Bitcoin (BTC) price risk persists as demand slows

A fairly lackluster Bitcoin price action has left the market hoping for some quick moves, but BTC may make participants wait a little longer for some good news to emerge.

Bitcoin price action has been a rather dismal affair for investors, stuck below the $20,000 mark for most of October so far. A tight supply band around the $19,000 mark has steered the BTC price as bulls and bears both fail to move prices in either direction.

BTC was trading at $19,268 at press time, recording a 23.72% increase in daily trading volumes to start the week. The global crypto market cap moved more or less in step with the Bitcoin price today, rising ever so slightly to $964 billion.

BTC price in consolidation

Although the market is hoping for recovery after a long bearish period, Bitcoin’s technical signs are not yet showing rally signals.

On the long-term chart, BTC price is testing the late 2020 lows that it recovered from the pandemic fall. A big difference between these two time periods is the significantly higher trading volumes this time.

With the BTC price at such low levels, on-chain calculations suggest that short-term sentiment continued to be bearish as the short-term SOPR (break-even) value was below 1.

As seen in the SOPR vs aSOPR comparison, all participants who bought after December 2020 are now at a loss. It will be difficult for long-term holders of SOPR stock to regain a positive trend anytime soon.

In the short term, the SOPR values present a bearish trend as the BTC price broke below the on-chain resistance at $19,500.

Low market demand

While retail demand was relatively stable in the spot market, it is undeniable that the perpetual futures market also significantly affected BTC’s short-term price movement. Therefore, in times of confusion, it is beneficial to assess the sentiment of the futures market.

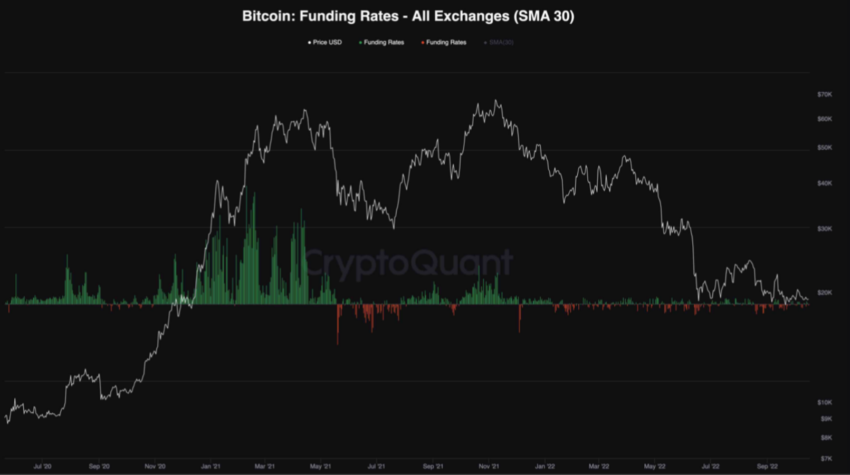

In particular, BTC funding rates are treading in the negative territory again as the price dropped from the $22,000 level and started consolidating on the $19,000 support.

Interestingly, the funding rate values are still significantly low compared to the 2019-2021 period, indicating a massive lack of demand and activity in the futures market.

All in all, due to the low demand and high macroeconomic uncertainty, BTC price may be stuck in this range path for a bit longer before any major moves are seen.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.