Kevin Helms

A student of Austrian economics, Kevin found Bitcoin in 2011 and has been an evangelist ever since. His interests lie in Bitcoin security, open source systems, network effects and the intersection of finance and cryptography.

all about cryptop referances

Shark Tank star and NBA Dallas Mavericks owner Mark Cuban has warned that the US Securities and Exchange Commission (SEC) will come up with rules for token registration that will be the “nightmare ahead for the crypto industry”.

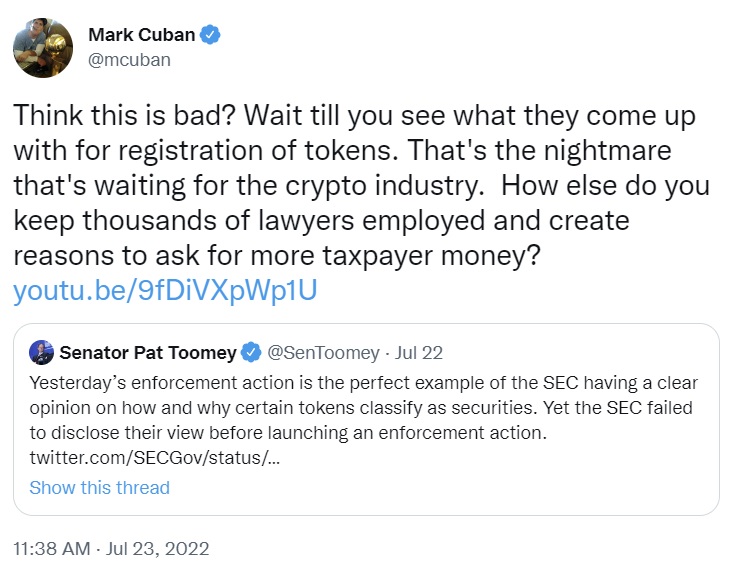

Billionaire Mark Cuban, the Shark Tank star who owns the NBA team Dallas Mavericks, warned in a tweet on Saturday about how the SEC will regulate crypto tokens.

His warning was in response to a tweet by US Senator Pat Toomey (R-PA) slamming the securities watchdog over its enforcement action against a former Coinbase employee in which nine crypto tokens were identified as securities. Coinbase quickly disputed the claim that it was listing crypto-securities.

Toomey noted that the enforcement action “is the perfect example of the SEC having a clear opinion on how and why certain tokens are classified as securities. Yet the SEC failed to disclose their view before initiating an enforcement action.”

Cuban, whose net worth is around $4.7 billion, believes that the SEC will come up with rules on how to register crypto tokens that will be a “nightmare” for the crypto industry. He replied to Toomey: “Do you think this is bad? Wait till you see what they come up with for token registration. It’s the nightmare that awaits the crypto industry,” wrote the Shark Tank star. How else do you keep thousands of lawyers employed and create reasons to ask for more taxpayers’ money?”

Cuban’s tweet includes a link to a Youtube video of him attempting to file a no-action letter with the SEC to ensure that a stock purchase he is about to make will not violate insider trading laws. However, the billionaire demonstrated that the process is very complicated, stressing that it does not give investors confidence that they will not break the law. “What I found shocked even me,” Cuban wrote after going through the process as instructed by the SEC.

“Most no-action letters describe the request, analyze the particular facts and circumstances involved, [and] discuss applicable laws and regulations,” the SEC stated on its website. If the no-action request is granted, “the SEC staff will not recommend that the Commission take enforcement action against the requester based on the facts and representations described in the individual’s or entity’s request.”

Cuban has previously criticized the SEC for taking an enforcement-centric approach to regulating the crypto sector.

In August, the owner of the Dallas Mavericks called out SEC Chairman Gary Gensler about his focus on “investor protection.” “If you worked on behalf of investors, you make it easy for questions from investors and business people to be asked and answered. You make it almost impossible. They [who] cannot afford lawyers can only guess,” he stressed.

The SEC recently came under fire for regulating the crypto sector through enforcement. Last week, US Congressman Tom Emmer also criticized the SEC for “cracking down on companies outside their jurisdiction”. He argued: “Under Chairman Gensler, the SEC has become a power-hungry regulator, politicizing enforcement, luring companies to ‘come in and talk’ with the commission, then hitting them with enforcement, discouraging good faith cooperation.”

Do you agree with Mark Cuban? Let us know in the comments section below.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.