Bitcoin and gold prices may converge again in 2023-24

shining stars

I have only written one article on Seeking Alpha about cryptocurrencies and suggest in August 2021 here investors should avoid Bitcoin (BTC-USD), when the price was around $45,000. My story explained how Bitcoin was in a bubble that would end crack. I’ve never owned cryptos, because I have no idea how to value them without concrete, verifiable math. Bitcoin can be worth $100 or $1000 or $100,000. Who knows, it’s all guesswork and one hopes “bigger fool” will show up willing to pay more. Just like everyone else tulip mania, at a point when you maximize ownership and speculators become net sellers, rather than buyers over time. Well, it looks like we reached that balance in 2021, with a top price over $65,000 achieved.

Now the price is around $16,000 as crypto exchanges blow up revealing serious accounting and fiduciary problems beneath the surface of this go-go asset supported only by owner over-enthusiasm and excessive liquidity in the global financial system. An explanation from last week FTX (FTT-USD) saga and bankruptcy are linked here. Unfortunately, the US central bank, the central bank, has decided to dry up liquidity by raising interest rates and selling bonds on its balance sheet. This action has created a wholeness in the higher “forever” hope of crypto lovers. What if a lower forever trend is the new reality?

Conversely, gold has been used and valued as base money for thousands of years in all parts of the globe. Paper currencies have always been associated with it, whether it was made official with a gold standard or not. Trading precious metals since 1986 and engaged in all kinds of historical research, it remains fascinating to me that gold prices are clearly linked to fiat money printing and sovereign debt issuance in every nation on earth, even in 2022. I have written many articles explaining how gold and silver prices are a function of the level of paper money, along with the relative pricing of alternative assets and commodities. One such bet in August on silver’s current undervaluation is linked here.

My point is that gold has been left for dead by Wall Street as a “relic of the past” many times in my 36 years of trading experience. But it has always come back into fashion when recession, economic uncertainty and war appear. The exact rush to buy occurs when investors decide to get really scared about the future. 2023 may provide a different setup where investors, traders, institutions and governments of all types decide they want to own it again.

A bullish November data: foreign central banks have added to their gold positions in 2022 at the highest intake rate in 55 years! According to one OilPrice.com article:

Central banks globally have been accumulating gold reserves at a breakneck pace last seen 55 years ago when the US dollar was still backed by gold. According to the World Gold Council (WGC), central banks bought a record 399 tonnes of gold worth around $20 billion in the third quarter of 2022, with global demand for the precious metal returning to pre-pandemic levels. Retail demand from jewelers and buyers of bullion and coins was also strong, the WGC said in its latest quarterly report. The WGC says world demand for gold totaled 1,181 tonnes in the September quarter, good for 28% year-on-year growth.

So, here’s my prediction: as cryptocurrencies continue to deflate in 2023, and the reasons to buy gold multiply in a deep global recession (forecast of October’s yield curve financial inversion here), gold priced in US dollars per ounce will eventually converge with Bitcoin . Then gold will surpass Bitcoin in price and regain its position as the leading base money to value everything else in our fractional reserve banking world. It may happen quickly, or it may take several years, but I am confident that this convergence will become a reality soon enough.

My specific prognosis

What I visualize next year is a giant jump in gold prices above USD 2,500 per ounce, with Bitcoin slipping well below $10,000. It makes perfect sense that investors and traders should prepare for both assets to converge in price between $3,000 and $4,000 at end of 2023 or sometime in 2024.

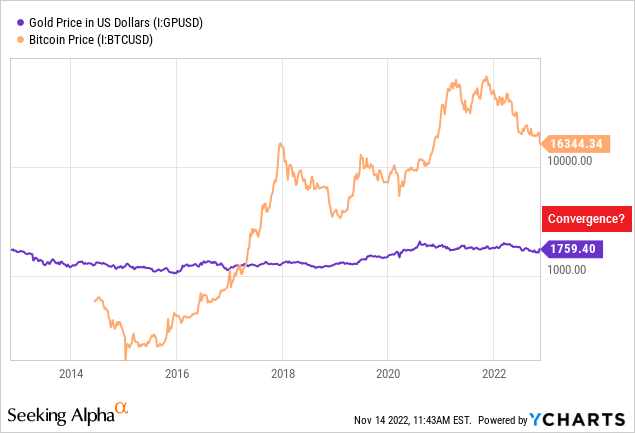

Below is a log scale chart of prices over the past decade for both assets, one physical, simple, understandable and accepted for thousands of years, the other a new age computer code content that has not been seriously tested in a prolonged recession and liquidity crisis. The last time the two decentralized money ideas converged in price was in early 2017. I have marked with a red box my “convergence” area that I will see in 2023 or 2024.

YCharts – Gold vs. Bitcoin, Price Changes with Author Convergence Point Estimate, 10 Years

Since November 2021, the vicious -75% collapse in Bitcoin has done wonders to quickly bring the prices of both closer together. Another -75% Bitcoin decline matched by a +70% to +120% increase in gold prices would get us to equal pricing in the $3000 to $4000 range.

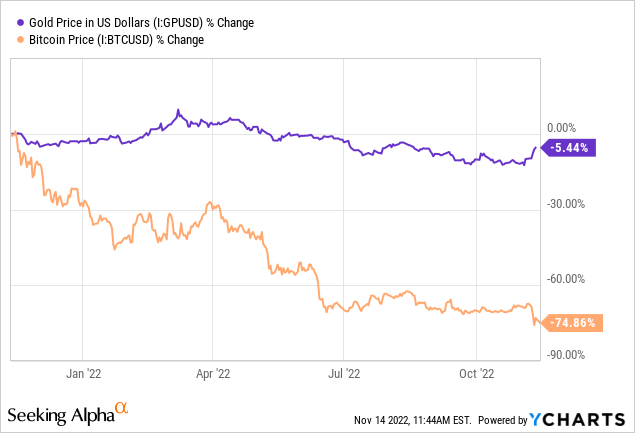

YCharts – Gold vs. Bitcoin, percentage price changes, 1 year

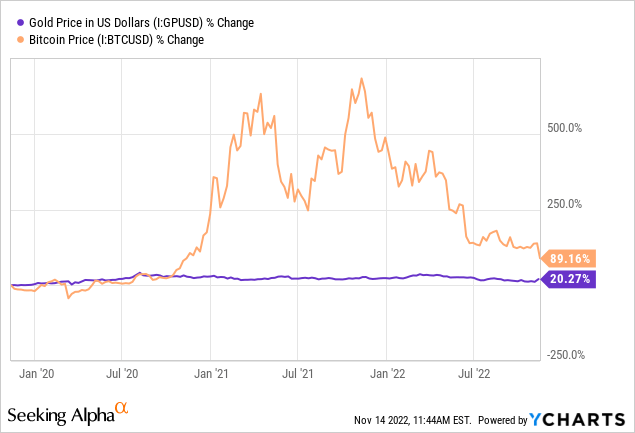

On a 3-year chart, we can see how Bitcoin’s monster run to last year’s peak is being deflated with incredible speed. A more concentrated wave of selling will put Bitcoin (and many other cryptocurrencies) back to 2019 pre-COVID levels.

YCharts – Gold vs. Bitcoin, percentage price changes, 3 years

How to play The Convergence

Avoiding or selling your Bitcoin now is the easiest way to avoid the next wave of liquidation in crypto. Pretty basic reasoning.

To prepare for a significant gold advance, you can directly buy bullion and coins well above the spot price on COMEX futures or the official London fix. Frankly, something of a shortage globally of physical metals has existed since the start of the COVID-19 pandemic.

However, the best option for brokerage portfolios is still bullion-linked ETFs if you’re looking for easy and affordable ways to gain ownership and exposure. My two favorites are also the two biggest in this space, the one SPDR Gold Shares ETF (NYSEARCA:GLD) and iShares Gold Trust ETF (IAU). I own these names and others personally.

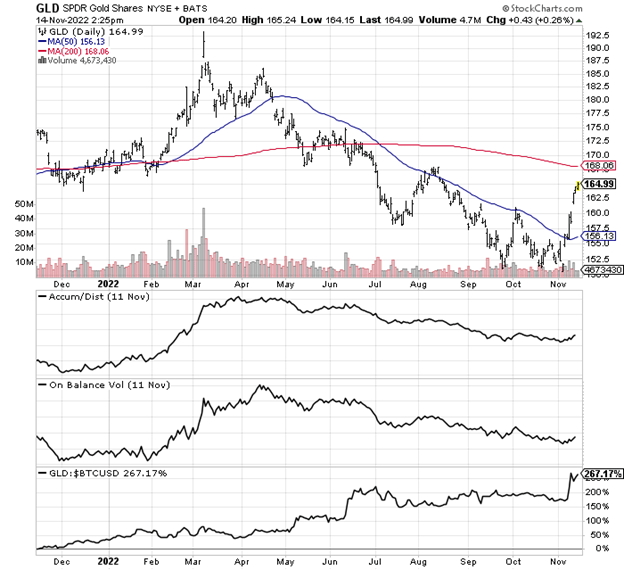

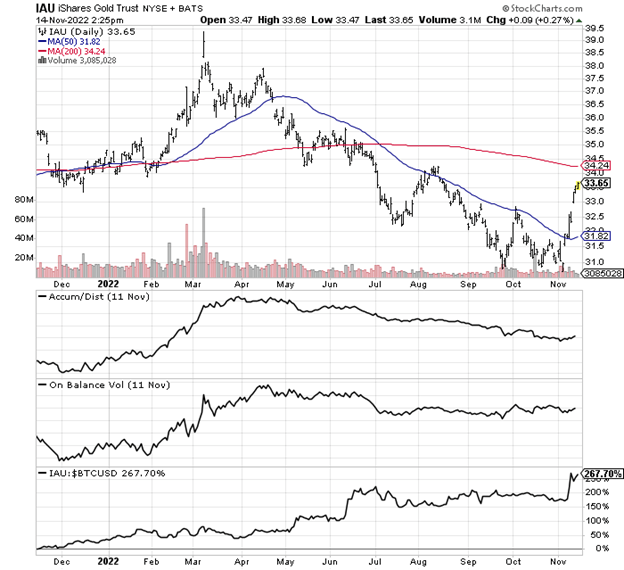

On the 1-year graphs below you can see decent trends in the Accumulation/distribution line and On balance volume readings for both gold bullion ETFs. Also, I have drawn a comparison line against Bitcoin prices. The two gold picks have “outperformed” Bitcoin by +267% over the past 12 months!

StockCharts.com – GLD, daily changes in price/volume, since November 2021

StockCharts.com – IAU, daily changes in price/volume, since November 2021

Final thoughts

Could my forecast turn out to be wrong? To some extent it could. It is possible that neither Bitcoin nor gold will fall/rise much in 2023, if a recession does not occur. In this case, price convergence may not take place for two or three years. However, booms in things/assets with little underlying value or utility have inevitably gone all the way back, close to zero for price (after you turn off your computer, cryptos are relegated to an idea in your head). It is the clear history of fads and fads throughout human time, regarding widespread speculation in beanie babies, or tulips, or dotcom stocks with no earnings/sales, or today’s cryptocurrency experiments supported only by fantastic computer code and blind faith.

I’d rather go with a proven winner throughout history. Gold has been accepted as a form of wealth and currency long before Jesus or Muhammad or Buddha. You can use gold in jewelry. It is important for electronics and industrial applications. So if history and philosophical logic are important in your investment decisions, gold will easily outshine Bitcoin for long-term holding value and value.

With a world awash in record debt and fiat money, gold should once again stand out as a beacon of investment honesty. Gold/silver bullion are some of my largest financial holdings as a hedge against dollar devaluations in a severe recession scenario. Bankers and government officials seem OK with inflation creeping higher. What if stagflation turns into hyperinflation? How do you prepare?

I firmly believe $5,000 or even $10,000 gold quotes are a certainty over time. The only question is when these numbers will play out. Remember that gold traded at $50 an ounce in 1970 and $275 in 2001. $1759 gold today is only a temporary stepping stone to even higher numbers in the not too distant future. My argument is to count on gold for future asset protection against dollar devaluations, not volatile/controversial Bitcoin or related crypto inventions. Food for thought in any case.

Thank you for reading. Consider this article a first step in the due diligence process. It is recommended to consult a registered and experienced investment advisor before trading.