Bitcoin (BTC) Flashes ‘Yellow Flag’ As Prices Move Sideways, Crypto Analytics Firm Santiment Warns

Crypto analytics firm Santiment says recent Bitcoin (BTC) data contains mixed signals that could be cause for concern on price charts.

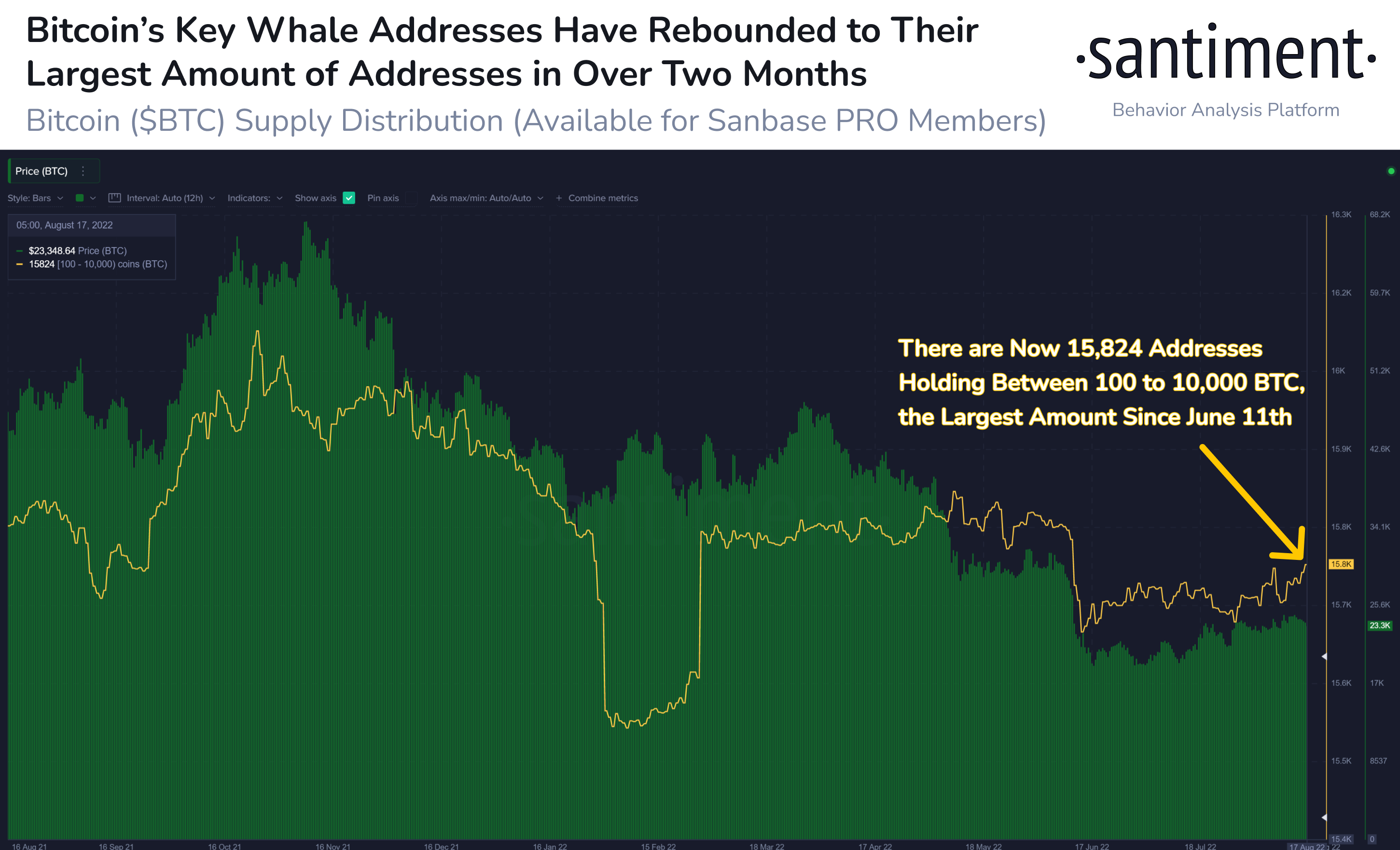

According to a new post, the market intelligence company suggests that the increase in wallets holding between 100 and 10,000 Bitcoin is a bullish indicator from wealthy investors.

“The amount of Bitcoin addresses holding between 100 to 10,000 BTC ($2.3 million to $233 million) has reached its largest number since June 11.

We see this level of large addresses as confidence from large active holders and this increase is encouraging.”

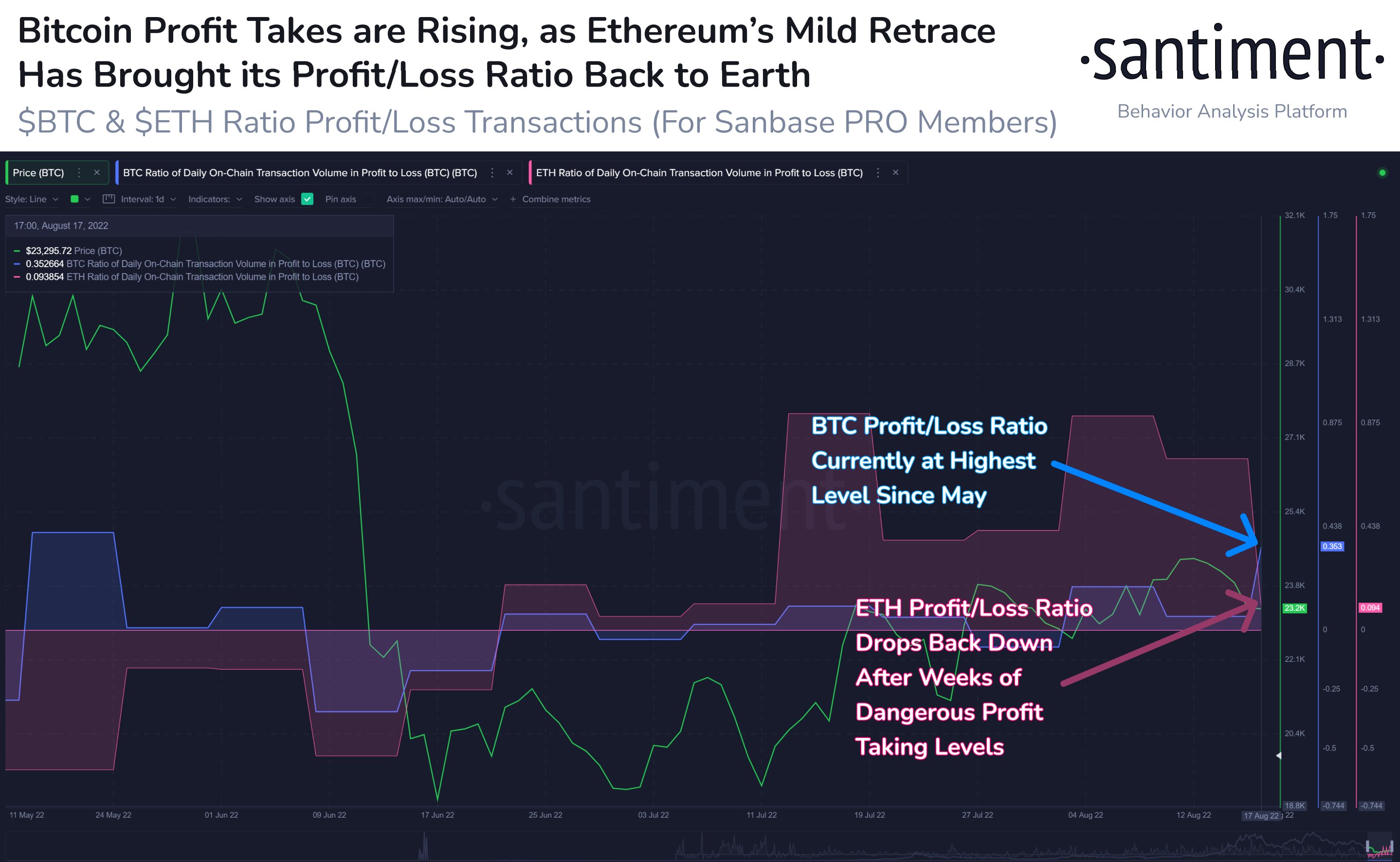

Sentiment next offer a counterbalance, noting that recent increased profit-taking by Bitcoin holders could lead to a price drop. The firm also notes that sales volume for Ethereum (ETH), in contrast, has returned to moderate levels.

“Bitcoin is staying relatively flat at $23,400, but the profit-to-loss transaction ratio is creeping up to ‘yellow flag’ levels.

Meanwhile, Ethereum is finally producing a much safer ratio this week after some very large profit taking in early August.”

At the time of writing, Bitcoin is down less than one percent and is trading at $23,173.

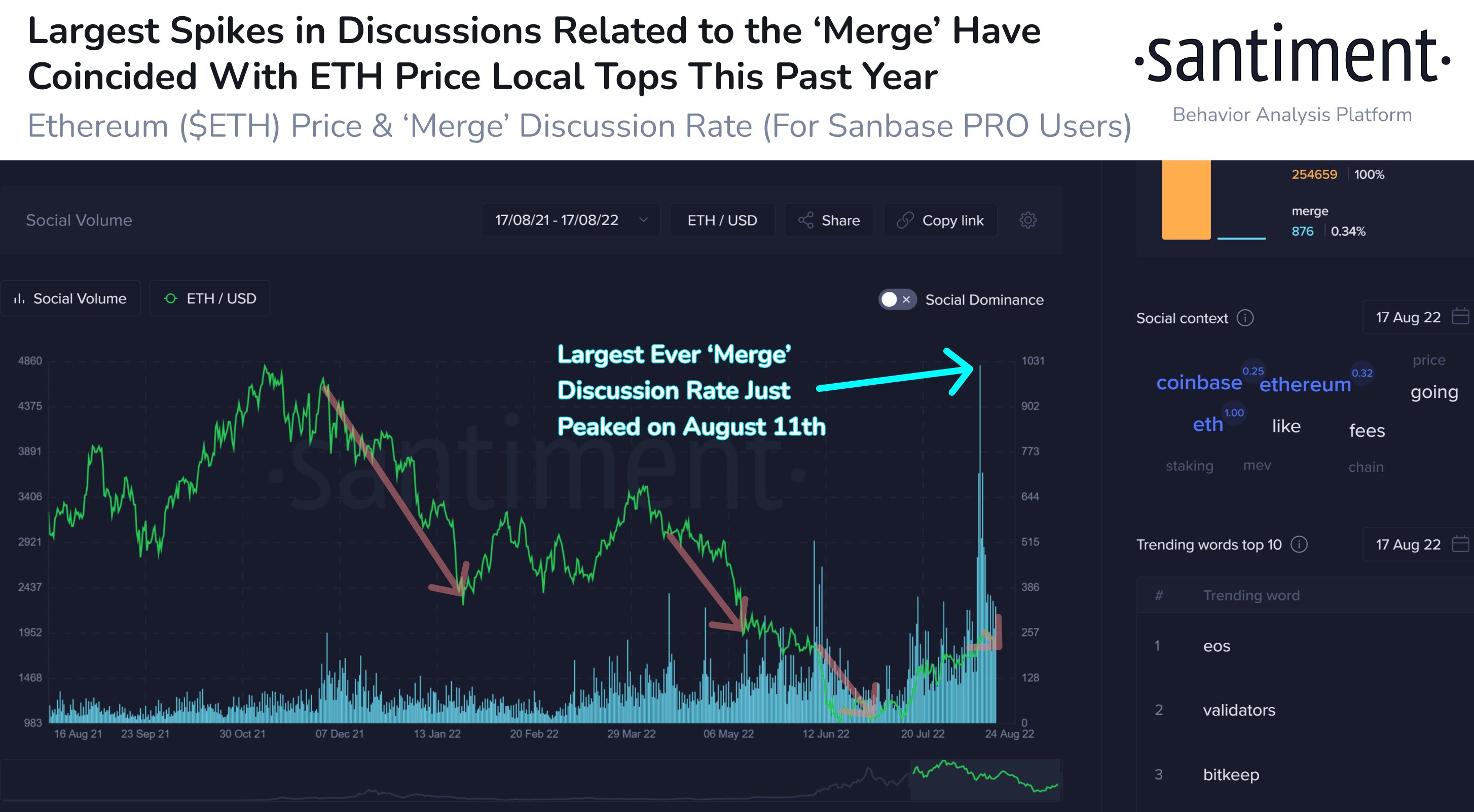

Sentiment too more points chatter on social media leading up to Ethereum’s mid-September switch to a proof-of-stake mechanism as a historical marker of short-term price peaks.

“The ETH Merge discussions have understandably heated up and August 11th was when this topic really took off after a date was announced.

Throughout the past year, the relatively largest spikes in this topic have marked approximate local ETH prices.”

The research firm takes a deeper dive into Ethereum’s social dominance in its weekly newsletter as it warns of a possible blow-off peak.

“It almost seems like everyone is in on this very obvious speculative play.

As we get closer, it is very likely that we will see another increase in “merger” social dominance and similar price action (altar falling, ETH rising) as those who come next pile in what they have to ride on, which to eventually, the chance of things leading to a blow-off stop increases.”

Ethereum is up a fraction on the day, changing hands at $1,842.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/Art Furnace