Avalanche [AVAX] double down on the NFT industry, here’s how

![Avalanche [AVAX] double down on the NFT industry, here’s how Avalanche [AVAX] double down on the NFT industry, here’s how](https://www.cryptoproductivity.org/wp-content/uploads/2023/01/1669897105632-b12c71dc-570c-4668-8875-79f4b64bf2e7-1-1000x600.png)

- Avalanche’s latest announcements underscore a stronger focus on NFTs in 2023.

- The AVAX bulls failed to provide significant short-term upside.

Avalanche layer 1 blockchain recently announced interesting developments that may reveal more about what to expect in 2023. This includes a deeper focus on the NFT industry through strategic partnerships.

Read Avalanche (AVAX) Price Prediction 2023-2024

According to one of Avalanche’s latest announcements, the network has teamed up with Shopify for an NFT-related venture. The partnership will allow Shopify merchants to create eco-friendly NFT collectibles that will be distributed through the Venly Shopify NFT app. This development has the potential to increase NFT transactions on the Avalanche blockchain.

Landslide and @Shopify join forces to enable millions of Shopify merchants to create eco-friendly digital collectibles for the masses with @Venly_io The Shopify NFT app.

Shopify sellers can quickly start selling #Avalanche NFTs straight from our own shop! pic.twitter.com/WOwoV0oCYh

— Avalanche 🔺 (@avalancheavax) 5 January 2023

Avalanche also aims to provide a solid WEB3 gaming experience this year. It aims to achieve this through a partnership with MetaOPs. Why is this an important development?

Well, this is among the cutting edge FPS games to be rolled out via a blockchain network. Gaming is a multi-billion dollar industry and this development could allow Avalanche to capitalize on the robust potential growth in the segment.

Prepare for an unparalleled gaming experience with #MetaOps! This fast-paced 6v6 first-person shooter builds upon and co-operates with #Avalanche🔺

Developed with a gamer-first approach, players can look forward to action-packed multiplayer gameplay🎮

Check it out below👇 pic.twitter.com/0jgEf6RwiB

— MetaOps ™ – Tactical FPS Game (@MetaOpsGaming) 5 January 2023

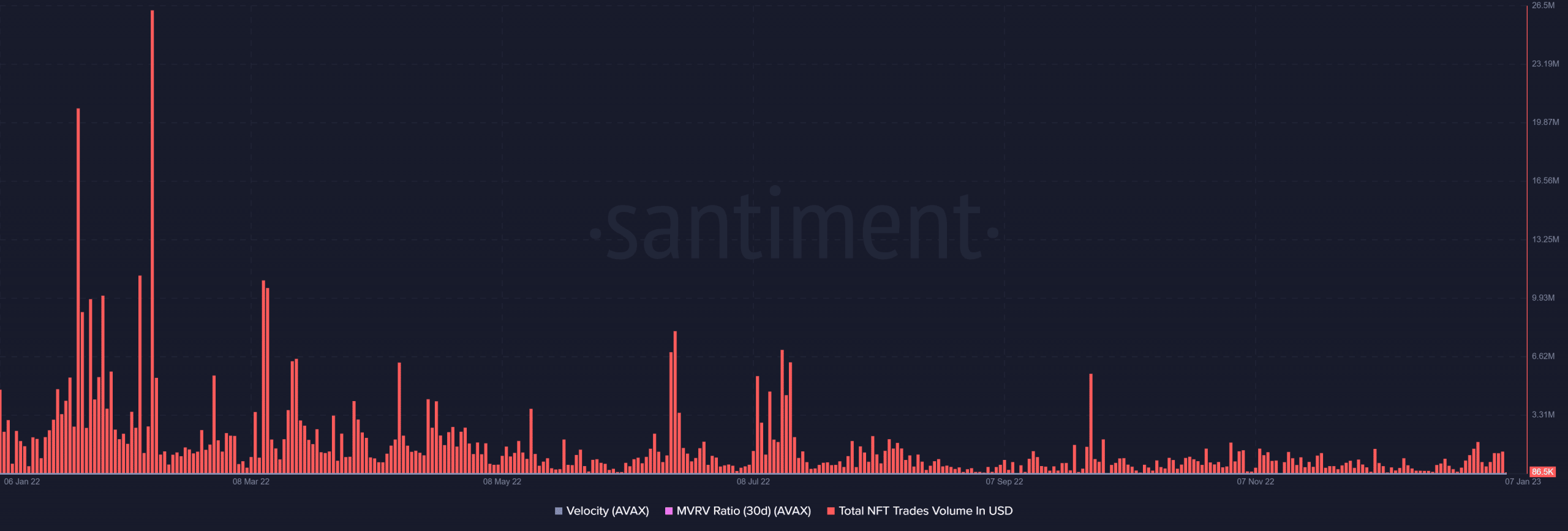

This development is likely to boost Avalanche NFTs. Over the past 12 months, the network’s total NFT trading volume has dropped significantly. However, we are seeing some stimulation in the same metric over the past two weeks.

Source: Sentiment

The potential impact on AVAX

This development underscores several growth opportunities for the Avalanche network. They can also lay the foundation for more use and demand for AVAX. This is likely to be the case in the long term, but what about in the short term?

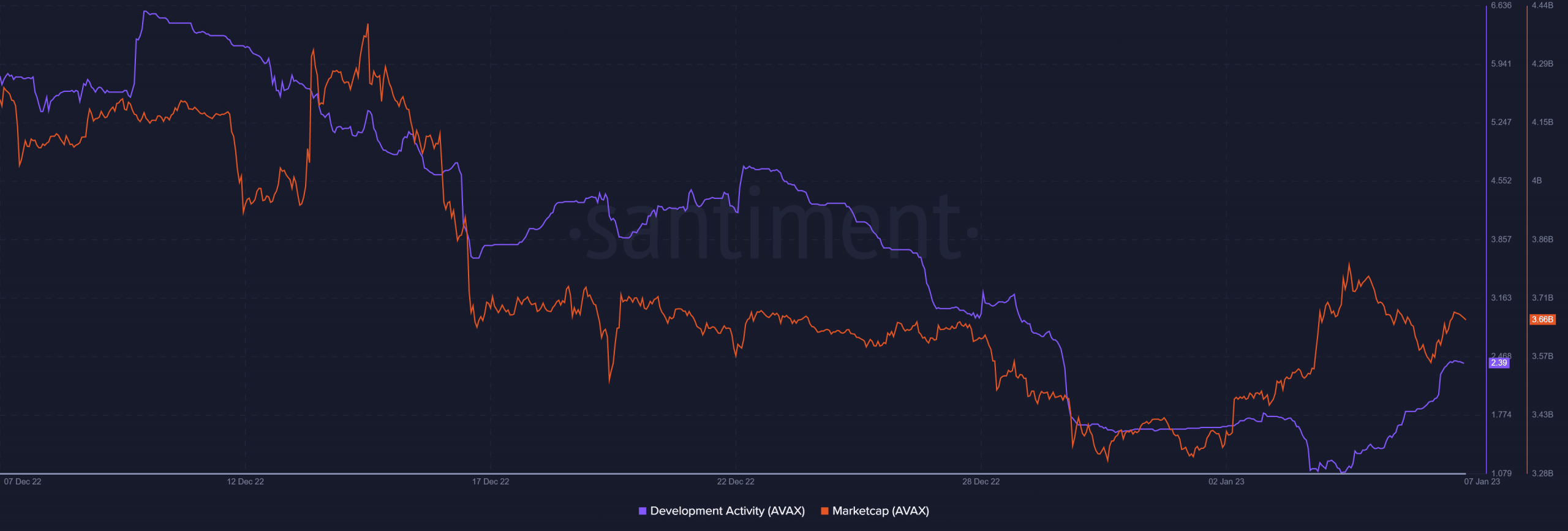

Several metrics on the chain currently support a higher probability of a sentiment shift in favor of the bulls. For example, Avalanche development activity has been slowing for most of December, but it managed to fluctuate in the last four days.

Source: Sentiment

Similarly, the Avalanche’s market cap has increased by roughly $322 million so far this month. This is evidence that there is significant accumulation. This demand also reflects observations in the derivatives market.

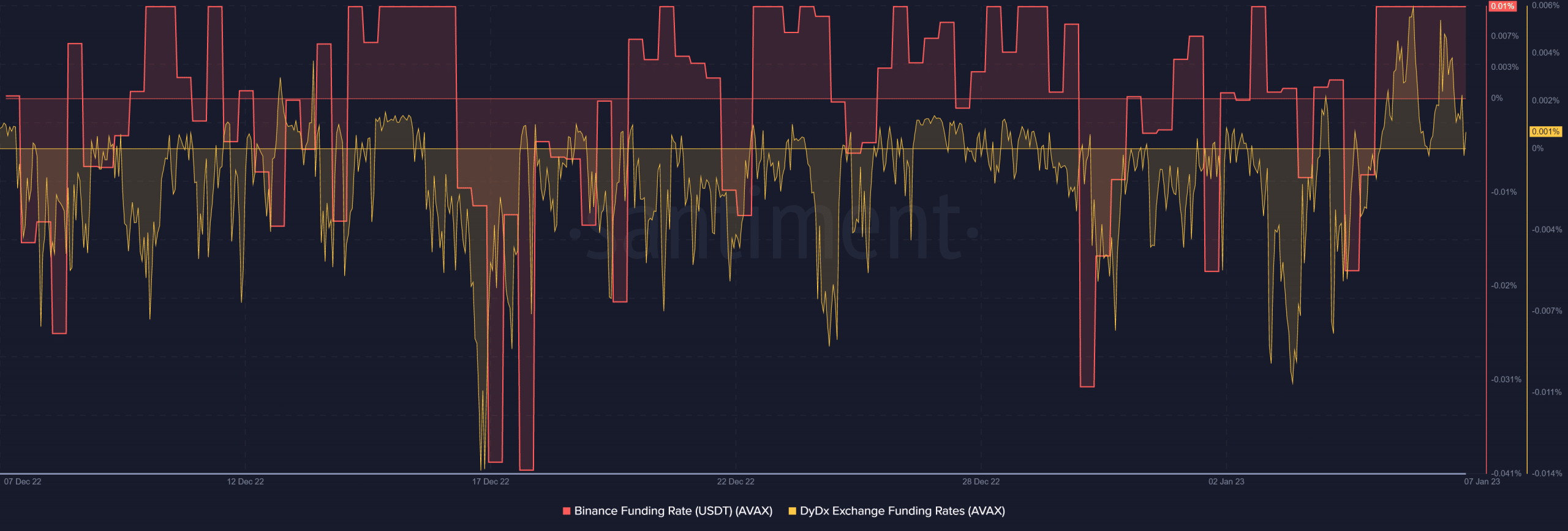

Binance and DYDX funding rates have also improved since early January. These indicators confirm that demand for AVAX derivatives is on the rise.

Source: Sentiment

How many AVAX’s can you get for $1?

Despite the above favorable changes, AVAX only managed to rise by as much as 16% from its December lows. This means that there are still many untapped benefits as weak demand fails to produce a significant recovery. AVAX was trading at $11.82 at the time of writing, having struggled to push above its 50-day MA.

Source: TradingView

Avalanche’s latest development could help boost market sentiment for AVAX. Perhaps this could lead to a stronger bullish outcome further down the line, but that remains to be seen.