Bitcoin holders realized 14 times more losses than profits recently

Data from Glassnode reveals that Bitcoin holders have realized 14 times more losses than profits in recent weeks.

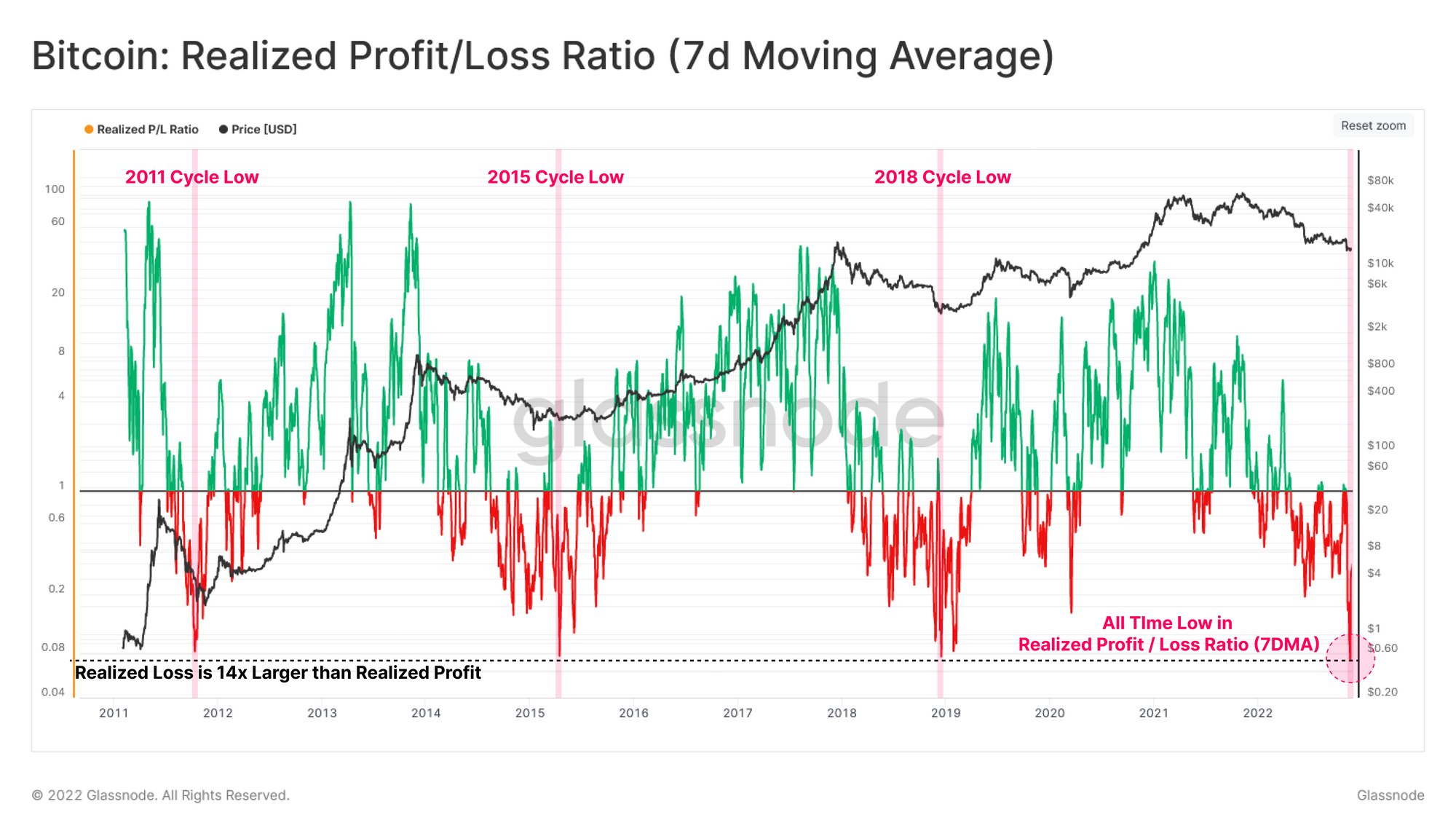

Bitcoin 7-Day MA Realized Profit/Loss Ratio Sets New All-Time Low

According to the latest weekly report from Glassnode, the realized profit/loss ratio has assumed its lowest value ever.

Every time a coin is idle in the chain and the price of Bitcoin changes, it accumulates a certain amount of profit or loss, depending on the direction of the price swing.

This profit or loss is called “unrealized”, so as long as the coin stays in the same wallet, but as soon as the holder moves/sells this coin, the total amount of profit/loss it had is said to be “realized.”

The realized profit and realized loss calculations keep track of such amounts of profit and loss reaped by investors across the BTC market.

Now, the “realized profit/loss ratio” is an indicator that measures the relationship between the current values of these two metrics.

Here is a chart showing the trend of the 7-day moving average of this Bitcoin ratio over crypto history:

The 7-day MA value of the metric seems to have been quite low in recent days | Source: Glassnode's The Week Onchain - Week 49, 2022

As you can see in the graph above, Bitcoin’s realized win/loss ratio has plunged deep below a value of 1 after the FTX crash.

When the indicator has values in this zone (that is, when it is less than 1), it means that BTC investors are realizing a higher loss than profit right now.

In the latest plunge, the calculation not only fell to fairly low values, it actually registered a new all-time low. This bottom level corresponded to the realization of losses being 14 times more than the realization of gains.

It is clear from the chart that deep downturns that have now historically been observed at or near bottoms in past bear markets, meaning they have always been at the center of changes in macro market regimes.

If the same trend follows this time as well, then the current Bitcoin market may also be in the midst of such a shift.

BTC price

At the time of writing, Bitcoin’s price is hovering around $16.9k, up 3% in the last week. Over the past month, the crypto has lost 20% in value.

The chart below shows the trend in the price of the coin over the last five days.

Looks like the value of the crypto has been trading sideways around $17k | Source: BTCUSD on TradingView

Featured image from 愚木混株 cdd20 on Unsplash.com, charts from TradingView.com, Glassnode.com

![Bitcoin [BTC] attempting another resistance breakout: Will it break $30,000 Bitcoin [BTC] attempting another resistance breakout: Will it break $30,000](https://www.cryptoproductivity.org/wp-content/uploads/2023/03/BTC-michael-AMBCrypto_bulls_running_while_bitcoin_lurks_in_the_background_cc2f6f61-f2bf-4ded-992e-7660dccb3f48-1000x600-120x120.png)