Bank of England Raises Rates to 14-Year High: Impact on Crypto

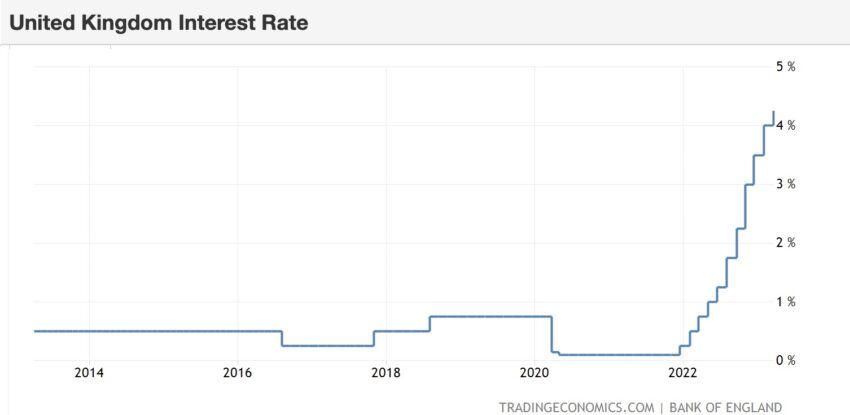

In a move that surprised some market observers, the Bank of England (BoE) recently raised its benchmark interest rate to 4.25%, the highest level since 2008. As the financial world digests this news, many are wondering what this decision could mean for Bitcoin and the broader crypto market .

Interest rates and monetary policy

Interest rates play a crucial role in controlling inflation and promoting economic growth. Central banks, such as the BoE, adjust these interest rates to stabilize their respective economies. This latest rate hike comes in the context of increasing inflationary pressures and an attempt to cool down the overheated economy.

Other central banks have taken similar measures, reflecting a trend towards tightening monetary policy worldwide.

The relationship between interest rates and asset prices is well established. In general, higher interest rates can reduce the appeal of riskier assets as investors seek safer, income-generating investments.

For Bitcoin, which is often seen as a store of value and a hedge against inflation, this interest rate hike could affect its attractiveness.

Potential effects of the interest rate hike on crypto

In the short term, the crypto market may experience increased volatility as a result of the interest rate increase. Investors can reassess their portfolios and adjust their exposure to riskier assets such as cryptocurrencies. This may cause a temporary decrease in Bitcoin’s price and overall market value.

Still, it’s important to consider the historical context when considering Bitcoin’s potential response to this rate hike. In the past, crypto has shown resilience during similar changes in monetary policy. However, its performance has varied depending on several factors, such as market sentiment and the state of the global economy.

A crucial factor affecting Bitcoin’s vulnerability or resilience to interest rate hikes is the role of institutional investors. As more institutions have entered the crypto market, their response to changes in interest rates can have a significant impact on the market.

If these investors perceive a higher risk in holding cryptocurrencies due to rising prices, they may shift their capital to more traditional investments, further affecting the prices of Bitcoin and other digital assets.

Despite these challenges, the long-term outlook for Bitcoin and the cryptocurrency market remains uncertain. The decentralized nature of cryptos and their potential to serve as alternative financial instruments may continue to drive adoption and demand.

Crypto investors may need to adapt their strategies in the face of rising interest rates, closely monitor global changes in monetary policy and assess their implications for the crypto market.

Disclaimer

BeInCrypto has reached out to the company or person involved in the story for an official statement on the latest development, but has yet to hear back.