Bitcoin, Ethereum, Quantum Price Analysis

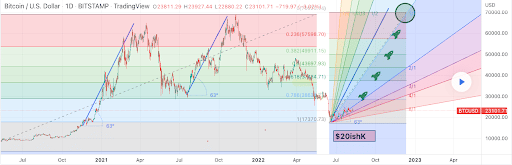

Bitcoin Analysis

Bitcoin’s price took two consecutive days of positive price action on Tuesday and closed its daily light -$676.

Today’s price analysis begins as always with bitcoin and today’s first chart is BTC/USD 1D Chart below from Operation_Morningstar. BTC’s price trades between the 1 fibonacci level [$17,370.73] and 0.786 [$28,638.77]at the time of writing.

The above goals for bullish BTC market participants are 0.786, 0.618 [$37,484.71]and 0.5 [$43,697.93].

Traders going short in the BTC market are looking to once again send BTC’s price back down to test the 2017 all-time high of $19,891. If they succeed in pushing BTC’s price below that level, the next fibonacci target is the 2022 low of 1 [$17,370.73] on bitstamp’s exchange.

Bitcoin’s moving average: 5 days [$23,241.62]20 days [$22,562.79]50 days [$22,959.44]100 days [$30,315.23]200 days [$38,559.77]Year to date [$34,136.83].

The fear and greed index is 31 Fear and is -11 from Tuesday’s reading of 42 Fear.

BTC’s 24-hour price range is $22,888-$23,913 and its 7-day price range is $22,526-$24,185. Bitcoin’s 52-week price range is $17,611-$69,044.

The price of Bitcoin on this date last year was $45,612.

The average price of BTC for the last 30 days is $22,295 and its +7.4% over the same duration.

Bitcoin’s price [-2.84%] closed its daily candle worth $23,141 on Tuesday and in the red for the first time in three days.

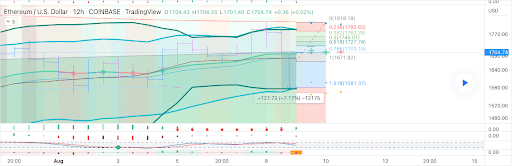

Ethereum analysis

Ether price sold off more than 4% on Tuesday, and when traders settled at the daily session’s close, ETH was -$75.55.

The second chart we are looking at today is ETH/USD 12HR Chart below of puzzledHare79535. Ether trades between 0.786 [$1,703.15] and 0.618 [$1,727.74]at the time of writing.

Market players who are long ETH is looking at overhead targets at 0.618, 0.5 [$1,745.01]and 0.382 [$1,762.38].

Traders who are convinced of lower prices are waiting because of the recent period bearish rejection of Ether bulls at the $1,800 level have targets on the downside of 0.786, 1 [$1,671.82]and 1,618 [$1,581.37].

Ether’s Moving Average: 5-day [$1,685.47]20 days [$1,544.50]50 days [$1,406.91]100 days [$2,059.90]200 days [$2,767.33]Year to date [$2,364.98].

ETH’s 24-hour price range is $1,667.93-$1,790.83 and its 7-day price range is $1,592.48-$1,806.67. Ether’s 52-week price range is $883.62-$4,878.

The price of ETH on this date in 2021 was $3,139.33.

The average price of ETH for the last 30 days is $1,503.33 and its +40.12% over the same time frame.

Ether price [-4.25%] closed its daily candle on Tuesday worth $1,702.8 and with red digits also for the first time in three daily candles.

Quantum analysis

Quant’s price also took a step back on Tuesday and ended its daily trade -$3.1.

The final chart that concludes today’s price analysis is QNT/USD 1W Chart below from huy221. Quant’s price trades between 1 [$110.12] and 1,618 [$147.98]at the time of writing.

The overhead targets for QNT bulls are 1,618 and 2,618 [$209.24].

The downside targets for bearish QNT traders are the 1 fib level, followed by 0.5 [$79.49]and a full retracement back to 0 [$48.86].

Quant’s price is +86.73% against the US dollar for the last 90 days, +153.3% against BTC and +159.8% against ETH, over the same time frame.

QNT’s 24-hour price range is $119.8-$129.6 and its 7-day price range is $101.43-$132.05. Quant’s 52-week price range is $40.5-$416.6.

Quant’s price on this date last year was $154.4.

The average price of QNT in the last 30 days is $101.33 and its +73.04% over the same period.

Quant’s price [-2.41%] closed its daily candle on Tuesday worth $125.7 and in the red for the first time since August 4.