Bitcoin: Assessing the State of BTC After the Royal Coin Hits This ‘Four-Year Low’

Bitcoin [BTC] investors may have found a reason to be loyal to the Royal Mint’s cause, especially after signals an “Uptober” appearance this week. According to Santiment, BTC investors seem to have settled on the long-term HODL.

This was because investor activity per BTC exchange holdings hit a four-year low with a decline of 8.3%. With this attitude, it meant that investors were inclined to sell.

👍 With #Bitcoin back above $20.7k traders seem to be happy with long term holdings as coins continue to move away from exchanges. With the relationship on $BTC on exchanges down to 8.3%, the lowest seen in 4 years. October has been a big outflow month. pic.twitter.com/2J4ym7850K

— Santiment (@santimentfeed) 28 October 2022

Here is AMBCrypto’s Bitcoin Price Prediction [BTC] for 2022-2025

At press time, BTC was leaning towards reaching $21,000. With its price to $20,959, traders would have been expected to take advantage of the rally and take some profits. However, that was not the case. So, could it be that investors were ready for a rally or was the bottom in?

Meeting at the crossroads

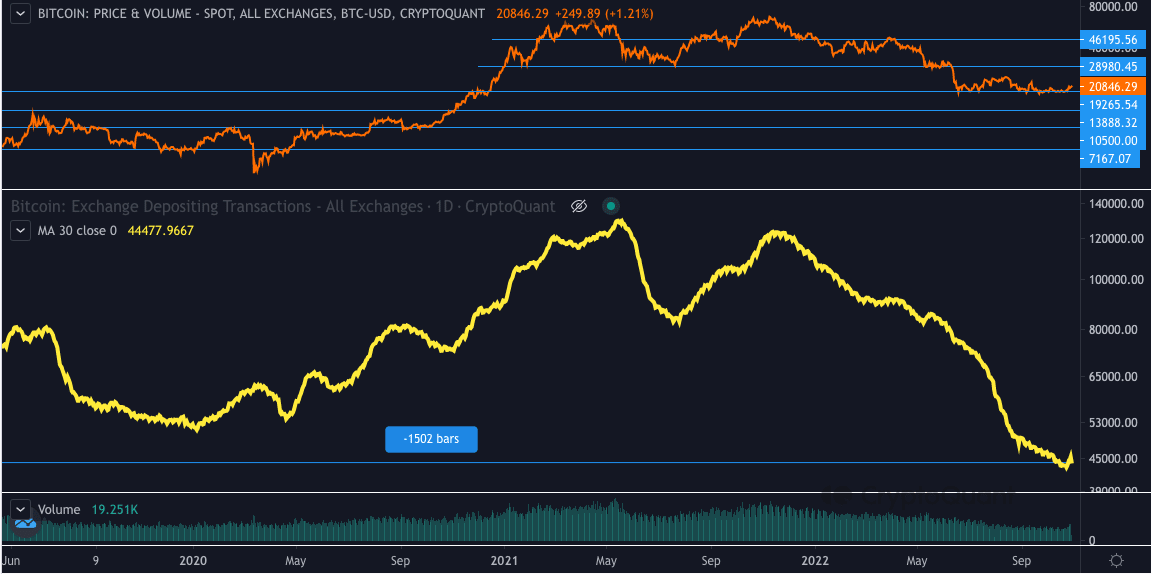

Similarly, Tomáš Hančar, a CryptoQuant analyst, took note of the event. According to him, the lack of exchange deposits indicated that retail investors were less interested in accumulating BTC.

Source: CryptoQuant

At the same time, BTC was currently experiencing low volatility. Therefore, it was less certain that the price will rise to incredibly high levels. In addition, the low volatility meant that BTC could continue its consolidation. Hančar so,

“If the last cycle is any guide, then at the moment dying from volatility as well as declining retail interest (primarily judging from 4-year lows with deposit transactions), we may have up to, say, a month of this consolidation ‘calm before the storm » still ahead of us before the final capitulation comes.”

Considering the events, Hančar pointed out the possibility that the bottom could be in. However, Bitcoin’s Market Value to Realized Value (MVRV) z-score revealed that the coin was still massively undervalued. At its value of 20,200, BTC was well below a “real value”.

Source: Sentiment

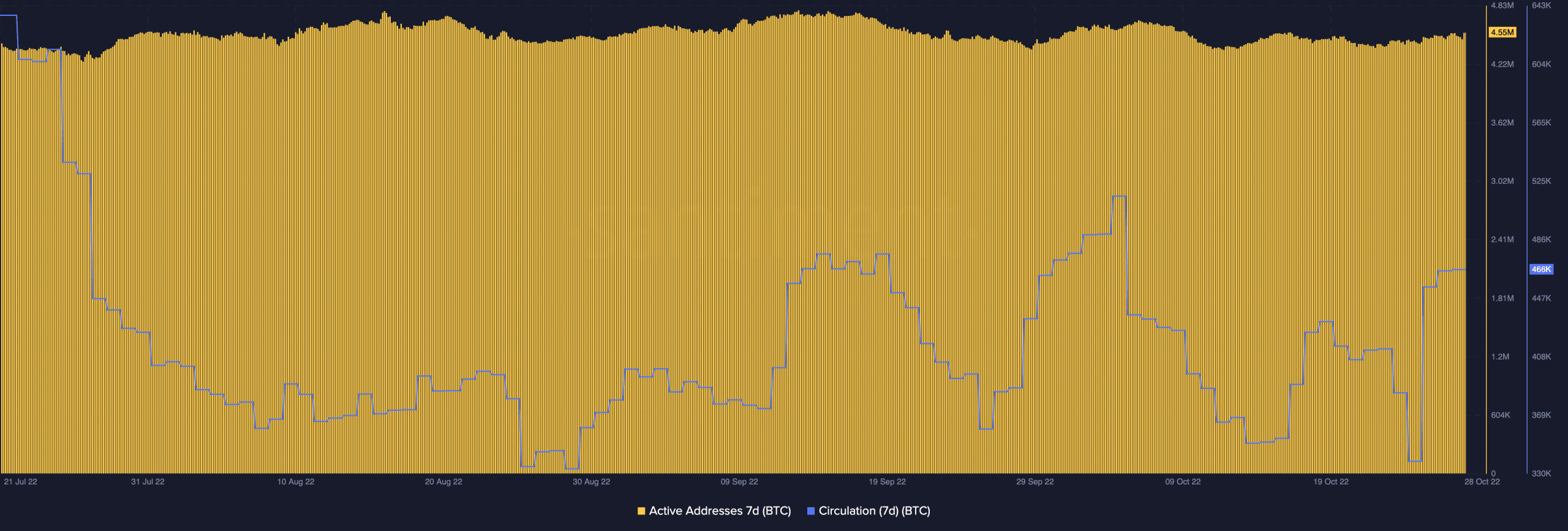

Despite low exchange data, Bitcoin’s circulation has been relatively impressive recently. Sentiment data knew that the seven-day circulation was 2.1 million at press time. Before this was written, circulation was as low as 114,000.

Due to this increase, it suggested that investors have been using BTC a lot in the past few days. Similarly, the active addresses did not take a downturn. Nor did the number increase significantly. However, it retained its position at 4.55 million. The implication of this was that traders and investors participated in a moderate number of transactions. In case it goes higher, Bitcoin will most likely follow the increase.

Source: Sentiment

Is the wait worth it?

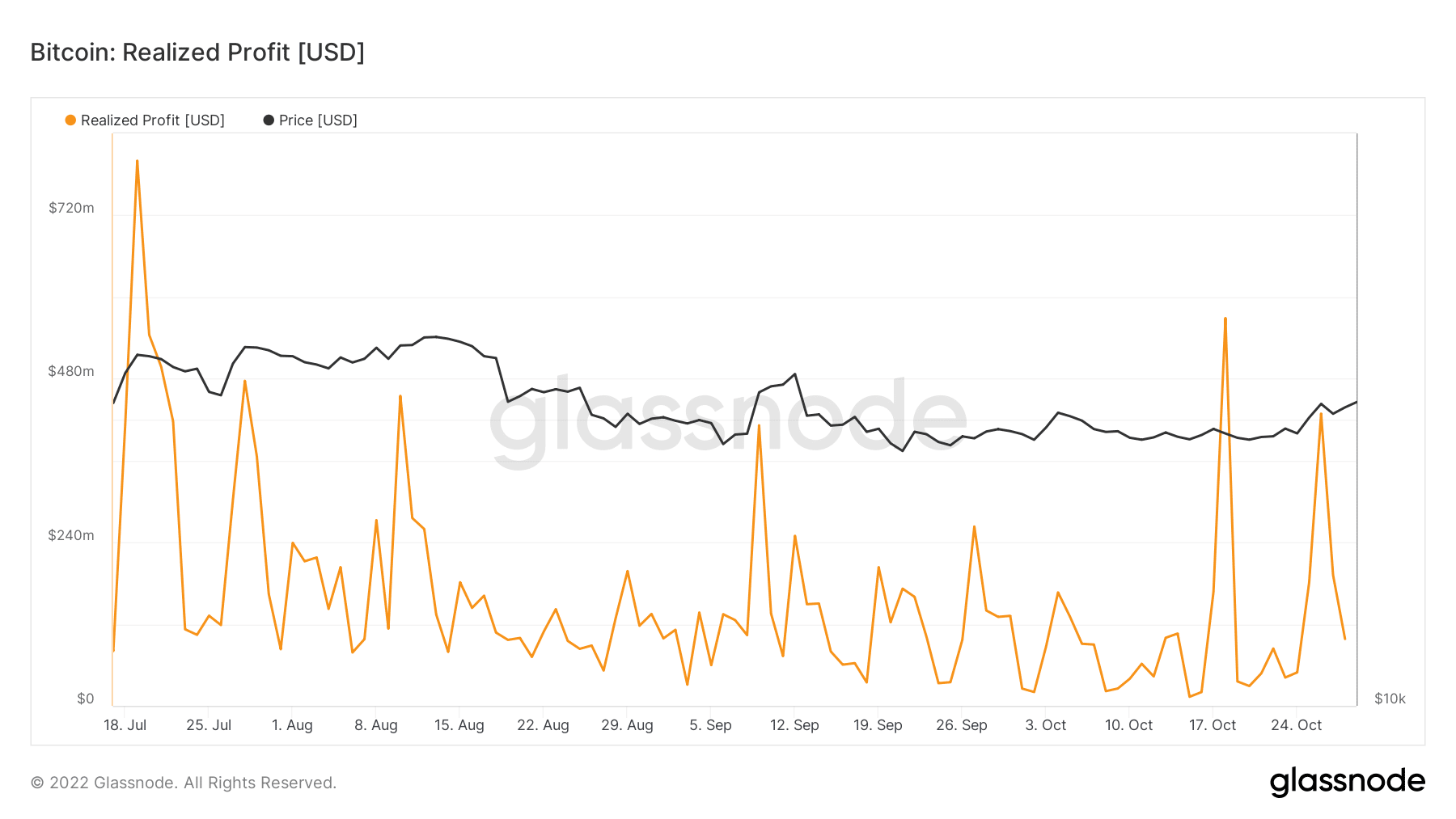

While Bitcoin investors may have remained loyal, it didn’t seem like there was much rosy from the “repeat”. In accordance Glass nodethe realized profit between October 26 and the time of writing was a glaring blemish.

The information portal of the chain showed that the realized profit was down to $98.08 million after being as high as $428.77 million on the said date. Therefore, investors may need to continue capitalizing buy buttons to promote increased demand to make the most of this opportunity.

Source: Sentiment

![Will 2023 be the year of Bitcoin [BTC] despite the USA huffing and puffing? Will 2023 be the year of Bitcoin [BTC] despite the USA huffing and puffing?](https://www.cryptoproductivity.org/wp-content/uploads/2023/04/AMBCrypto_The_Bitcoin_logo_walking_towards_the_sunset_in_a_beac_1cfb41bd-4667-44ba-817f-f5b61beae732-1000x600-120x120.png)