Bitcoin and Ethereum Price Prediction – Is BTC About to Rise 100% This Month?

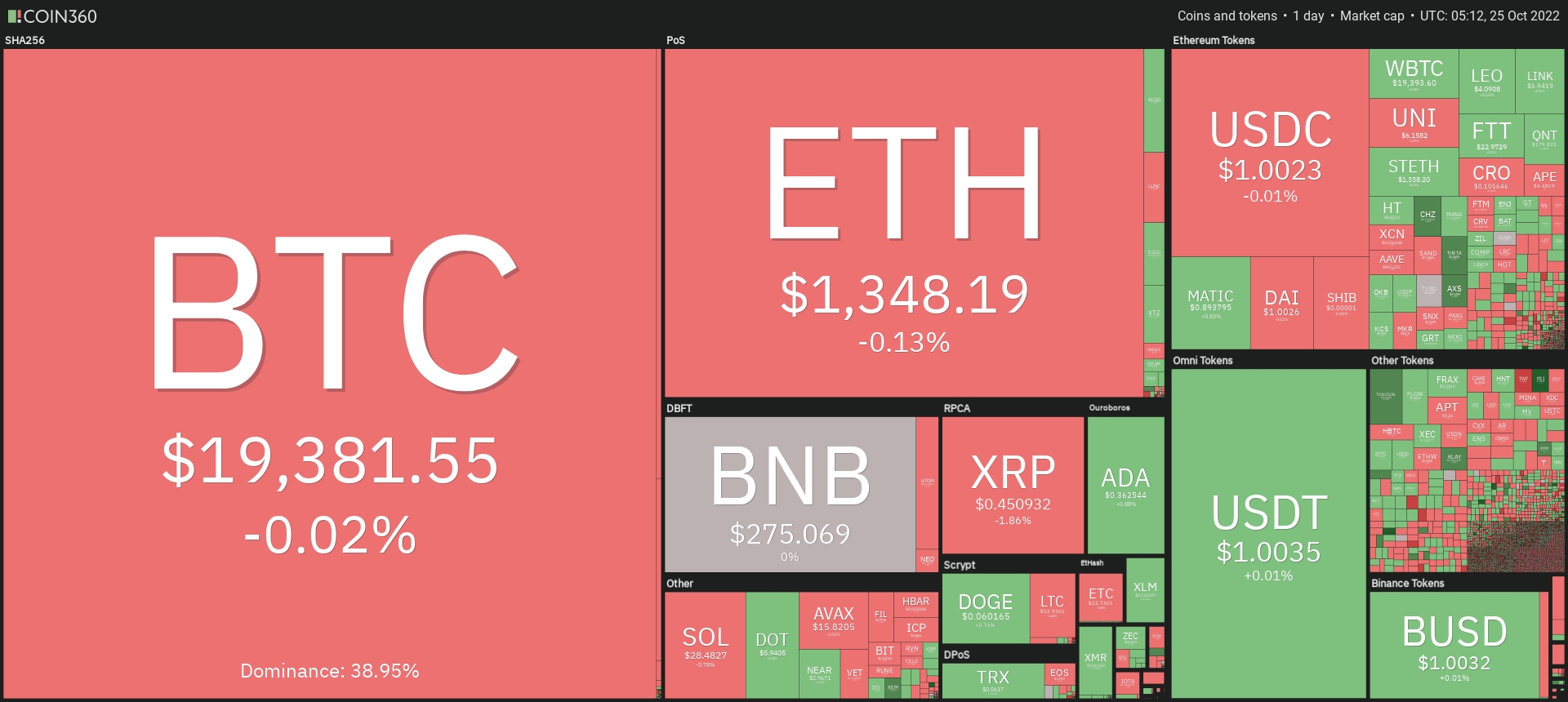

On October 25, Bitcoin price showed a slight bearish correction after being rejected at the $19,700 resistance mark. In contrast, Ethereum is consolidating in a narrow trading range of $1,335 to $1,360.

Major cryptocurrencies traded sideways, maintaining narrow trading ranges, with a global crypto market cap of $931 billion and a trading volume of $513 billion. Let’s take a look at the top winners and losers so far today.

Top Altcoin Winners and Losers

The top performers in the Asian session were Klaytn (KLAY), Axie Infinity (AXS) and Toncoin (TON). Klaytn (KLAY) is up more than 11% to $0.20, while AXS is up nearly 6% to $9.20. At the same time, TON has risen more than 5% to trade at $1.49 in the last 24 hours.

In the last 24 hours, the price of The Trust Wallet Token (TWT) has fallen more than 5% to $1.04. The price of Aave (AAVE) has fallen more than 4% to around $83.

Bitcoin vs. stocks – positive correlation to drive uptrend in BTC

For most of this year, bitcoin has moved in lockstep with the stock market. However, risky asset prices have fallen since the Federal Reserve tightened monetary conditions as part of a strategy to combat soaring inflation.

According to research released this week by cryptocurrency data provider Kaiko, Bitcoin’s 20-day realized volatility, a measure of daily price swings, has fallen below the levels of both the Nasdaq and the S&P 500 for the first time in two years.

Bitcoin has been less volatile than the Nasdaq for the first time since October 2020. Furthermore, the correlation between bitcoin and stocks has reached an all-time low. The strong correlation has weakened recently, and digital asset experts are speculating that cryptocurrencies may decouple from stocks. Furthermore, due to disconnection, BTC did not rise as much as stocks did last week.

However, Bitcoin’s correlation with stocks is restabilizing, which could lead to a rally in BTC if the stock market continues to rise. If there is a positive correlation between BTC and stocks, it is possible that it will rise again.

Fed Pivot may continue to be dovish

At their November meeting, Federal Reserve officials are likely to discuss whether and how to announce plans to approve a smaller rate hike in December. They will see a further 75 basis point increase in interest rates.

The Wall Street Journal published an article by Nick Timiraos, CEO and founder of Reventure Consulting, on October 21. Timiraos is known on Wall Street as the Fed Whisperer, the reporter the central bank turns to when it needs to convey a message.

In his latest writing, he predicts that the Fed will raise interest rates by three-quarters after the November 2 meeting.

According to Timiraos, the Fed is divided, with some members worried about further rate hikes to fight inflation. Some policymakers also want to pause rate hikes in the first quarter of the following year to monitor the effects of their actions on the economy and reduce the risk of an unusually sudden downturn.

The Fed ignored this year’s rapid inflation for most of 2021 and the first few months of this year, but it has started to make up for lost time since March. Jerome Powell, the Fed chairman, now appears to be able to ease off the accelerator, if only slightly.

Bitcoin’s optimistic recovery shows that the article is in favor of the markets and forces the safe US dollar to give up some of its intraday gains.

Bitcoin price

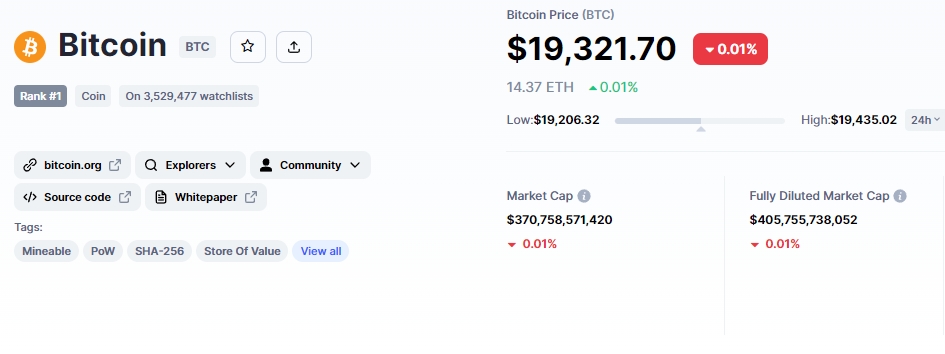

Bitcoin is worth $19,339, with a 24-hour trading volume of $27 billion. Over the past 24 hours, Bitcoin has consolidated in a narrow range, with near 0% gains and losses. BTC’s live market is worth $370 billion, and CoinMarketCap currently ranks it at the top.

On Tuesday, BTC/USD broke the symmetrical triangle pattern at $19,250, and that level is now expected to act as important support. A bullish crossover above this level could drive an uptrend towards the $19,650 level, and a bullish crossover above this level could take BTC to $19,950.

Bulls can dominate the market if the symmetrical triangle’s bullish breakout results in a continuing trend. MACD and RSI are both in a buy zone, indicating a bullish trend.

Consider remaining bullish above the $19,200 support level today. On the downside, a break below $19,200 could allow more selling at $18,950 or $18,650. Bitcoin may not rise 100% this month, but there is huge upside potential after the symmetrical triangle breaks out.

Ethereum price

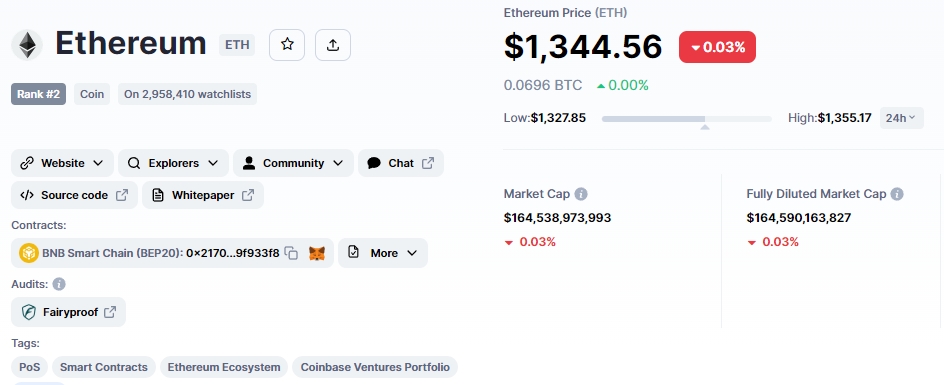

The current price of Ethereum is $1,344, with a 24-hour trading volume of $12 billion. Ethereum is also throwing profits and losses, showing almost 0% gain in the last 24 hours. CoinMarketCap, on the other hand, now ranks ETH at number two, with a live market cap of $164 billion.

On the technical front, the ETH/USD pair has broken above an ascending triangle pattern. After the $1,365 rejection, Ethereum is back in a downtrend and is likely to find immediate support near $1,340, the double bottom area.

Near the psychological trading level of $1,300, the 50-day moving average is now likely to provide additional support.

On the upside, Ethereum’s key resistance levels remain at $1,360 and $1,384. At above $1,340 today, the bullish bias remains strong.

New crypto pre-sale

Dash 2 Trade (D2T) is a cutting-edge cryptocurrency market research and analysis platform. It was created by Learn 2 Trade, the world’s largest cryptocurrency learning community with over 70,000 members.

Trading signals, chain analysis, stock exchange listing notifications, user trading contests and other features will be available to those who register for the platform.

Dash 2 Trade is currently holding a cryptocurrency pre-sale where interested parties can purchase D2T tokens for $0.0476 USDT. There are a total of 35,000,000 tokens available.

D2T has already raised more than 2 million USDT, with 60 million D2T tokens remaining at the price when 1 D2T = 0.0513 USDT.

Visit Dash 2 Trade now

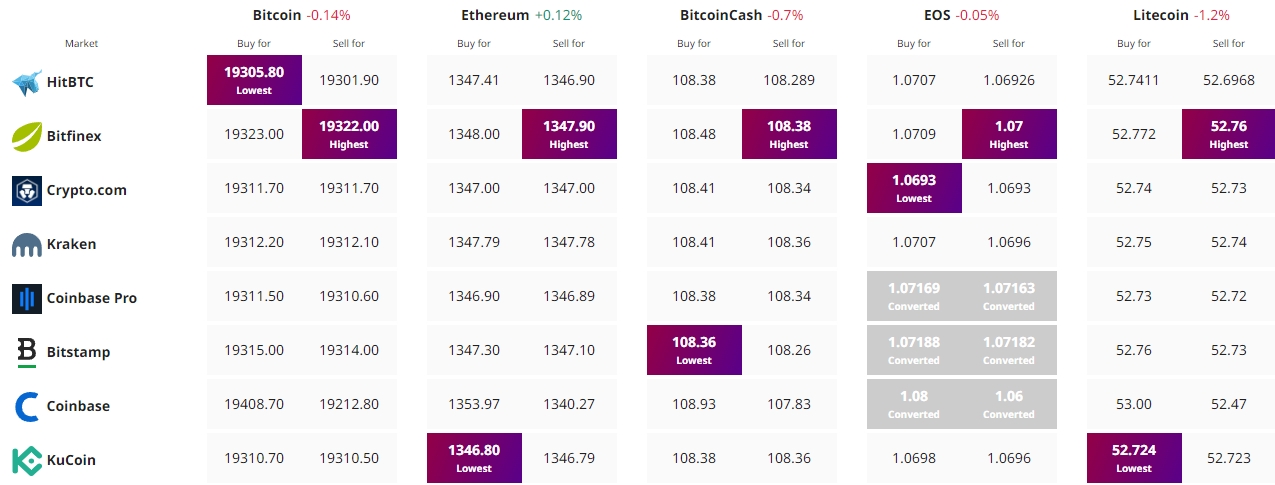

Find the best price to buy/sell cryptocurrency