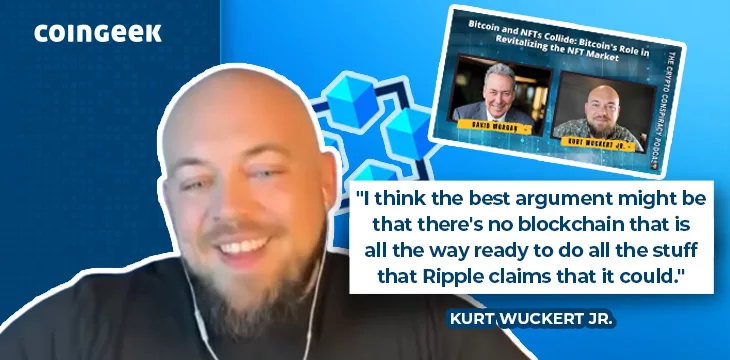

Bitcoin and NFTs Collide: Kurt Wuckert Jr. talking to the Morgan Report

Kurt Wuckert Jr. appeared on the Morgan Report to discuss Ordinal and Bitcoin’s role in revitalizing the non-fungible token (NFT) market. Of course, he covered more ground than that in this latest interview.

NFTs on BTC– thanks, Casey Rodarmor!

Morgan begins by noting that Wuckert was the most requested guest to return to the podcast by viewers. He says he purposely held off on bringing him back as he wanted to make the podcast as valuable as possible and was waiting for the right moment.

Wuckert dives right in and says that the NFT craze is the big thing that made Ethereum explode – some of which sold for millions of dollars. He points out that users on Ethereum cannot store NFTs that must sit on separate servers due to the technical limitations of that blockchain.

After the frenzy, people assumed the NFT market had disappeared, and in many ways it did, says Wuckert. However, there are many possible uses for NFTs that this immature market has yet to explore.

Recently, BTC developer Casey Rodarmor came up with Ordinals inspections on the BTC blockchain. He realized that he could write artwork directly on satoshis, store it on the blockchain and make it immutable.

“Now your artwork is as immutable as the blockchain itself,” he says, noting that this has caused quite a stir, with many asking fundamental questions about tokens, NFTs and what is possible on Bitcoin again. This creates tension between those who see BTC as digital gold and those who are interested in what else it can do.

A brief look at the wider digital currency industry

Morgan then asks Wuckert his thoughts on the recent BTC price move up and the value of XRP. He is interested in both and wants to hear Wuckert’s opinion.

Dealing with the BTC price movement first, Wuckert believes it is a sucker rally. He cannot see where the money is coming from to start a bull market when interest rates are so high, BRICS nations are attacking the dollar, and we are on the precipice of a major global conflict. In short, macro conditions are not favorable for a new bull market right now, and the maximalists calling for it have a track record of being wrong.

What about XRP? Wuckert notes that Ripple (the company) preceded Bitcoin and was even mentioned by Satoshi Nakamoto in its early days. But while he thinks Ripple has some interesting technology, he doesn’t see the need for XRP, which has done little but enrich Ripple executives, hence the lawsuit with the SEC. He says Bitcoin should try to compete with Ripple in the areas they are interested in, such as money transfers, settlements and small payments.

That being said, Wuckert notes that BTC is unable to compete with Ripple in the aforementioned areas. He is a miner on Bitcoin SV, which has much faster payments with lower fees. If any blockchain can compete, it’s BSV, and Wuckert is betting his reputation and his money that it will.

Are regulators cracking down on crypto-friendly banks?

Morgan notes the recent failure of banks such as Signature, Silvergate and Silicon Valley Bank and wonders if there is a conspiracy to get “crypto” out of the way.

Wuckert asks a return question, “who are the banks?” He notes that there are factions, and banks like JP Morgan (NASDAQ: JPM ) can hardly be classified as the others. He notes that the same factions exist in the regulatory camps, with different agencies voicing different opinions. For example, the Commodity Futures Trading Commission (CFTC) has said that Ethereum is a commodity, while the SEC is leaning against classifying it as a security.

Wuckert also points out that as the “traveling circus” of crypto goes from city to city, robbing people blind, it makes it harder for libertarians like himself to argue for a light-hearted or relatively hands-off approach to the industry. Likewise, as the years go by, the chance for Bitcoin to disrupt payments and create change is slipping away; While it was compelling in 2008, it now faces competition from a variety of apps like Venmo.

Speaking briefly about central bank digital currencies (CBDCs), Wuckert says they have only entered the conversation because Bitcoin has failed to meaningfully disrupt payments. For him, CBDCs are the worst of both worlds.

About the meaninglessness and absurdity of maximalism

Morgan states his opinion that maximalism of any kind is pointless. He wants to know Wuckert’s thoughts on that.

Wuckert says he is a Bitcoin maximalist, but not in the typical way. In fact, many typical BTC maximalists would consider him a Judas and a traitor. He sees Bitcoin as a valuable attestation tool and source of truth.

However, he agrees that BTC maximalism is absurd. The vision some of them promote is dystopian and cannot exist unless the world collapses, and that is not to anyone’s benefit.

In summary, Wuckert says that we have wasted a lot of time, but there is still time to carry out the Bitcoin revolution. He is deeply invested and hopes it will work out, but he says it is important to be safe and remember that you can be wrong. In conclusion, he encourages everyone to invest in themselves and their skills, because that way you are never completely out of the game.

See: The very beginning of Bitcoin

New to Bitcoin? Check out CoinGeeks Bitcoin for beginners section, the ultimate resource guide for learning more about Bitcoin – as originally envisioned by Satoshi Nakamoto – and blockchain.