Bitcoin has safe haven properties during economic uncertainty: Galaxy

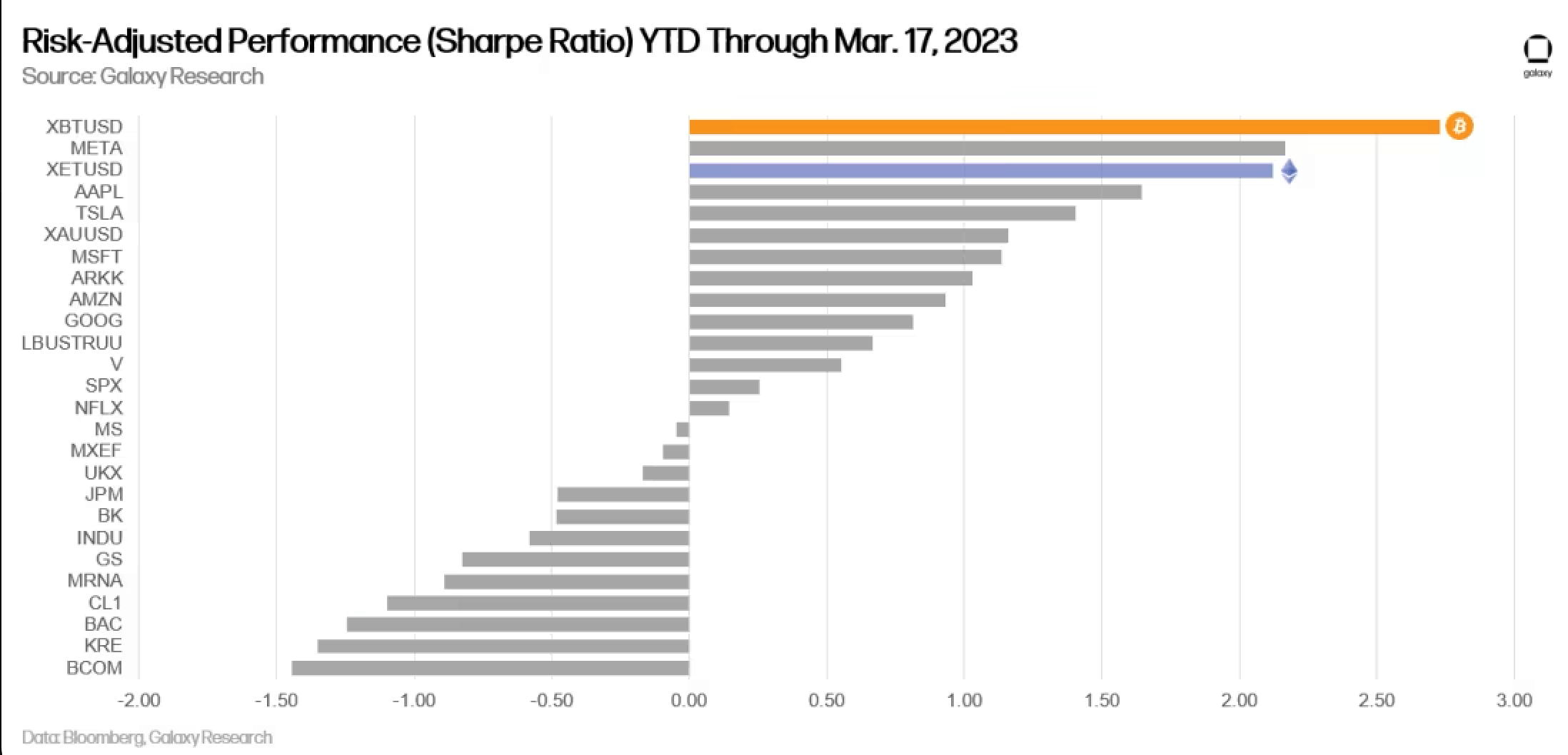

According to new data from digital asset management company Galaxy, Bitcoin (BTC) is the year’s best performing asset compared to stocks, fixed income, indices and commodities on a risk-adjusted basis.

The recently released data equates to gold rising and stocks falling. It explains how the volatility of Bitcoin is on a multi-year downtrend, and that futures open rates and perpetual swap funding rates suggest that the rally is not based solely on speculation.

Data on the chain shows ongoing accumulation, longer holding times and increasing ownership dispersion. The upcoming fourth halving is expected to precede a long-term bullish advance.

Bitcoin performance compared to other assets

Bitcoin has been the best asset in 2023 when measuring risk-adjusted performance (Sharpe ratio) compared to stocks, bonds, indices and commodities. It has consistently been one of the best performers across different time frames, with the exception of the one-year time frame.

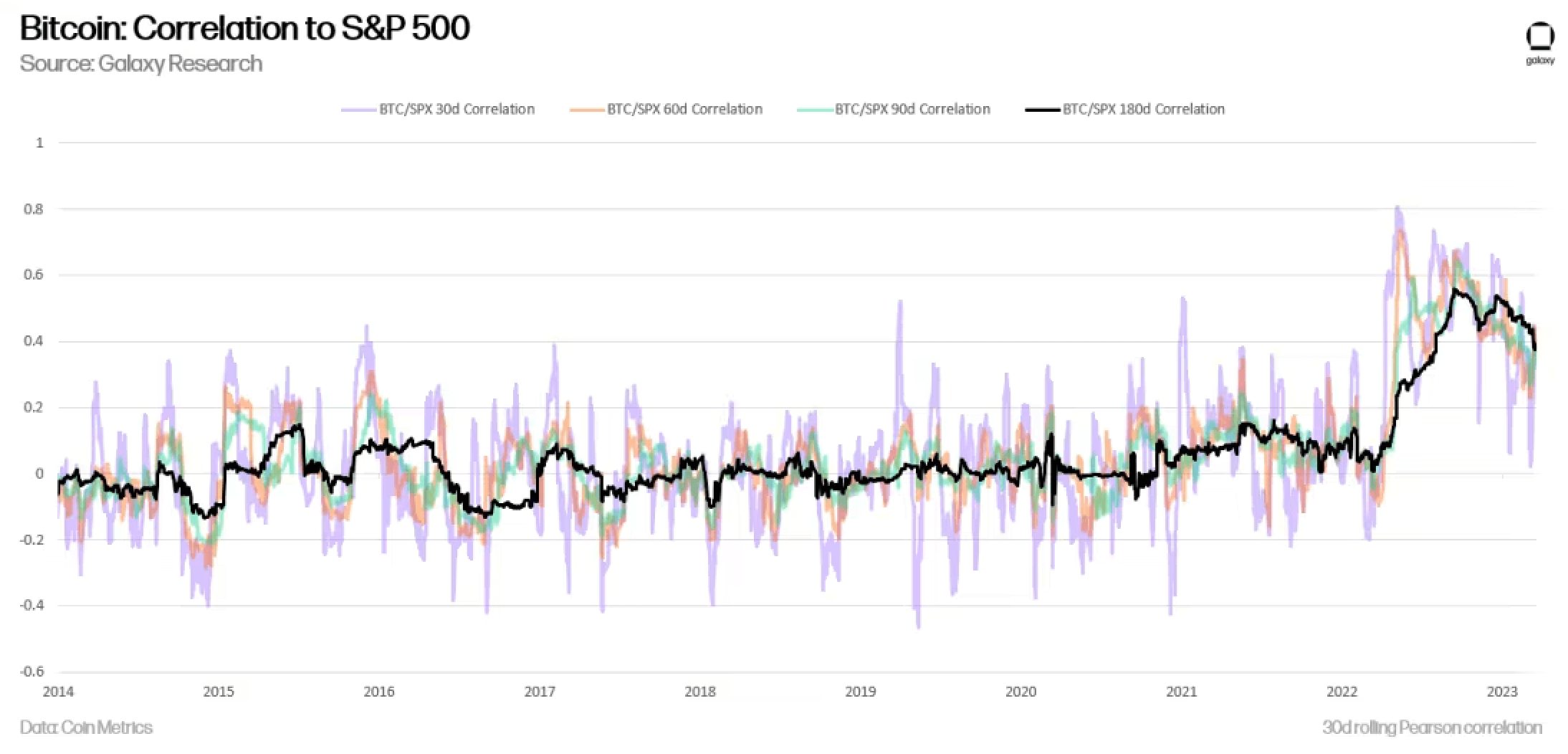

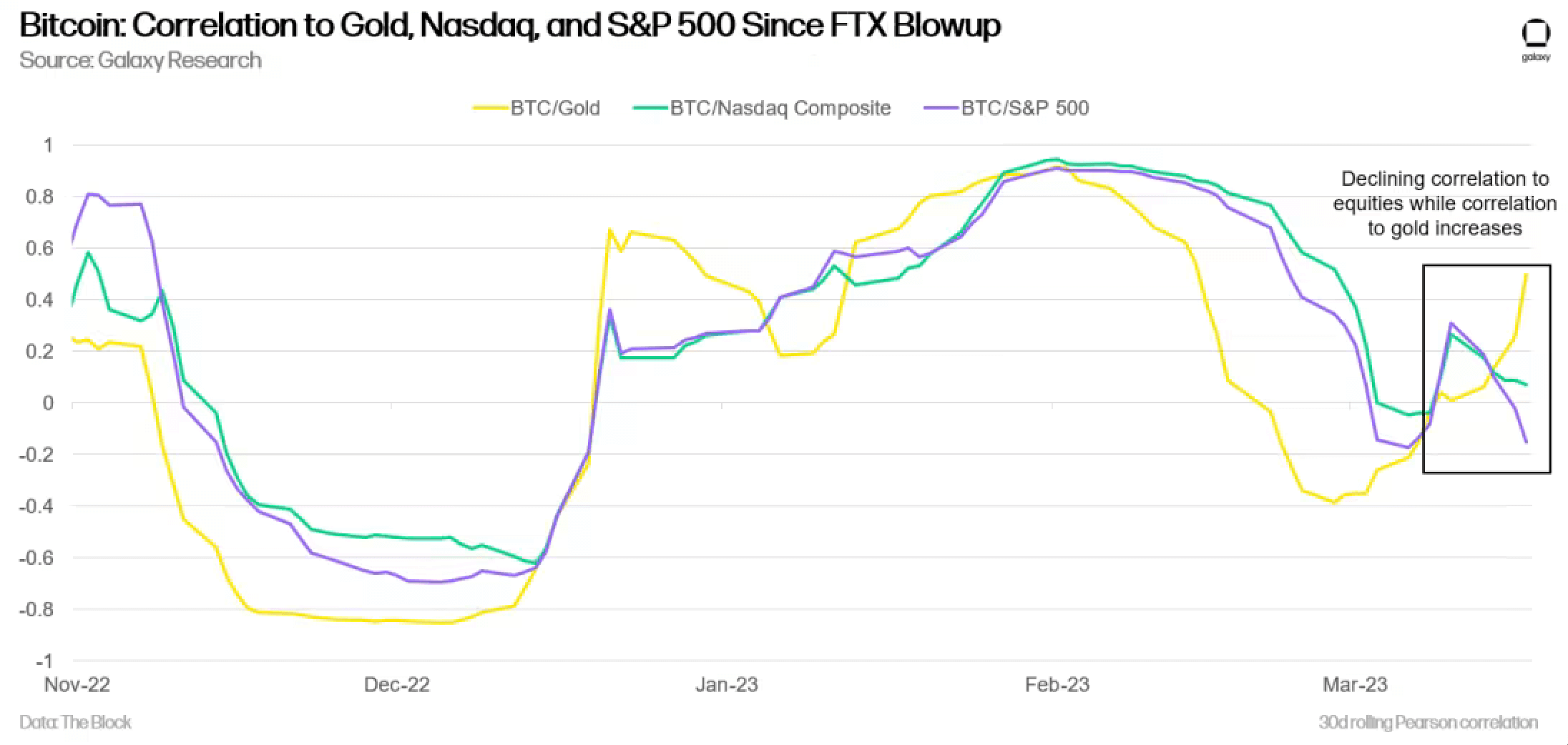

Bitcoin’s correlation with stocks has been high over the past 18 months, but has recently declined. Meanwhile, the correlation with gold has increased significantly – especially since the banking crisis.

These correlations indicate that Bitcoin has demonstrated safe haven properties in the current economic climate – demonstrating the value of Bitcoin’s fundamental properties.

Important future supply events

There are two upcoming delivery events for Bitcoin – one bullish and one potentially bearish. The fourth halving – set for April 2024 – is expected to bring the inflation rate below 1%, which historically leads to successive bull runs. Galaxy notes that the decline in new daily issuances may have less impact than expected.

Furthermore, Mt. Gox bankruptcy estate 141,686 BTC – which it recently said it does not plan to sell. The largest creditor – Mt. Gox Investment Fund – chose to receive early payment in approximately 70% BTC and 30% cash and does not plan to sell the BTC it receives.

Early distribution date is expected in September and it is expected that most BTC will not be sold at distribution. There could be second-order impacts in BTC lending markets if creditors want to lend BTC either off-chain or on-chain via conversion to WBTC, according to Galaxy.

Read the full Galaxy report.