Binance converts Industry Recover funds into BTC, BNB and ETH

Binance has converted the rest of its $1 billion in industry recovery funds into other assets. The converted assets include Bitcoin, Binance Coin and Ethereum.

Binance CEO Changpeng Zhao has announced that Binance will convert the rest of its $1 billion Industry Recovery Initiative funds from BUSD to native cryptocurrencies, including Bitcoin, Binance Coin, and Ethereum.

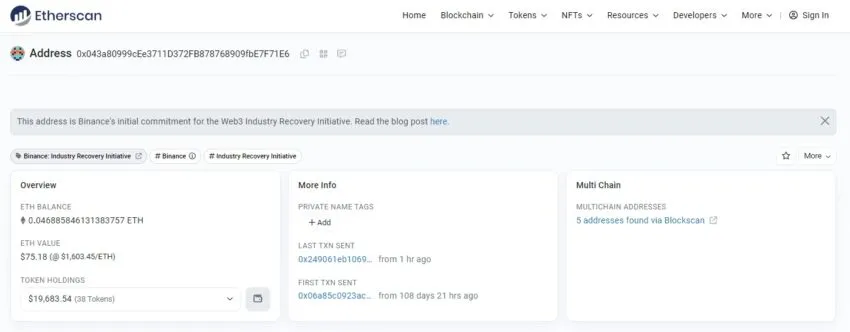

He also tweeted the address to ensure some transparency:

The reasoning from Zhao was the major changes that the stablecoin market and banks have faced in recent weeks. He later responded to other tweets that it was a way to keep the funds in a safe asset.

Most of the crypto community supported the move, although some questioned why more assets were not considered. However, there is no conclusive evidence that the market will hold its current value after reeling from news of the Silvergate closure and wider market turmoil.

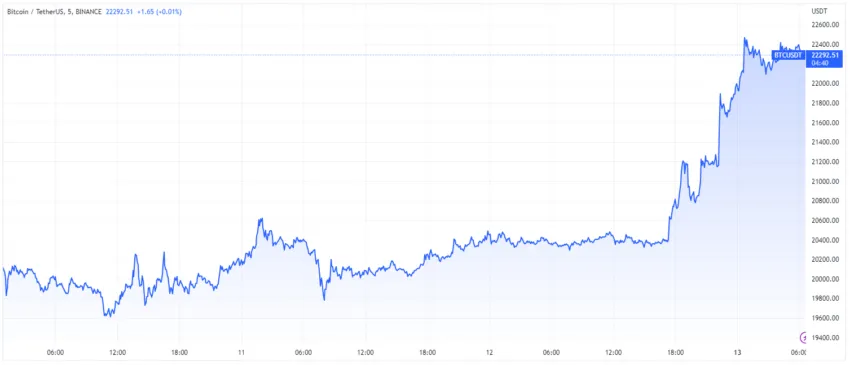

Since this development, the market has managed to move back up, and in the last 24 hours, bitcoin has risen by over 9%. Still, it’s uncertain times for the crypto market, with no sign of whether it can break resistance levels, although it looks set to hold well above $20,000.

Binance has total assets of over $70 billion

Binance has done well amid all this turmoil. The exchange has over $74 billion in total assets, with most of the assets on Ethereum and BSC.

The stock exchange has the most assets is BNB, which accounts for 29.55% of all assets. This is followed by USDT and BTC, with 21.51% and 15.21%. It also added 11 tokens to its proof-of-reserves (PoR) system, including Dogecoin (DOGE), the Curve DAO token (CRV), and 1inch (1INCH).

Bank runs an opportunity when companies go down

Zhao has looked into recent events over Twitter. He reassured investors and market enthusiasts by saying that Binance had no exposure to Silicon Valley Bank. Crypto-focused banks, such as Silvergate and Signature Bank, have also declined, giving the market anxiety.

There is concern that bank runs are taking place; crypto enthusiasts suggest moving funds to centralized exchanges. Of course, this comes with its own problems. Zhao has even suggested that Binance might buy a bank.

Sponsored

Sponsored

Disclaimer

BeInCrypto has reached out to the company or person involved in the story for an official statement on the latest development, but has yet to hear back.