. Even that won’t kill Bitcoin, but it will be a significant blow and will likely seriously damage consumer interest in acquiring and holding it. There is precedent for the US government to do something like that with gold. In 1933, FDR signed Executive Order 6102 which made gold hoarding illegal. Of course, US citizens are allowed to hold gold again, but that came after a significant revaluation.

Importantly, the US is only one jurisdiction, and there are certainly reasons why other countries have and may continue to take a more opportunistic approach to BTC.

BTC: Country Holdings (BuyBitcoinWorldwide)

The other major risk for Bitcoin is that it is dependent on the internet to be used while other traditional fiat escape assets such as gold and silver are not. There is no denying that fact. But if a significant enough part of the world loses electricity to the point that Bitcoin’s ledger is no longer accessible, humanity would have far bigger problems than discussing investment assets.

Summary

Regarding Charlie Munger and his lousy take on Bitcoin, if a currency that helps kidnappers should be avoided, I have some bad news for him about the USD. BTC cannot simultaneously be worth nothing and also be used to facilitate crime. Which is it? Bitcoin antagonists must choose. Is it worth nothing, or is it potentially so valuable to non-Western nations that it threatens to end the dollar system as we know it today? Perhaps a better question is whether a network of decentralized computers tasked with maintaining a public ledger cares what anyone thinks?

If you are bearish Bitcoin long term, fine. I’m not going to try to win you over. If you are bullish on Bitcoin long term, keep your dollar costs average and you will be fine. Are we at the bottom in Bitcoin? I doubt it. But I think we are much closer to the bottom than the top, and I think this Bitcoin bear cycle is closer to the end than the beginning. The network is still strong. Be calm and stack your bet.