Airtel Africa: Fast Growing Telecom with Fintech Potential

TPROduction/iStock via Getty Images

Introduction

Airtel Africa is a telecommunications and fintech company based in Africa. Airtel Africa operates 14 mobile networks in Africa, with Nigeria as their largest market. Airtel also operates the Airtel Money platform, which offers online mobile payment and banking services services to 26.2 million users. Africa is a continent with enormous opportunities. Both business segments in which Airtel Africa operates are benefiting from major tailwinds such as increasing mobile penetration, data usage and mobile banking usage. All three areas lag behind other emerging markets such as Asia and Latin America, and therefore have many “catch up” opportunities. This gives Airtel a long growth trajectory, not to mention Airtel trades at under 12x FCF with a rising ROIC of over 20%.

Opportunity in Africa

The opportunity in Africa is characterized by increasing mobile penetration, data use and a large unbanked population.

Mobile penetration

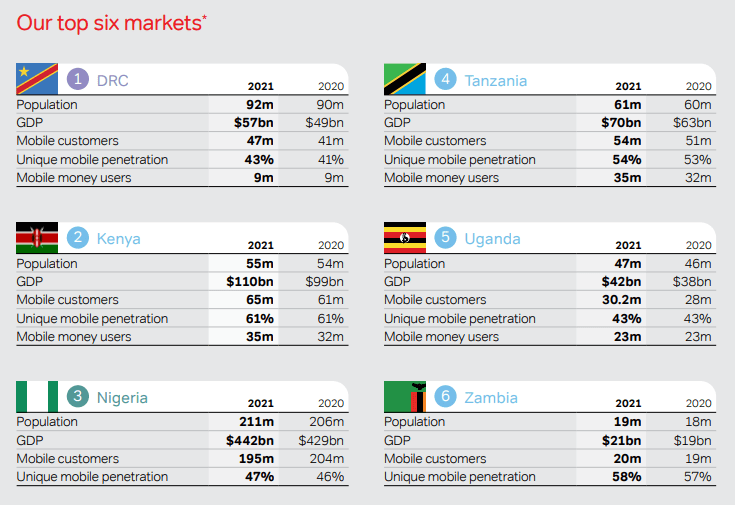

Airtel’s largest markets are Nigeria, DRC and Kenya and in these markets mobile penetration is 92%, 118% and 51% respectively. Mobile penetration is calculated as the number of SIM cards in use. However, this is a misleading calculation as most consumers in Africa use multiple SIM cards, allowing them to easily switch between network providers. If you look at unique mobile penetration adjusting for multiple SIMs, sub-Saharan Africa, which emphasizes most of Airtel’s 14 markets, is at around 50%. Airtel’s largest markets Nigeria, DRC and Kenya have a unique mobile penetration of 47%, 43% and 61% respectively.

Airtel Africa’s Top Six Markets (Source: Airtel Africa’s 2022 Annual Report)

This is quite low and represents a huge opportunity for Airtel to participate. For example, at the end of 2020, Latin America had 70% unique mobile penetration. Not only is mobile penetration low, but it is growing rapidly if we only look at Airtel’s top 6 markets. In total, mobile customers have increased by 71 million in 4 years, which is an increase of 20%. This is much faster growth than anywhere else in the world. Airtel itself has increased its customers from 89 million in 2017 to 128 million in 2022.

|

Country |

Mobile customers 2022 |

Mobile customers 2018 |

|

Nigeria |

195 m |

172 m |

|

Kenya |

65 m |

50m |

|

DRC |

47 m |

36 m |

|

Uganda |

30m |

23 m |

|

Zambia |

20 m |

15 m |

|

Tanzania |

54 m |

44 m |

|

Total |

411 m |

340m |

Source: Author created tabular data from Airtel Africa annual reports

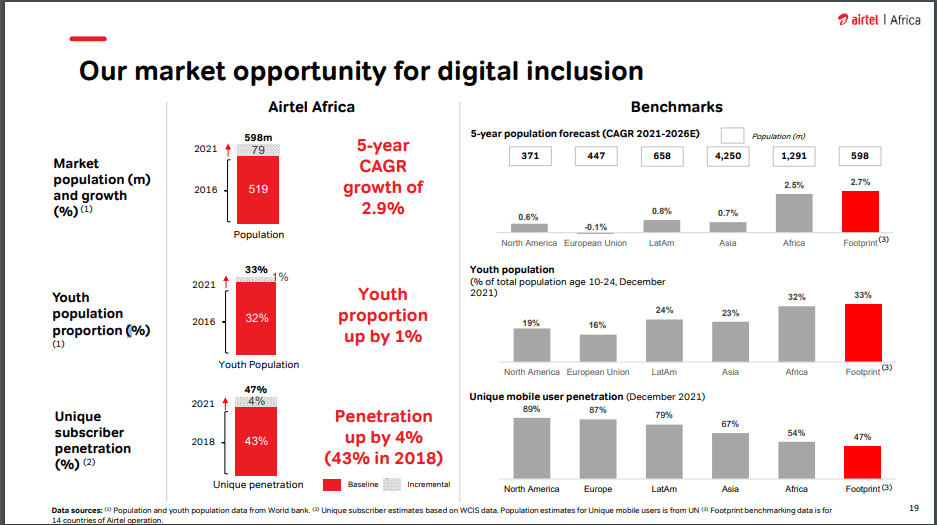

Not only is there a huge amount of customers left to acquire, but Africa has the fastest growing population. Africa’s population is projected to grow by 2.5% compared to other emerging markets such as Latin America and Asia, where growth is only 0.8% and 0.7%.

Source: Airtel Africa FY22 Presentation

Data usage

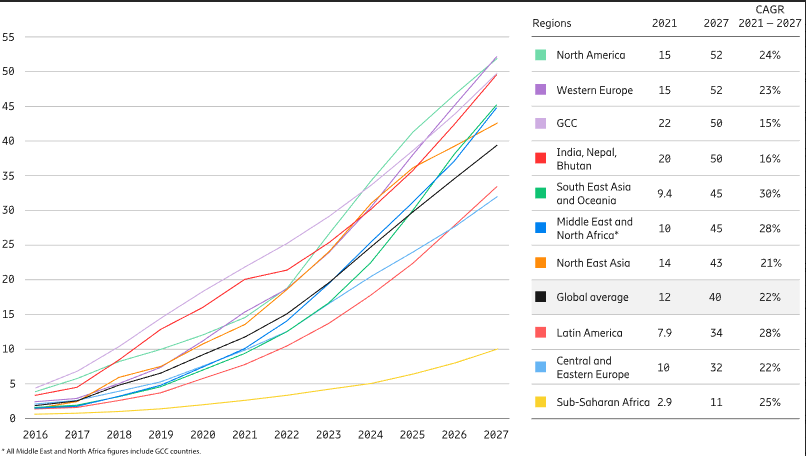

Data usage is an even bigger opportunity than mobile penetration. The average sub-Saharan African smartphone user uses just 2.9GB of data per month. This is the lowest amount of data usage in the world, with Latin America being 3 times higher. By 2027, data usage in sub-Saharan Africa is projected to be 11 GB per month, which is a CAGR of 25%.

Source: Ericsson Mobile Data Traffic Report

Not only is data usage low and increasing, the total amount of customers using data is dramatically lower than customers using voice service. Airtel has a total of 128 million customers using its mobile services as of its 2022 annual report, but only 46.7 million using data services. Number of people using data correlates with smartphone penetration. Currently, Airtel’s markets have only 39% smartphone penetration. Brazil, for example, has 76% smartphone penetration. The growth in data use and data customers will be massive. Data growth per customer for Airtel has already grown from less than 1GB in 2018 to 3.52GB in 2022.

|

Year |

2022 |

2021 |

2020 |

2019 |

2018 |

|

Data usage per customer |

3.52 GB |

2.67 GB |

1.86GB |

1.19GB |

.95GB |

Source: Table created from author data collected from company annual reports

Mobile Money/Fintech

The last growth area is the Mobile Money segment. Many people in Africa lack basic banking services. According to the EIB, less than half of adults in Africa have a bank account. This is where mobile money comes in. Mobile money allows you to do everything a bank does such as send and receive payments, checking and savings services and loans. By the end of 2021, 50% of the sub-Saharan African population or 621 million were using mobile money services. Growth is driven by smartphone penetration and growth in network coverage. Airtel has seen rapid customer growth through its Airtel Money platform. Airtel money has increased customers for their platform from 11 million to 26 million since 2018.

|

Year |

2022 |

2021 |

2020 |

2019 |

2018 |

|

Customer growth |

26.2 m |

21.7 m |

18.3 m |

14 m |

11 m |

Source: Table created from author data collected from company annual reports

Airtel Africa’s growth opportunity in data usage, mobile penetration and mobile money is huge. Next, I will look more specifically at Airtel’s finances, strategy and execution.

Economy

Since Airtel’s IPO in 2019, Airtel has grown revenues, expanded margins and increased returns. Airtel pairs this growth with a cheap valuation. Airtel’s prize is its fintech platform, which could be worth almost half its market cap.

Financial performance

Airtel has pursued its growth potential. Income growth has averaged 13% over the past 4 years. ROIC, a measure of management effectiveness, has increased from 12% to 23% in the past year. Both FCF margin and EBITDA margin have increased dramatically since 2019. FCF margin of 14% in the past year is particularly impressive due to a corporate tax rate of 39%.

|

Year |

Average |

2022 |

2021 |

2020 |

2019 |

|

Income growth |

13.43% |

20% |

14% |

10.8% |

8.4% |

|

FCF margin |

9% |

14.08% |

12.09% |

9.16% |

0.58% |

|

ROIC |

16.35% |

23.3% |

16.5% |

13.5% |

12% |

|

EBITDA |

46% |

49% |

46.1% |

44.3% |

43.3% |

Source: Table created from author data collected from company annual reports

Fintech

Airtel Money is the third largest mobile money platform in Africa with 26.2 million customers. From the 1st quarter of 2023, Airtel has received a mobile money license to operate in Nigeria, which is the largest country in Africa with 220 million people. This will be a huge expansion for Airtel money where they can easily double customers in a short span of time.

|

Mobile Money customers by company |

|

|

Company |

Customer base |

|

Vodacom M-Pesa (OTCPK: VDMCY) |

60.6 m |

|

MTN Money (OTCPK:MTNOY) |

56.8 m |

|

Airtel money |

26.2 m |

|

Orange Money (ORAN) |

25.1 m |

|

Wave |

10 m |

Source: Table created from author data collected from company annual reports

The mobile money platform that Airtel has built is worth quite a lot. Mastercard recently invested in Airtel Money back in 2020 at a 12x EBITDA multiple. Airtel intends to spin off this valuable asset to monetize it within 3 years. Using the multiple at which Mastercard invested, Airtel Money is worth $3.2 billion. Airtel has sold a minority stake not only to Mastercard, but TPG and two other investors. I estimate that the total minority share is around 20% of the company. Airtel is currently valued at £5.4 billion when you net out Airtel Money, the rest of the company trades at just 1.9 times EBITDA or 4.75 times EV/EBITDA. This works out to a less than 7x FCF multiple. Including Airtel Money in the operation, Airtel trades at 12 times FCF multiple. This is extremely cheap for a company with the return on capital and growth prospects that Airtel has.

|

Multiples (currency in USD) |

|

|

Airtel Money Valuation x Minority Stakes |

2.6 billion dollars |

|

Airtel market cap |

6.4 billion dollars |

|

Airtel Market Cap x Airtel Money |

3.8 billion dollars |

|

EBITDA x Airtel Money |

2 billion dollars |

|

EBITDA Multiple x Airtel Money |

1.9 |

|

EV/EBITDA x Airtel Money |

4.75 |

|

Current FCF to controlling shareholders |

541 million dollars |

|

Current FCF Multiple |

12 |

Source: Table created from author data collected from company annual reports

Risks

I see two main risks for Airtel, this includes political instability, competition and debt.

Political instability

Africa is not known for the most stable governments. For example, Ethiopia is currently in a civil war and in Nigeria, 800 inmates were broken out of a prison. This general instability in African nations is the biggest risk. Nigeria is Airtel’s biggest market in terms of revenue and thus the biggest country risk.

Competition

Competition in mobile services usually takes the form of an oligopoly structure. The real risk in competition comes from mobile money. The huge opportunity for unbanked individuals is attracting many fintech investments. Orange reported a large decline in mobile money revenue citing Wave, a VC-backed fintech platform, as a key reason for the decline.

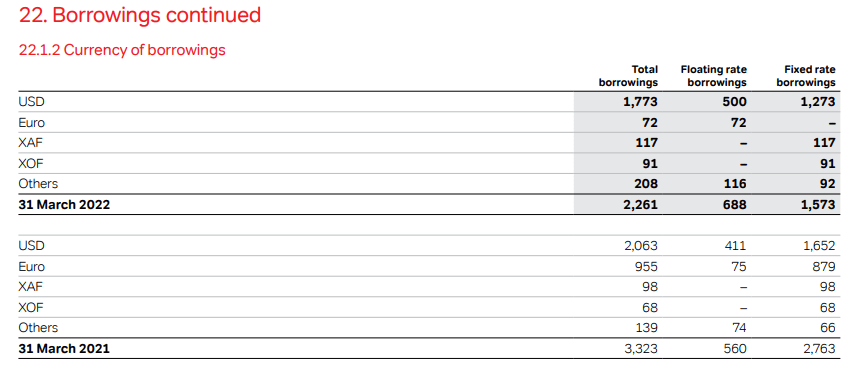

Debt

Airtel’s debt is mostly fixed, which is good, but most of the debt is in USD. Airtel derives its revenue in African currencies, which creates a mismatch for its liabilities. A major devaluation in African currencies could adversely affect Airtel’s ability to service its debt.

Source: Airtel Annual Report 2022

In Airtel’s Q1 2023 call, management announced that it intended to change its debt structure with more local currency debt in the operating companies instead of foreign currency debt at the holding company level.

Conclusion

Airtel Africa is benefiting from major tailwinds as smartphone penetration, data usage and banking services grow rapidly in Africa. This gives Airtel a long growth trajectory. Not to mention, Airtel has performed by growing revenues, expanding margins and increasing ROIC – with ROIC in excess of 20%. Mobile money is a particularly valuable segment that Airtel will soon monetize. All this at just 12 times FCF.

Side note:

Airtel Africa’s listing on the British ticker (AAF) is much more liquid than Airtel’s OTC listings in the US.