Bitcoin (BTC): Don’t Fight the Fed (and Win No Matter What)

NiseriN

Summary of the assignment

Bitcoin (BTC-USD) is an ideal investment to hold, in my opinion, no matter what the Federal Reserve does. In this article I talk about the different directions the Fed could take, what the outcome of this would be for the economy, and what would happen to the price and value of Bitcoin.

Ultimately, no matter what the Fed does, I think Bitcoin will thrive. Loose monetary policy will inflate assets, which is good for Bitcoin. On the other hand, further monetary tightening, while bad at first, would eventually lead to complete economic collapse, which would lead to a run on the dollar, leaving Bitcoin as one of the few assets capable of storing value .

The current state

Monetary policy has been used as an economic tool for thousands of years. The economy was “stimulated” in Roman times by making more coins from less pure metals. During World War II, the Federal Reserve lent a hand to the Treasury by capping interest rates, and before that, various attempts were made to promote growth by deliberately devaluing the currency.

Today, economists believe they have perfected the art of monetary policy, and indeed it seems as if the entire market depends on the words of those in charge of the Fed.

While the Federal Reserve has managed to maintain a semblance of normalcy since abandoning the gold standard in 1971, it has built an incredibly fragile and ever-growing house of cards, which I mean debt, from which there is only one real way out. ; A sharp credit crunch, a prolonged recession and a much less dollar-dependent global economy.

Since the dot-com bubble collapsed, or perhaps before, the Federal Reserve has paved the way for this outcome. Every crisis, dot-com, housing, and more recently COVID, is met with the same response, more fiscal and monetary stimulus. In other words, cover the problem with a mountain of debt. Indeed, debt has become systemic, which is why we cannot “normalize” politics without a major shake-up.

The Fed’s Catch-22

The Federal Reserve is in a Catch-22 situation because it cannot normalize policy without destroying the economy, but not normalizing will also eventually destroy the economy. There are at least three reasons why the US cannot return to normal monetary policy anytime soon:

-

Debt markets

-

National debt

-

Recession

First, companies and households in America have become dependent on cheap debt,

Private debt to GDP (trade economy)

The chart above shows the debt to GDP ratio, which has increased by over 50% since 1995. This becomes an even bigger problem as growth slows and debt continues to increase due to interest payments.

The same can be said about the federal budget:

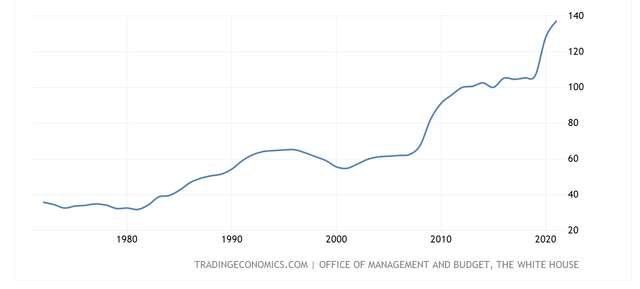

Government debt/GDP (trade economy)

We now have almost 140% of debt to GDP. This graph isn’t just growing, it’s growing exponentially, and there’s nowhere else it can go. Every year the population gets older and social security costs increase. More debt is the only way to maintain the current status quo.

This leads me to my third point, which is that a significant change in policy, i.e. normalization, would completely disrupt society and likely lead to political unrest, which the Fed wants to avoid at all costs.

Two possible outcomes

There are two possible ways this could play out.

First of all, the Fed could swallow the pill, raise interest rates and cut QE for good. What would happen in this scenario? Mortgage rates would be much higher, which would deflate the housing market. This will have a real impact on consumer spending, which will affect businesses. These companies will be forced to reduce activity and debt levels at the same time. Many would not be able to continue operating without the option of refinancing their lines of credit, which are not subject to much higher interest rates. To cope with these higher rates, the deficit must be sharply reduced, which will further reduce economic activity.

Ultimately, the economy would suffer from a 1930s-style depression, caused by a major credit crunch. Most likely, at some point in this cycle, the Fed will once again try to improve the situation by inflating the bubble again. But the only thing that will inflate is the value of the currency. The US could, and probably would, cash in on Treasuries, but the rest of the economy, deep in a full-blown default cycle, would not respond to stimulus. The private sector will refuse to create more debt, and only when the dust settles and the system is cleansed of the excesses of previous decades can the US return to some semblance of normalcy.

We’re getting a taste of this now, but I don’t think the Fed will allow a full implosion. The more likely scenario is that the Fed will at least try to keep the game of musical chairs going. The Fed will tighten a bit, but it will eventually have to go back to quantitative easing and 0% interest rates as the economy grinds to a halt and debt/GDP levels threaten to become unsustainable.

Now the Fed can probably get away with this for a while, and it already has because the rest of the world is also in the same trap. Despite unprecedented levels of QE, the US dollar continues to be held as the world’s reserve currency and, paradoxically, is stronger than ever, at least compared to other currencies.

So as long as we all agree, we can keep inflating our debt forever, but history shows that eventually something will move the needle enough to cause a shift. A shift that would probably end up pushing us back into scenario one.

How will Bitcoin fare?

In the first scenario, Bitcoin will serve as a means for the rich to preserve their wealth and protect themselves from exposure to the dollar, which at this point is likely to face a collapse. The USD has managed to hold its value due to it being the world’s reserve currency and backed by the world’s most prosperous economy.

But with the US economy in disarray, it’s only normal to assume that this will cast a shadow of doubt over the US dollar, given the possibility of some sort of default on US Treasuries. It is likely that foreign countries will sell government bonds en masse, which will lead to a run on the dollar, and will see it replaced by another standard of value.

As an American, holding Bitcoin would be one of the most convenient ways to maintain global purchasing power. In fact, a collapse of the US dollar could bring sound money alternatives like Bitcoin and gold back to the forefront of the world’s financial system.

In scenario number 2, where the Fed continues to print money indefinitely, or at least tries to, Bitcoin would also do very well. The continued oversupply of dollars would lead to a steady loss in the value of the currency. This can continue for decades, with assets steadily increasing in value while purchasing power disappears. Instead of deflating the debt, we would inflate it.

But with inflation becoming a constant affair, people would quickly start turning to alternative assets, which would exacerbate inflation even more. Eventually, once systems were in place to replace the dollar, the world would turn its back on the US currency, likely in favor of a commodity-backed currency.

The US government may attempt to defend the value of the USD, but that will inevitably lead to scenario 1, where the US economy enters a deflationary credit crunch.

In either case, we would find ourselves in a situation where the US dollar eventually loses its value and place in world hegemony. Once again, Bitcoin and other limited resources such as gold, land and oil will be the best place to be invested when this happens.

Bitcoin: A New Beginning

The great thing about Bitcoin is that it can act as a “risk-on” type of asset while the debt bubble continues, but when it bursts, it will become even more valuable due to its use as an alternative currency and store of value.

This may seem far-fetched right now, but there is clear evidence of Bitcoin’s value all around us. Bitcoin is used in many places where currency and political stability are not guaranteed, such as in Africa.

More than that, though, if we get a system-wide failure that many have been talking about for years, Bitcoin becomes not only a store of value, but potentially the most useful tool we can have to rebuild our financial system.

Bitcoin already has its own financial system, which is largely insulated from external shocks. Onboarding is easy, anyone can join the Bitcoin network, and the system is self-regulating. This is the magic of decentralized systems.

Bitcoin and the DeFi ecosystem built around it and other cryptocurrencies could become the lifeboat that the world needs during its darkest hour.

Remove

In conclusion, whatever the Fed does, Bitcoin is a must-have. At best, for them, we keep the music going for the next 100 years. At that time, however, the dollar would suffer a sharp loss in value, while Bitcoin would continue to strengthen due to its limited supply and its increased use as a store of value.

But, more likely sooner rather than later, we could see a major credit crunch and a sharp fall in the value of the USD. At that point it will become clear to those who do not have Bitcoin why it is so important to own it.