“Bitcoin Could Skyrocket to $100,000,” According to Standard Chartered – Here Are 3 Stocks to Benefit

Bitcoin failed to fulfill one of its purposes last year as a hedge against skyrocketing inflation, but it came into its own recently via another original purpose – as a bet against the old banking system. Its decentralized and trustless attributes have made the leading crypto hold up against a backdrop of several bank collapses. In fact, delivering gains of 70% through Q1 made it the best asset of the quarter.

And it has a lot more room to run, says Geoff Kendrick, head of crypto research at British banking giant Standard Chartered. “We see the potential for Bitcoin to reach the $100,000 level by the end of 2024 as we believe the much talked about ‘crypto winter’ is finally over,” Kendrick noted.

That’s a 240% gain from current levels, an increase that will be hard to find elsewhere. However, for many, buying bitcoin directly still represents something of a complicated act, but there are ways to get skin in the game without buying the asset directly. The stock market offers opportunities with many names operating in the bitcoin ecosystem – miners in particular – and their performance naturally correlates with that of the crypto danger. Therefore, if bitcoin is set to rise, so will many bitcoin-themed stocks.

With this in mind, we delved into the TipRanks database and pulled out the details of 3 crypto stocks poised to ride the expected run. Moreover, all 3 are rated as strong buys by the analyst consensus. Let’s take a closer look.

CleanSpark, Inc. (CLSK)

We’ll start with CleanSpark, a bitcoin miner that decided some time ago that bitcoin mining was where it’s at. While the company once specialized exclusively in microgrid solutions, it began to focus on mining towards the end of 2020. Since then, however, mining has become the main priority.

CleanSpark oversees its own mining operations in Atlanta, Georgia and co-locates miners in Massena, NY. Bitcoin is known to be hugely energy-intensive, but the company likes to tout its credentials as a sustainable player, mining most of its BTC with renewable or low-carbon energy sources. By frequently selling its mined bitcoin, the company has funded expansion and last year, even as the crypto winter raged, its hash rate – the measure of computational power used to mine the asset – increased from 2.1 EH/si in January to 6.2 EH/s at the end of the year.

The company has set its sights on bringing the hash rate up to 16.0 EH/s by the end of 2023, and recent purchases will go towards making this goal a reality. The company recently announced a purchase of 45K new Antminer S19 XP machines which when eventually deployed will almost double the current hash rate.

According to HC Wainwright analyst Mike Colonnese, the company showed some nifty business in securing the deal, which comes about two months after the company bought 20,000 Bitmain rigs for a 25% discount.

“CLSK secured the machines for a very attractive $23/TH (before coupons), the lowest we’ve seen in the market for these rigs, and 12% below the going rate for high-efficiency ASICs (under 25 J/TH), based on Luxor’s Bitcoin ASIC Price Index,” the analyst explained.

“Management has been very opportunistic in acquiring new mining rigs at rock-bottom prices over the past year, which we believe will drive significant shareholder value, and with this latest purchase the company has now secured 99%, or 15.9 EH/s, of miners that required to reach its hash rate target of 16 EH/s by the end of 2023… We continue to view the stock as significantly undervalued relative to fundamentals,” Colonnese added.

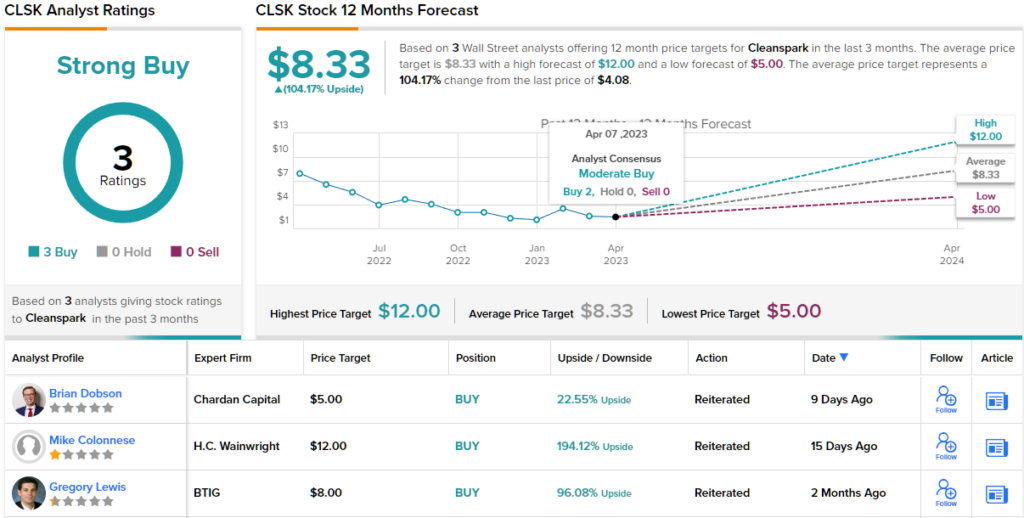

Overall, CLSK shares have risen 98% so far this year, but Colonnese sees good growth ahead. Calling CLSK a “top pick,” the analyst rates the stock a buy, while his $12 price target allows for a 12-month return of a whopping 194%. (To see Colonnese’s track record, click here)

This bitcoin miner has received two other recent reviews, and both are positive, making the consensus view here a strong buy. The average target of $8.33 may represent a more modest target, but could still yield gains of a handsome 104% over the next year. (See CLSK stock forecast)

HIVE Blockchain Technologies (HIV)

The next bitcoin miner we look at is HIVE Blockchain Technologies. Fun fact: in 2017, HIVE became the first publicly traded crypto miner. The company actually started as a GPU-based miner of Ethereum, but in 2020 it also started mining bitcoin and has been expanding its operations ever since. The company has a commitment to ESG practices and mines its bitcoin using green energy, using favorable power costs and renewable energy sources with mining operations in Canada, Iceland and Sweden.

The company asserts its BTC credentials and aims to promote long-term shareholder value with the OG practice of HODLing – holding its bitcoin close to the chest.

That said, HIVE saw a big drop in its revenue stream in its latest financial report – for the third quarter (December quarter). Revenue fell 79% year-over-year to $14.3 million, which can be attributed not only to an increase in global hashrate and reduced cryptocurrency prices, but also to Ethereum’s transition to a proof-of-stake model. That said, the company mined 787 bitcoins during the quarter, representing a 13% year-over-year increase, while the average production cost per BTC was $13,599. The current BTC price is more than double.

The company also said that to maximize profitability, it intentionally scaled back on production and also used some of its GPUs for non-mining.

Looking at these activities, Canaccord analyst Joseph Vafi likes the way this firm operates. The 5-star analyst writes: “We see the current setup for HIVE as healthy on several fronts. We are encouraged by the company’s efficient Bitcoin production, strong balance sheet, steady progress at the facilities and cautious approach to GPU reuse. Perhaps most importantly, on a macro level, we believe digital assets are higher biased over the medium to long term, and particularly Bitcoin, which has handled resistance relatively well in the face of recent market volatility…”

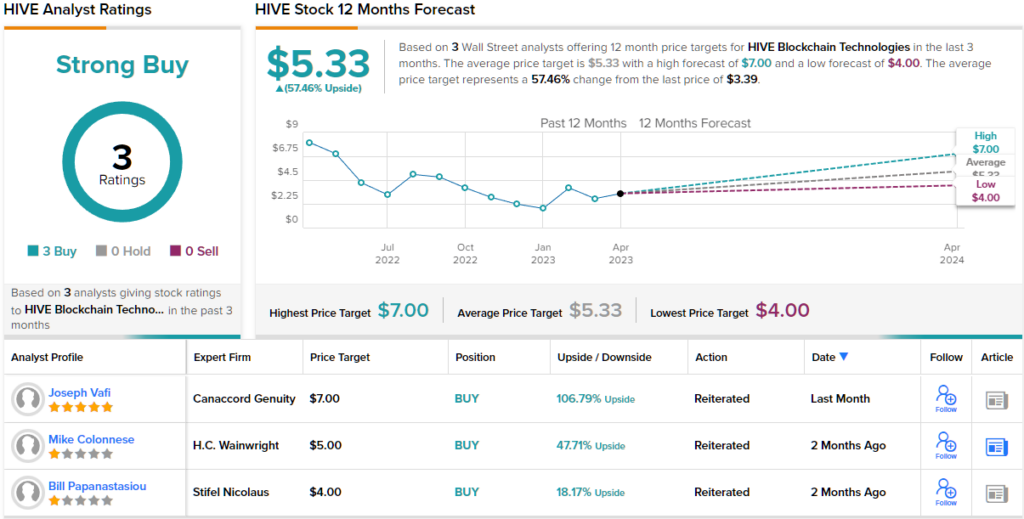

These comments form the basis of Vafi’s Buy rating on HIVE, which is supported by a $7 price target. Even after posting year-to-date gains of a hefty 119%, investors are facing a pocket return of 134%, if that figure is reached. (To see Vafi’s track record, click here)

Elsewhere on the street, with two more positive reviews in tow, HIVE claims a strong buy consensus rating. The forecast suggests a 12-month return of 57%, considering the average target is $5.33. (See HIVE stock forecast)

Iris energy (THE IRISH)

Bitcoin has its fair share of evangelists and two early adopters who are convinced its value is the driving force behind the next BTC flavor. Daniel and Will Roberts are the co-founders and co-CEOs of Sydney, Australia-based Iris Energy and used their background and expertise in renewable energy and traditional mining to launch their bitcoin mining venture.

The company operates in regions that have an abundance of renewable energy – wind, solar, hydropower – and their locations are powered by 100% renewable energy. Iris sticks to a simple plan: mine bitcoin, sell it and pay utility bills and overhead costs.

However, the company ran into some problems last year, trying to scale meaningfully at what turned out to be extremely poor timing. With the crypto winter at its peak and the industry rocked by several scandals (Terra Luna, Celsius, FTX), bitcoin’s price crashed. Against this backdrop, several mining companies over-leveraged, saw profits fall and were driven into insolvency.

However, through careful business practices, Iris seems to have weathered the storm. And for Compass Point analyst Chase White, the way the company has handled the issues informs his positive attitude.

“Now that IREN has restructured its balance sheet to eliminate virtually all of its debt, replaced the miners who lost to creditors due to the restructuring without additional cash outlays, and is almost done with its investment costs to get to 5.5 EH/s, we believe the company is very well positioned to start generating solid free cash flow at current BTC prices with the ability to invest in further growth should BTC prices rise further,” White said.

In fact, the lack of debt and the almost complete development of the facility “deteriorated the story significantly,” the analyst said.

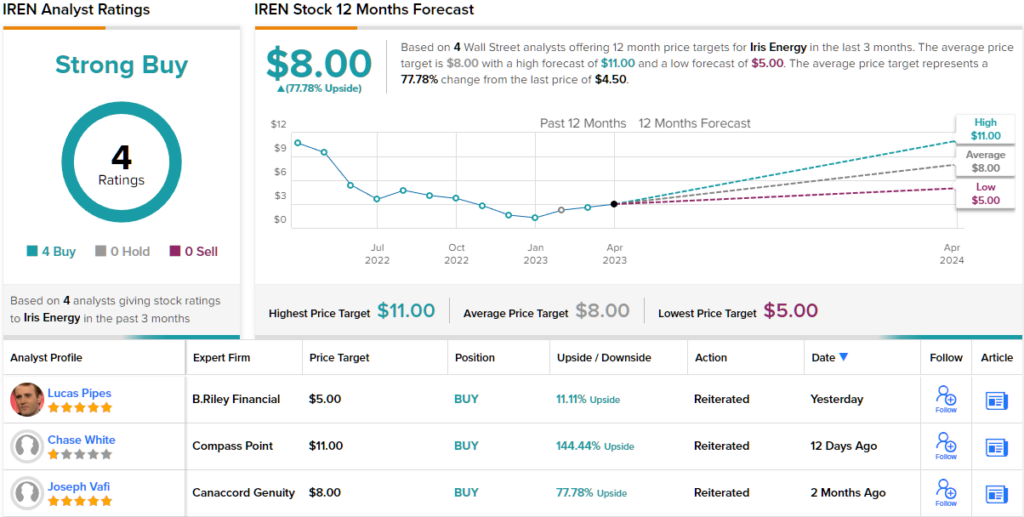

IREN shares have benefited enormously from bitcoin’s rise and have seen 260% growth since the turn of the year. However, White believes there are many more gains to come. Along with a Buy rating, his price target of $11 suggests the stock has room for further growth of 144% in the coming year. (To see White’s track record, click here)

White’s thesis receives the full support of his colleagues here. The stock only achieves buys – 4 in total – for a strong buy consensus rating. Shares are expected to change hands for a ~78% premium a year from now, considering the average target is $8. (See IREN stock forecast)

To find great ideas for trading crypto stocks at attractive values, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unifies all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the analysts featured. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making an investment.