Bitcoin heading for 1% weekly loss amid broader caution as FTX contagion continues

Olemedia/iStock via Getty Images

Bitcoin (BTC-USD) is on track to end the week ~1% lower, with investors remaining wary as contagion from the implosion of troubled cryptocurrency exchange FTX continues.

The top crypto fell to an over two-year low of $15.6K earlier this week and can potentially slide further.

“More will likely come from the FTX collapse and contagion effects, not to mention other scandals that may be uncovered. This could continue to make crypto traders very nervous and leave the foundations of price support extremely shaky,” said OANDA analyst Craig Erlam.

Recent on-chain data from IntoTheBlock showed that 24.6 million BTC addresses (~51%) were in negative territory, the largest share of “out-of-the-money” addresses since the start of the pandemic downturn.

The global cryptocurrency market cap is $831.94 billion, down 0.26% over Thursday, according to CoinMarketCap.

The FTX fallout continues

Sam Bankman-Fried, former CEO of FTX, ran the platform as his “personal fiefdom,” FTX attorney James Bromley reportedly said in the firm’s first bankruptcy hearing. He added that a large part of FTX’s assets may have been stolen or have disappeared.

It was also revealed that FTX and affiliates had $1.24 billion in cash – more than debtors disclosed. The company owed ~$3.1 billion to its 50 largest creditors.

Turkey is the next country to step up scrutiny of FTX, with authorities seeking to seize Fried’s assets. Meanwhile, a Texas regulator launched an investigation into whether celebrity endorsements by FTX violated securities laws.

Venture capitalist Bradley Tusk told CNBC that venture capitalists will step up their due diligence in the future after the FTX meltdown.

Genesis Global Capital, the crypto-lending unit of brokerage Genesis, has reportedly hired investment bank Moelis to explore how it can strengthen its liquidity. Given its exposure to FTX, Genesis has struggled to raise cash and may need to seek bankruptcy protection.

Regulatory news

Amid growing calls for increased scrutiny of the crypto space, certain US lawmakers reiterated that Fidelity Investments should reconsider allowing retail clients to put part of their savings in bitcoin (BTC-USD).

A group of lawmakers also called on financial regulators to review SoFi’s ( SOFI ) crypto trading activities, to which the firm responded by saying it is “fully compliant” with laws. Morgan Stanley believes the development increases the chances of SoFi (SOFI) leaving crypto entirely.

New York Governor Kathy Hochul signed a two-year moratorium on Proof-of-Work mining, making it the first state to partially ban PoW mining.

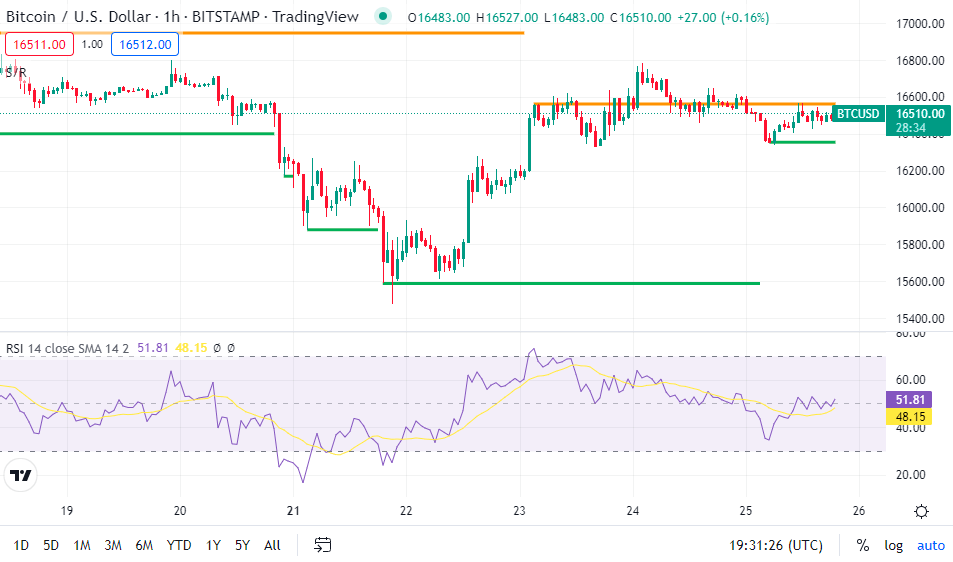

Bitcoin price

Bitcoin (BTC-USD) fell 0.32% to $16.53,000 at 2:40 PM ET, while Ether (ETH-USD) fell 0.53% to $1.20K.

Bitcoin (BTC-USD) looks set to form a support level at ~$15.6K, but OANDA’s Erlam said the $10K level is likely to be tested again in the days ahead.

SA contributor Pinxter Analytics said in a bearish analysis that there may not be a bottom for bitcoin (BTC-USD) prices since the crypto is not backed by anything tangible. Conversely, The Digital Trend is bullish, but warned that it is a speculative investment.

Cathie Wood, a longtime crypto bull, reiterated her forecast that the bitcoin (BTC-USD) price will reach $1 million by 2030.

Billionaire investor Bill Ackman has taken a U-turn on his view of cryptos, saying they are “here to stay”.

Crypto-related stocks that finished in the red on Friday include: Marathon Digital (MARA) -4.6%Riot Blockchain (RIOT) -3.7%Coinbase (COIN) -2.8%Bitfarms (BITF) -1.1%BitNile (NILE) -1%.