Bitcoin falls below key support level. How low can it get?

Bitcoin has pulled back to a crucial support area that served as the upper limit of the negative move in late June at the 18,000 range.

Bitcoin breaks the decisive level

After falling below the bear flag in mid-August, prices could fall further at a break of 20,000 before reaching a crucial support area around 19,600. Although it has just returned to action, this level has also served as a critical source of resistance for the leading cryptocurrency since 2017.

BTC/USD falls below $20k. Source: TradingView

This puts strong downward pressure on Bitcoin as it moves into September. In addition, according to cryptocurrency expert Ali MartinezBitcoin’s market share has fallen below 39% for the first time since 2018.

For Bitcoin maximalists, this is troubling news as alternative cryptocurrencies continue to overtake the cryptocurrency monarch.

Popular cryptocurrency analysts have also drawn attention to a worrying trend in Bitcoin’s past performance in September.

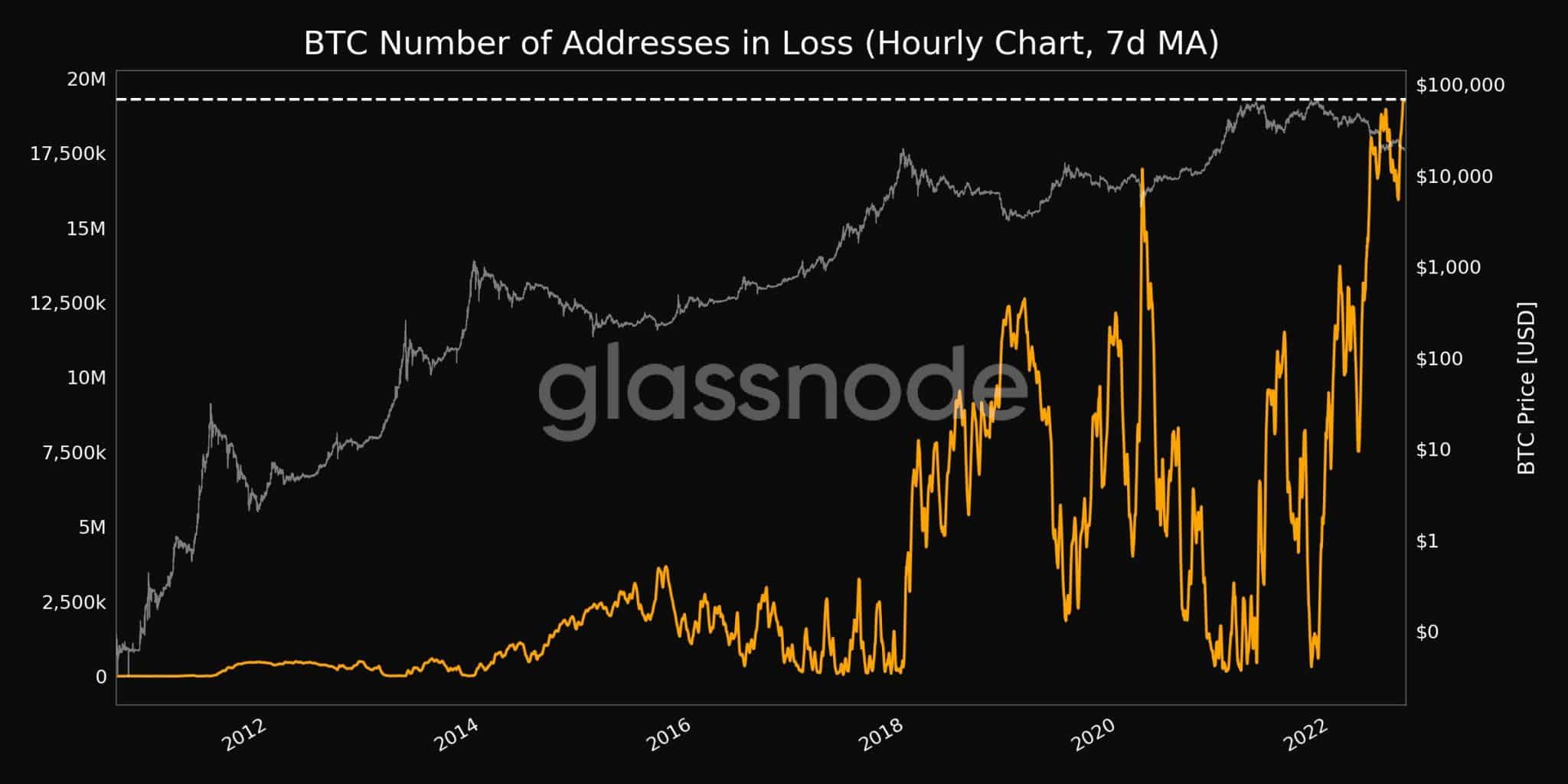

For example, according to one expert, Bitcoin has experienced a losing month end in nine of the last twelve Septembers. 7 September, Glassnode reported that 19.29 million BTC addresses had losses.

Source: Glassnode

When BTC/USD reached an all-time high of $19,666 on December 17, 2017, it reached its peak. Since then, a breach of this zone in December 2020 fueled a rally that helped the major cryptocurrency rally before reaching a new all-time high of $69,000 last November.

Selling pressure has returned prices below the end of June at $18,595, after a drop below previous support that had turned to resistance.

Price may crash further

Should prices fall further, a breach of the $18,000 psychological level could lead to a retest of the $17,792 level, which represents a 78.6% retracement of the 2020 to 2021 transition, with the December 2020 low of $17,569 being the next level of support.

The four-hour chart shows how these historical levels have created confluence zones that continue to keep both bulls and bears at bay as short-term price movements hover between $18,500 and $19,000. Retests at $19,666 and the subsequent resistance at $20,418 are likely to the upside if the price rises above $19,000 and $19,500.

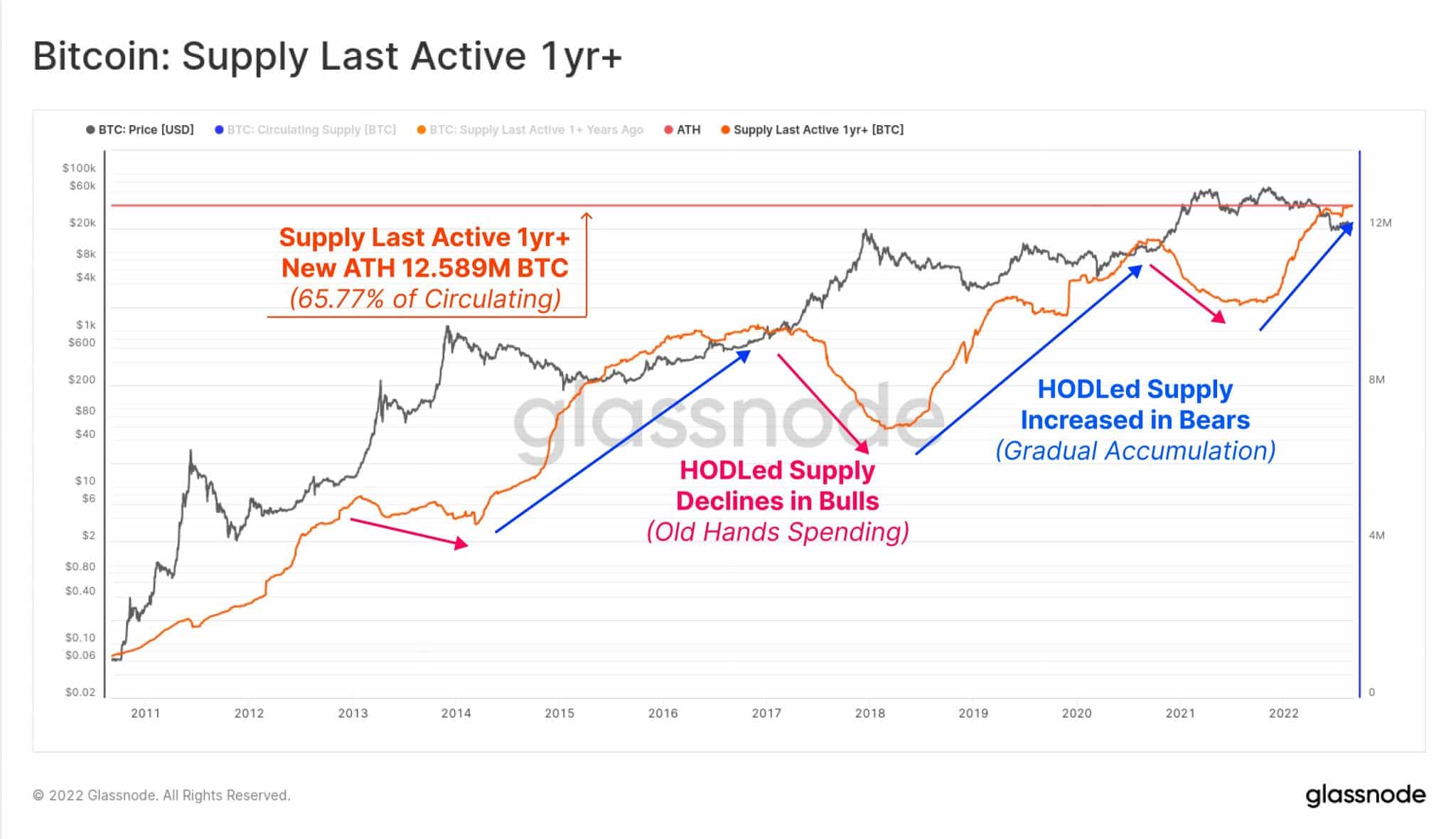

In a recent report, The glass node also mentioned a potential negative market movement from Bitcoin. It claimed that around 12.589 million BTC, or over 65.77% of the total amount of BTC in circulation, has been dormant for at least a year.

Source: Glassnode

In the past, “Bitcoin bear markets” have been characterized by an increasing inactive supply. The pain felt by maximalists who have patiently waited for a price breakout is compounded by this.

Short-term volatility was predicted by BaroVirtual, a CryptoQuant-based author. The analyst studied the net unrealized profit (NUP) trend pattern, which shows short-term periods of volatility.

Featured image from Shutterstock, charts from Glassnode and TradingView.com