Bitcoin: El Salvador on the brink

© Reuters

© Reuters By Marco Oehrl

Investing.com – More than a year has passed since El Salvador became the first country in the world to introduce legal tender. After initial teething problems, it looked as if the initiative taken by President Bukele could be a success. In the meantime, however, the tide seems to have turned, which is not only due to the drop in the Bitcoin price, but rather because of information that has come to light about the country’s BTC program.

The launch of the El Salvador-commissioned Chivo wallet, which serves as a central hub for BTC payments, was anything but smooth. The wallet’s developer, Athena Bitcoin Global, had to hire an outside firm tasked with eliminating existing bugs. The Texas-based software company ROI Developers/Accruvia took on this task. According to this company, Athena Bitcoin Global failed to pay an invoice of over $80,000, which led to a lawsuit.

According to No Fiction, some shocking details emerged in the process. The target set by President Bukele of 50,000 Chivo registrations on launch day was at risk of failure. ROI stated in court that the implemented verification service crashed during the first 150 registrations. However, the verification was inevitable because each new user received an initial credit of $30 bitcoin from the government.

In order not to jeopardize the presidential campaign, the operator decided to disable the KYC process. It was then apparently no longer necessary to check whether the registered users actually existed. According to ROI, fictitious profiles were created with user photos of potted plants, which was enough to get the $30 gift. The resulting damage is likely to be in the millions of dollars.

Some of the Chivo users also discovered that the wallet was ideal for getting into day trading. The BTC rate was updated only once a minute, according to ROI, which opened up the possibility of profitable arbitrage trades. All one had to do was compare the price of the Chivo wallet with the current rate from the data provider. In this way, one knew where the wallet’s Bitcoin rate would be in a minute and whether it was better to buy or sell. There is also said to be a verifiable case where a user traded the wallet up from $2,000 to $400,000. The money earned in this way had to be operated directly over the state budget.

Then there was a bug fix that allowed a 1:1 exchange rate. The bargain hunters made 3,600 transactions with a volume of $180,000. However, the real value was over $10 billion, “which immediately made the government insolvent.” Even before the payouts could be stopped, $250,000 flowed out of the system, according to ROI.

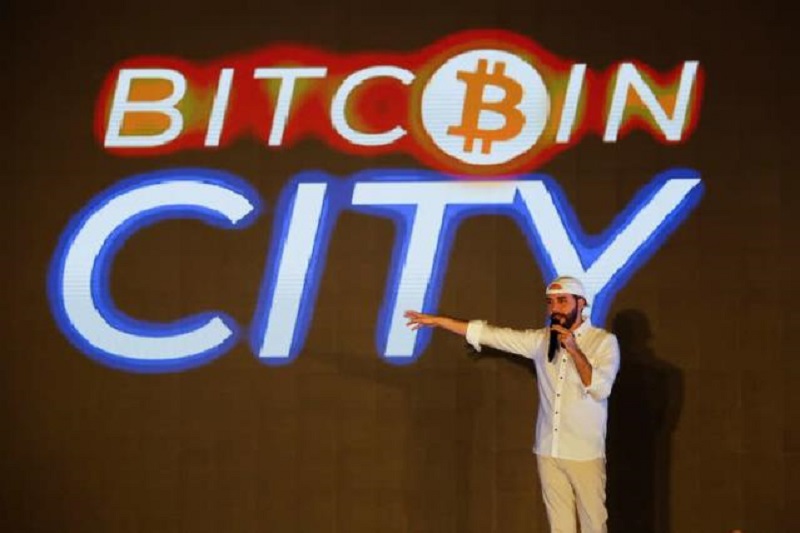

It all ended with Athena Bitcoin Global stopping work on the Chivo wallet in December 2021. Instead, iFinex was tasked with taking over the administration of Chivo. At that time, President Bukele had already announced that he was establishing a “Bitcoin City” and issued $1 billion worth of “volcano bonds” to implement this plan.

According to No Ficcion, that was the reason why iFinex would henceforth operate the Chivo wallet. iFinex is the parent company of both stablecoin and the crypto exchange Bitfinex. Apparently an ideal mix to make Bitcoin City and Volcano Bonds a similar “success story” as the staggeringly high registration numbers at the launch of the wallet.

Last month, Bukele introduced a bill that would give Tether similar rights to legal tender Bitcoin. The volcano bond was supposed to be launched last spring, but it was postponed due to the war in Ukraine. Now it’s back to discussion, although interest from institutional investors is likely to be low due to the recent market turmoil.

No Ficcion expects the bond won’t be a slow seller after all, as iFinex has enough financial power through Tether to thank the president for the “trust” it has placed in it. To date, Tether has not disclosed what security supports the stablecoin at all. This is a good prerequisite for covertly buying into the volcano bond with its 6.5% interest rate and strengthening its position in El Salvador.

Implementation may be imminent, as El Salvador needs $667 million in January to pay claims on a maturing bond. The country does not appear to have these funds and is said to have already applied to the IMF for a bailout, which was rejected.

Bitcoin technical price points

Bitcoin is currently giving a gain of 1.93% at a price of $17,322, while the weekly gain is 6.93%.

The cryptocurrency managed to break out of its recent range today after several consecutive days of trading around the 23.6% Fibo retracement of $16,986. Today’s upside move is supported by a daily close above the aforementioned Fibo retracement.

This opens the door for a test of the 38.2% Fibo retracement at $17,841. If this level can be overcome sustainably, the next resistances will be found at the 55-day MA at $18,312 and the 50% Fibo retracement at $18,533.

Only if the bulls fail to defend the support of the 23.6% Fibo retracement on a daily closing basis, a downward move towards the November 28 low, which can be found at $16,013, must be expected.