Kevin Helms

A student of Austrian economics, Kevin found Bitcoin in 2011 and has been an evangelist ever since. His interests lie in Bitcoin security, open source systems, network effects and the intersection of economics and cryptography.

all about cryptop referances

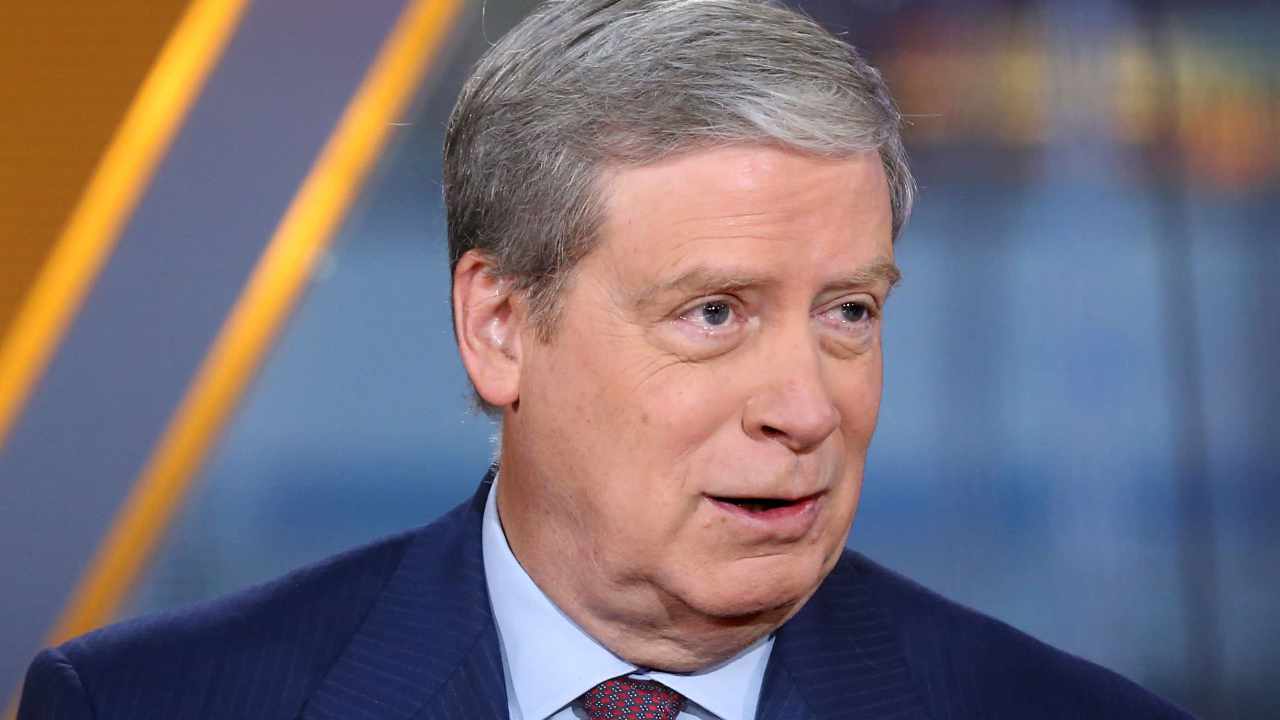

Renowned billionaire hedge fund manager Stanley Druckenmiller says he could see cryptocurrency “having a big role in a renaissance because people are just not going to trust central banks.” He added that he will be “amazed” if the US is not in a recession next year.

Billionaire investor Stanley Druckenmiller discussed the US economy and cryptocurrency in an interview at the CNBC Delivering Alpha conference on Wednesday. Druckenmiller is chairman and CEO of Duquesne Family Office LLC. He was previously CEO of Soros Fund Management where he had overall responsibility for funds with a peak value of $22 billion. According to Forbes’ list of billionaires, his personal net worth is currently $6.4 billion.

Referring to the news that the Bank of England was buying £65 billion of UK bonds, he said “if things get really bad” and other central banks take similar action over the next two or three years:

I could see cryptocurrency playing a big role in a renaissance because people are just not going to trust the central banks.

However, he revealed that he does not own any bitcoin or other cryptocurrencies, adding, “it’s tough for me to own something like that with central banks tightening.”

Focusing on the US economy, Druckenmiller stressed that the Federal Reserve is “taking incredible risks”. He stressed: “We’re taking this huge gamble where you threaten 40 years of credibility with inflation, and you burst the wildest raging asset bubble I’ve ever seen,” claiming:

The Fed was wrong. They made a big mistake.

“If you remember, the Fed did $2 trillion in QE after vaccine confirmation,” the billionaire explained. “At the same time, their partner in crime, the administration, did more fiscal stimulus — again, post-vaccine, after it was clear emergency measures weren’t necessary — than we did during the entire Great Financial Crisis.”

Druckenmiller continued: “If you look at what the Fed did, the radical gamble they took to get inflation up 30 basis points from 1.7 to 2, that, to me, is kind of a risk-reward gamble … And they lost.”

He elaborated: “And who really lost? Poor people in the U.S., ravaged by inflation, the middle class, and my guess is the U.S. economy for years to come because of the scale of the asset bubble in time and duration and breadth it went on.”

As for whether there will be a recession in the US, Druckenmiller shared:

Let me just say this. I’ll be stunned if we don’t get a recession in ’23. Don’t know the timing, but certainly towards the end of ’23.

In a subsequent interview with Bloomberg on Wednesday, the executive director of the Duquesne Family Office reiterated that the Federal Reserve’s policymakers “have put themselves and the country, and most importantly the people of the country, in a terrible position.” He warned that “Inflation is a killer,” noting that “To maximize employment in the long run, you have to have stable prices.”

What do you think of billionaire Stan Druckenmiller’s comments? Let us know in the comments section below.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is directly or indirectly responsible for damages or losses caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.