Bitcoin, Ethereum and Altcoins are on pace to outperform most major asset classes, according to Bloomberg analysts

Bloomberg commodity analysts say cryptoassets are poised to outperform the rest of the financial markets.

In the latest Bloomberg Intelligence: Crypto Outlook report, analysts Mike McGlone and Jamie Douglas Coutts argue that Bitcoin (BTC), Ethereum (ETH) and altcoins within the Bloomberg Galaxy Crypto Index (BGCI) are poised to outperform everything else as financial markets turn bullish again .

The Bloomberg analysts say digital asset markets could come to life on the narrative of Bitcoin becoming a risky asset rather than being closely correlated with stock markets.

“That the lone major asset class to rally in 1H – raw materials – may have logged a lasting one peak has implications for a bottom in Bitcoin. When ebbing economic tide turns, we see the inclination resume for Bitcoin, Ethereum and the Bloomberg Galaxy Crypto Index to outperform most major assets. Interest rate increases from more central banks than ever before are a strong headwind.

But there is the potential for the benchmark crypto to shift towards becoming a risk active asset like gold and US Treasuries, which could play out in 2H. Since 2014, October has been the best month for Bitcoin, with an average increase of approx. 20%, and in the 3rd quarter BGCI increased by approx. 16% vs. 5% decline for Nasdaq 100 and S&P 500. Ethereum’s move to proof of stake may help. it’s building a base above $1,000 and Bitcoin around $20,000.”

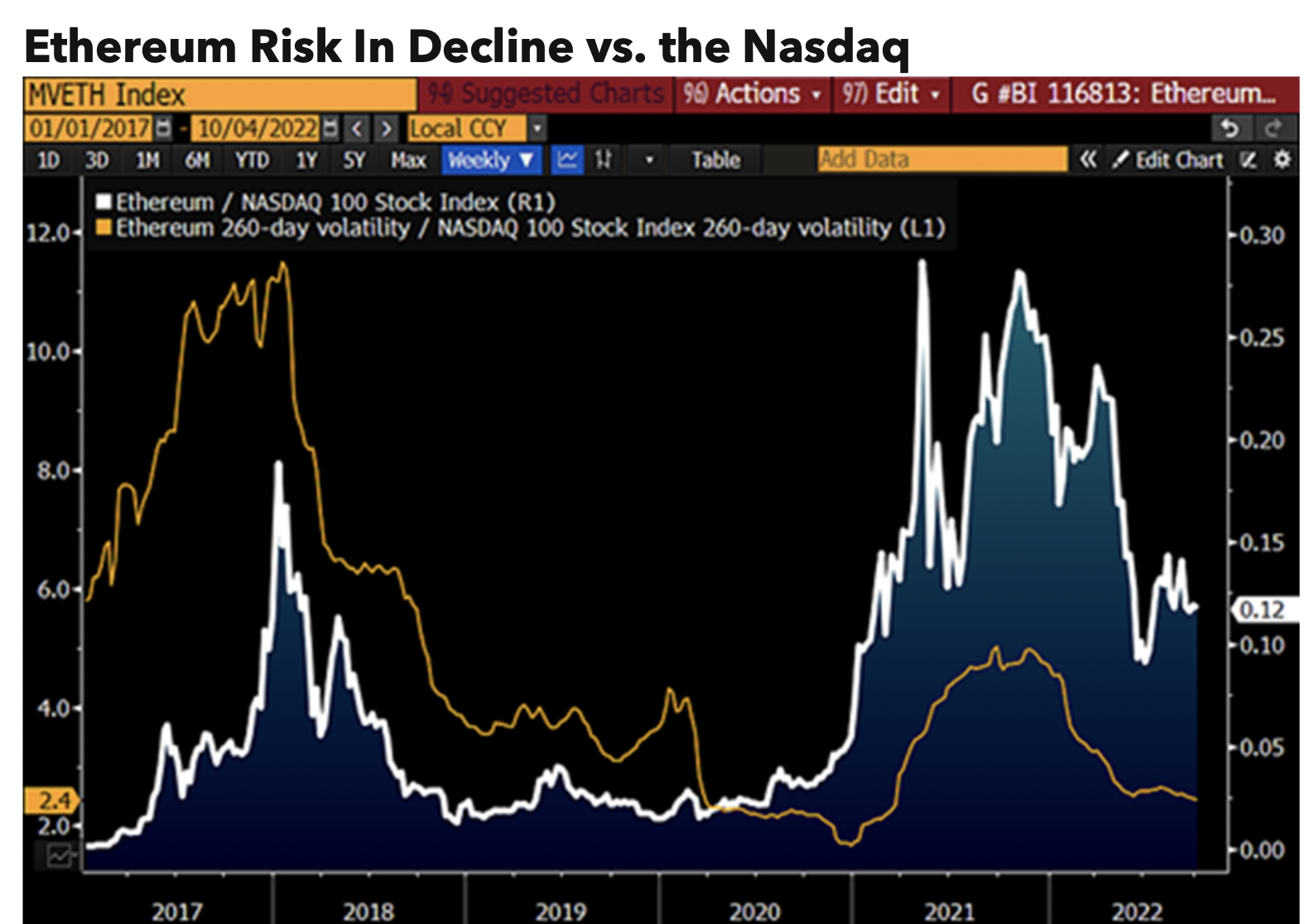

Looking at Ethereum, the Bloomberg analysts say that the second largest blockchain by market capitalization, the recent successful merger of proof-of-stake helped it into a new chapter. According to the strategists, ETH may be at a point where it becomes more stable than traditional financial instruments during macro bear markets.

“Ethereum took a leap forward with the proof-of-stake merger in September, with price implications

performance. Crypto #2 tends to respect support and resistance in big round numbers, and $1000-$2000 has been the cage.

Around $1,000 is key support, and our chart shows that Ethereum outperformed the Nasdaq 100 index in 3Q. The tech nascent and more volatile No. 2 crypto tends to outperform the stock index on the way up, but the merger could mark a turning point for Ethereum to also beat the Nasdaq 100 when it falls.”

The Bloomberg analysts are also bullish on the fact that USD-pegged stablecoins, the most traded type of crypto-asset, mainly rely on the Ethereum network to operate.

“The most traded digital assets are cryptodollars, which are tokens that track the dollar, mostly enabled by Ethereum. We like to ask what is stopping the tokenization of most assets, and it may simply be a matter of time.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/Illus_man