Almost a third of young investors say crypto offers the best opportunity to create wealth: Bank of America study

A new study from financial giant Bank of America reveals that young investors are losing confidence in traditional investments.

The report, which was conducted by market research firm Escalet on behalf of Bank of America, polled 1,052 high-net-worth respondents across the United States.

Respondents were over 21 years of age and had at least $3 million in investable assets, excluding primary residence.

According to the study, respondents between the ages of 21 and 42 only allocated a quarter of their assets to shares. The study also shows that 75% of respondents from the same age group say that “it is no longer possible to achieve above average returns” on traditional investment cars.

With the majority of young investors losing confidence in traditional assets such as stocks and bonds, the report reveals that their asset of choice is crypto.

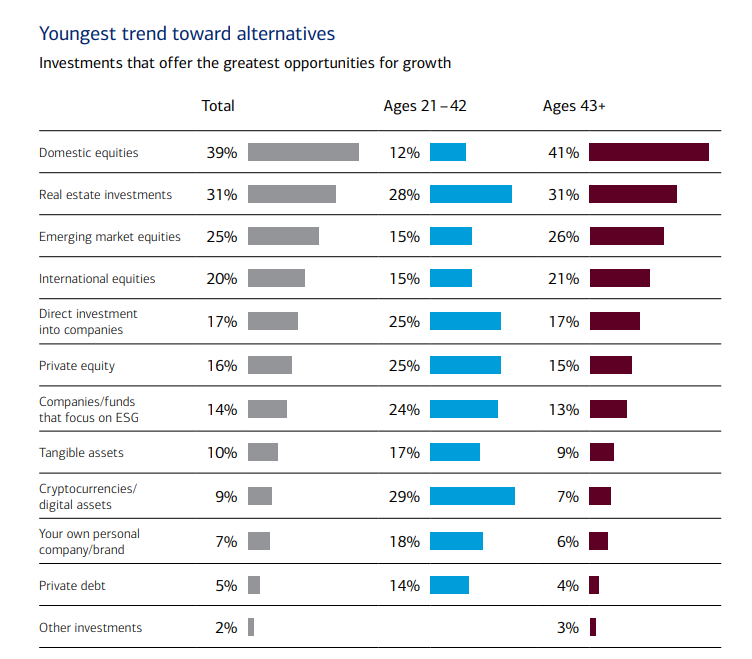

The Bank of America study shows that 29% of younger investors claim that crypto “presents a leading opportunity to create wealth.” The same group of investors is also interested in other alternative investments such as private equity, debt and ESG-related ventures.

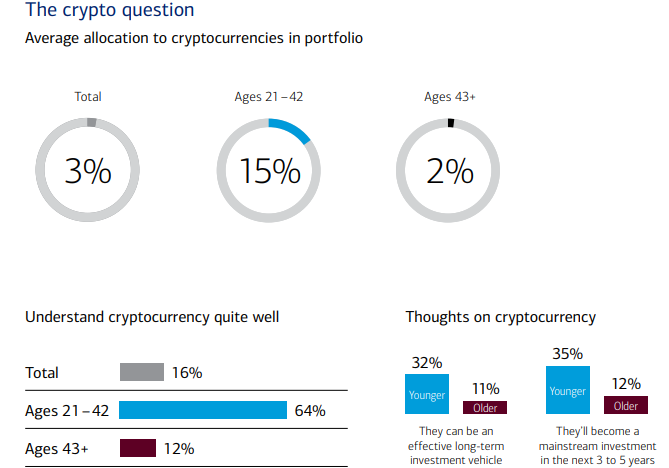

According to the study, young investors between the ages of 21 and 42 say that 15% of their portfolio consists of crypto, and 32% of them believe that digital assets can be an effective long-term investment vehicle. Of the same group of investors, 64% claim they understand crypto fairly well, and 35% say they believe virtual assets will become a mainstream investment within half a decade.

In addition, the report states that 60% of young investors have direct exposure to crypto assets, while nearly half have invested in shares of companies in the digital asset space. Young investors are also exploring the world of non-fungible tokens (NFTs) with 59% of them saying they currently own NFTs or are interested in the new type of digital asset.

You can read the full report here.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/Den Rise/Sensvector