Bitcoin beats 3 of America’s largest banks in terms of market capitalization

Bitcoin, the largest cryptocurrency by market cap, will most likely enter next month with a trading price significantly lower than its $69,044 all-time high achieved on November 10, 2021.

Also, the average price for October 2022, currently at $19,443, is nowhere near the average of $58,051 in the same month last year.

To say that the highly touted “digital gold” was hit hard by the unpredictable volatility known to affect the crypto space is an understatement as Bitcoin continues to bleed.

But even with lower prices and poor performance over the past couple of months, the leader of all digital currencies managed to outperform even the biggest banks in the US, including the front-runner on the list, JPMorgan Chase.

Such a feat is truly impressive, considering that these financial institutions, more often than not, remain skeptical of Bitcoin and its fellow cryptocurrencies.

Bitcoin dominates in terms of market capitalization

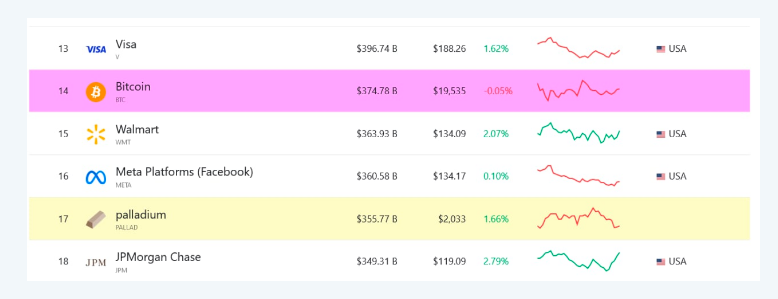

Yesterday, the total market capitalization of Bitcoin reached $374.78 billion, making it the 14thth most valuable asset class, according to CompaniesMarketCap.

JPMorgan Chase, a well-established financial institution in the United States that has achieved a global reputation, only managed to sit at 18.th spot with a market capitalization of $349.31 billion.

Source: CompaniesMarketCap

As impressive as it already is, Bitcoin also managed to outperform other US banks in the same category.

Bank of America ($280.26 billion market cap), Wells Fargo ($169.54 billion), Morgan Stanley ($134.57 billion) and Charles Schwab ($130.15 billion) are all included in the top 10 list of largest banks and bank holding companies in terms of market value.

But not even one of them was in close competition with Bitcoin, which also managed to surpass Walmart ($363.93 billion) and Meta Platform (Facebook) ($360.58 billion).

Not a first for Bitcoin

This is no fluke for the digital asset, as it managed to achieve this kind of performance last year on an even larger scale.

When Bitcoin traded at $48,481 in February last year, its market capitalization rose all the way up to $900 billion.

The cryptocurrency managed to surpass the combined market capitalization of JPMorgan Chase, Bank of America and Citigroup Inc. during that time.

All of this happened before the digital asset hit an all-time high later that year, catapulting its total value to even greater heights, peaking at $1.28 trillion.

Source: CompaniesMarketCap

While Bitcoin remains at the mercy of the volatile nature of the crypto space, it has once again proven that it has enormous potential. However, it is overshadowed by its dismal performance of late.

At press time, according to tracking from Coingeckothe virgin crypto has changed hands at $19,282, down 1.1% in the last 24 hours but up 1.2% in the last seven days.

Meanwhile, the United States currently has the highest volume of Bitcoin trading in the world, at approximately $1.5 billion. Just over 23 million people in the US currently hold Bitcoin, according to Bankless Times, citing data from PEW.

About 15% of US adults have bought or traded cryptocurrency in the past few months. During the transition from 2018 to 2019, the number of Americans who owned cryptocurrency increased, according to the PEW survey.

BTC total market cap at $370 billion on the daily chart | Featured image from Game of Life, Chart: TradingView.com