Binance-branded crypto token hit by $6 billion outflow after US attack

Investors have pulled more than $6 billion out of a Binance-branded digital token in the past month, in a sign that a recent US regulatory crackdown on digital assets is putting pressure on the world’s largest crypto exchange.

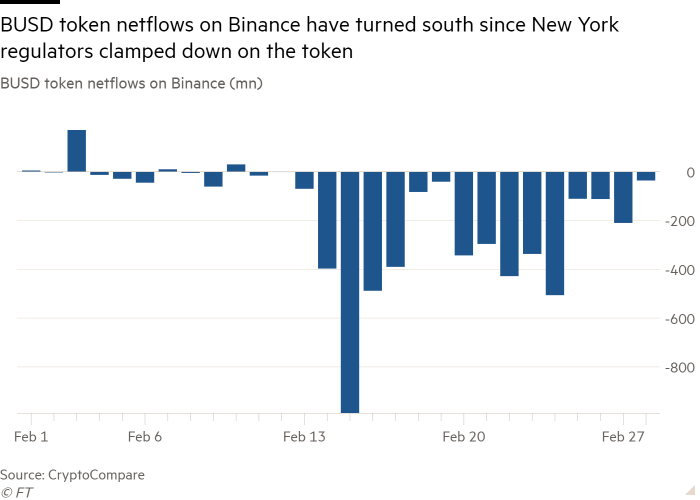

New York’s financial regulator last month halted new issuance of the stablecoin, known as BUSD, citing “several unresolved issues” related to Binance’s relationship with Paxos, the company responsible for minting the dollar-pegged token.

Since then, holders have rushed to withdraw their cash, causing BUSD in circulation to fall by more than a third, according to data from blockchain analytics platform Nansen.

Analysts said the outflow could act as a drag on the financial performance of Binance.

“This is likely to hurt Binance’s bottom line as BUSD is a significant part of the business,” said Ilan Solot, co-head of digital assets at Marex Solutions.

The outflows come as US authorities step up their scrutiny of the crypto industry following last year’s unprecedented market crash and a series of scandals that culminated in the bankruptcy of rival exchange FTX in November. Among their targets are stablecoins, which play a crucial role in crypto trading, allowing investors to trade between different digital tokens without withdrawing money in the form of fiat currency.

Following New York’s BUSD crackdown, Binance said it expected BUSD trading volume “to move to other stablecoin pairs over time”.

Earlier this month, CEO Changpeng Zhao said BUSD was never “big business” for the exchange, adding that Binance intended to support as many other stablecoins as possible.

Still, BUSD represented about a fifth of Binance’s trading volume over the past year, climbing to as much as 40 percent in December, according to data from CryptoCompare.

Binance said last year that the vast majority of its revenue came from trading fees. However, last year it waived fees for trading BUSD against some digital tokens in an attempt to increase market share.

“If Binance actually generates 90 percent of its revenue from transaction fees, then it is likely that a reduction in overall volumes will put some strain on the exchange’s revenue,” said David Moreno Darocas, head of research at data provider CryptoCompare.

This week, US exchange Coinbase also said it would delist BUSD because the dollar-pegged token “no longer met our listing standards”.

Binance’s BUSD troubles come at a time when the world’s largest crypto exchange is facing scrutiny from US regulators as part of a wider crackdown on digital assets in the US.

Earlier this month, Zhao said Binance intended to withdraw potential investments in the US, an announcement that followed the Securities and Exchange Commission launching a blitz of enforcement actions against key crypto companies.

The SEC also recently opposed Binance US’s proposed $1 billion acquisition of the assets of bankrupt crypto lender Voyager Digital, warning that part of the bailout could violate securities laws.