Bitcoin (BTC) Price Cycles Weaken – Next Bear Market Falls 67%

Bitcoin (BTC) price has already reached the bottom of the current bear market, according to a new model of market cycles.

The new hypothesis tries to predict the bottom of the next cycle and assumes that each successive downward phase in the cryptocurrency market will be weaker. The bull market is also expected to be weaker. So Are Bitcoin’s Price Cycles Weakening?

Parallel to the cryptocurrency market, there is a market for cryptocurrency cycle models. They serve analysts and their followers to find patterns, rationalize and predict the price of digital assets.

They represent an attempt to look deep enough into the market to uncover the fundamental mechanisms that govern it and provide a perspective on long-term price action.

In today’s analysis, Be[In]Crypto looks at the most popular models and examines whether Bitcoin price cycles are still an attractive narrative for investors.

In this context, we present a new, recently published model, according to which Bitcoin price cycles weaken, and the next decline will be only -67% against the new ATH.

Bitcoin Price Cycles – Repetitive Psychology

Bitcoin price cycles are an attractive hypothesis that states that the same phases in the cryptocurrency market are repeated over a sufficiently long period of time.

All together form a complete cycle, after the end of which another cycle begins. This provides a sense of order, harmony and the temptation to predict long-term price action.

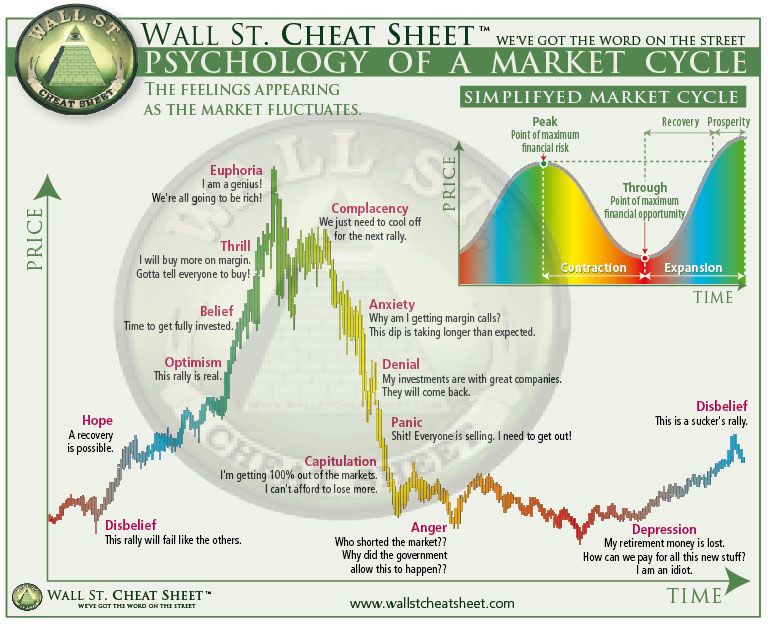

The reference point for the Bitcoin price cycle hypothesis is the classic Wall St. Cheat Sheet, which combines the cyclicality of traditional markets with the phases of investors’ psychological reactions.

Also, one of the main premises of the cyclical hypothesis is the repetitive nature of human psychology. Investors at any given point in the cycle are somewhere on the map of the spectrum of emotional states between extreme fear/depression and extreme greed/euphoria.

Halving sets BTC price cycles

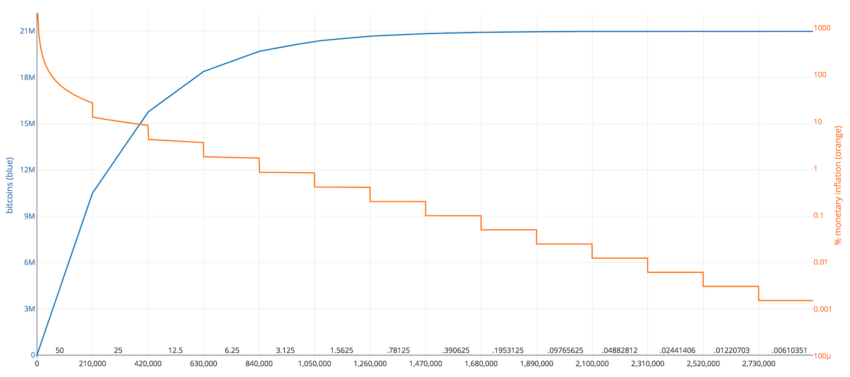

There are several leaders in the cryptocurrency cycle model market. The most classic and natural for the Bitcoin price is the model based on the halving rhythm.

It assumes that Bitcoin price cycles are mainly determined by the reward halving event for mining a block of the network. The halving occurs approximately every four years, depending on the speed and efficiency of the entire network.

The idea is that a reduction in the amount of BTC awarded to miners for validating blocks triggers a supply shock that translates into a long-term price increase. That is why some analysts believe that the bull market begins a few months after the halving.

Stock-to-Flow and lengthening cycles

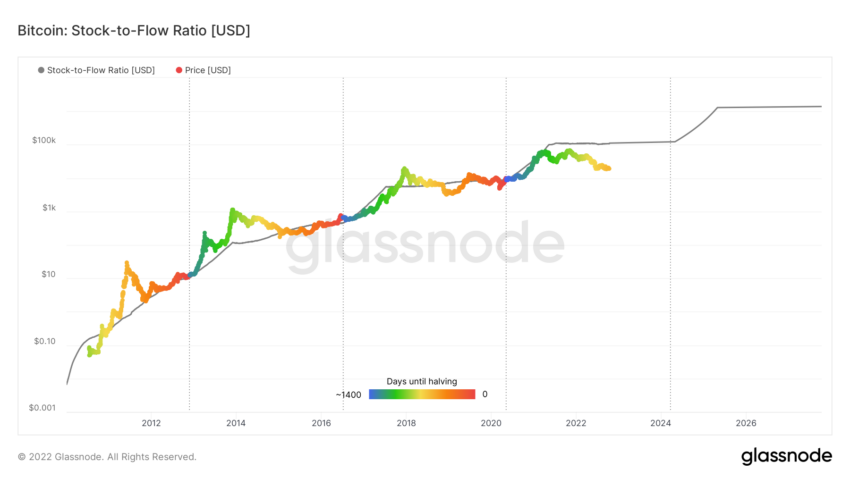

Another equally classic, but less popular today, model of Bitcoin price cycles is Stock-to-Flow (S2F) by pseudo-anonymous analyst Plan B.

It is built on the relationship between the inventory of an asset and its annual production (flow). The ratio of these two quantities is used to determine scarcity. The greater the scarcity, the potentially higher the price.

The model has the advantage of being able to compare the Bitcoin price with other assets and commodities, such as gold, diamonds and real estate.

Unfortunately, the current degree of deviation of the BTC price from the predictions of the standard S2F model is so great that many admit that it can no longer be applied to Bitcoin cycles.

A more popular model until recently was the hypothesis that Bitcoin lengthens the cycles by Benjamin Cowen.

It assumes that each successive cycle lasts longer, produces a lower return on investment (ROI), and is not necessarily dictated by a halving rhythm. It has become popular over the years, and historical data seemed to fit the assumptions well.

Even here, however, the model does not seem to have withstood the reality of the sharp declines in the cryptocurrency market that occurred in May and June this year.

According to the model, the current cycle should have had a much longer bull market phase, which however ended in November 2021.

The analyst already admitted in May 2022 that his model “is dead”. Despite this, it seems that some of the components – such as ROI decline and logarithmic regression – still retain their long-term validity.

New Model: Bitcoin’s Increasingly Weaker Cycles

The three models above and the Bitcoin price cycles they contain do not exhaust all the options and creativity of long-term analysts. Among many others, one can for example mention the circular analysis for BTC price or the cyclicity models that determine the legendary altcoin seasons.

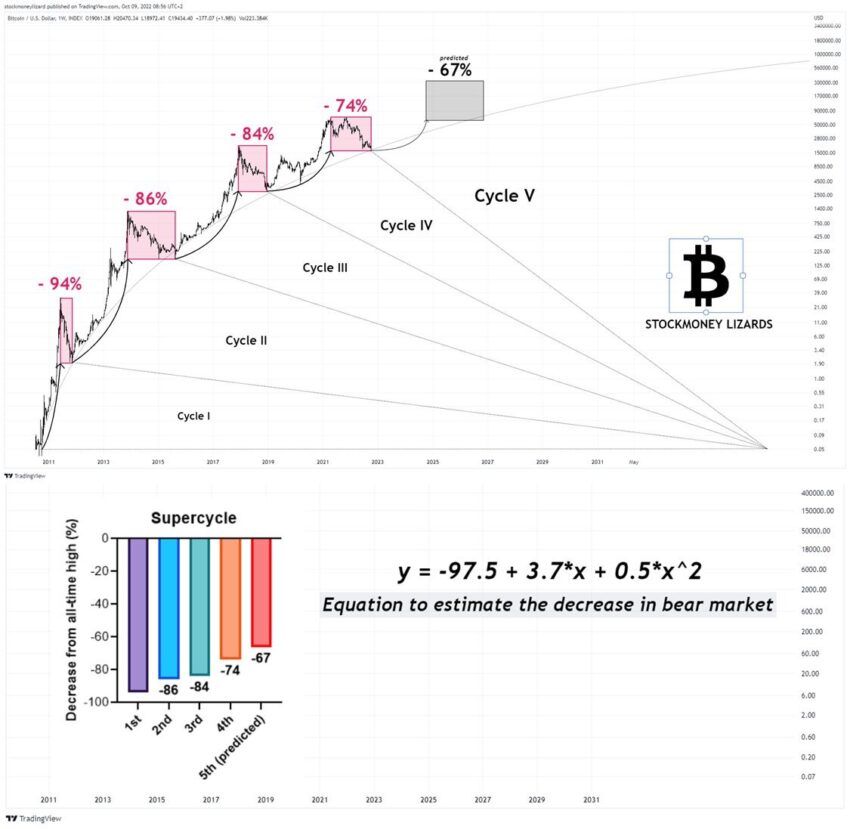

What is new about this model is the attempt to create an algorithm to accurately calculate the depth of falls during bear markets. The analyst does this not only for the current cycle, but also tries to predict the next one, which is expected to happen in 2023-27.

According to his relatively simple algorithm (y = -97.5 + 3.7*x + 0.5*x^2), the bottom of the current cycle should have already been reached with Bitcoin price falling 74% from all-time high (ATH) ). The bottom of $17,622 in June corresponds exactly to this value.

Next bear market probably only after BTC price reaches $250,000

Interestingly, the model predicts that the next bear market will result in a decline of only 67%. This is expected to happen after the Bitcoin price has previously risen to around $250,000.

According to the model’s estimates, the bottom of the next bear market will be somewhere in the $70,000 to $80,000 range. This would correspond to a re-test of the current November 2021 ATH of $69,000.

All cycles to date, according to @StockmoneyL, form a large super cycle where progressive weakness is evident.

This weakening is related to both the depth of the declines in a bear market and the height of the increases in a bull market.

This view remains consistent with both the classical halving rhythm and some elements of Benjamin Cowen’s hypothesis of lengthening cycles.

For Be[In]Crypto’s Past Bitcoin (BTC) Analysis, click here.

Disclaimer: Weather[in]Crypto strives to provide accurate and up-to-date information, but it will not be responsible for missing facts or inaccurate information. You comply and understand that you should use all such information at your own risk. Cryptocurrencies are highly volatile financial assets, so do your research and make your own financial decisions.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.