6 Reasons to Lean Bullish

The recent pullback and subsequent recovery demonstrate BTC price resilience in the face of market volatility. Key values and trends can provide insight into the price of Bitcoin today and where it is headed.

Looking at chain data, derivative indicators and the role of leverage in the cryptocurrency market can help traders make informed decisions about today’s Bitcoin price and its future.

Bitcoin Price Today: Support at 50-day SMA

Last week, Bitcoin experienced a brief pullback, but found strong support around a crucial moving average. After breaking the $25,000 mark, it is important to monitor pullbacks to assess the remaining buying power.

In this case, buyers were quick to enter the 50-day SMA, signaling bullish momentum. However, the $30,000-$31,000 range has proven to be a strong resistance zone for the Bitcoin price today, indicating the possibility of further consolidation.

The upcoming FOMC meeting could affect Bitcoin’s current strength, as the policy decision could affect market sentiment.

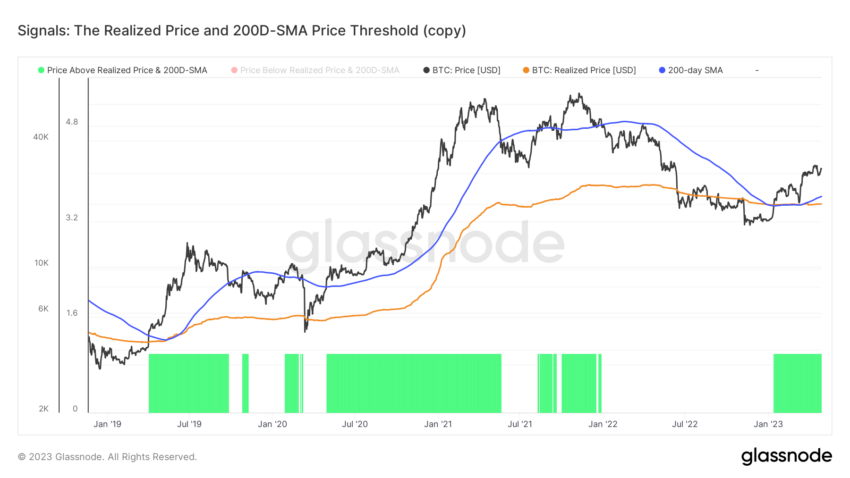

On-Chain Indicators: Cost base divergence and long-term holding supply

A growing difference between the short-term and long-term ownership cost basis is a historically accurate signal that the worst of the bear market is behind us. The cost base for short-term holders has risen to $24,000, while the cost base for long-term holders has fallen to just under $21,000.

This divergence suggests that the cost basis of short-term holders is now acting as support for today’s Bitcoin price.

Although this level has only been tested once during the current recovery phase, it held up successfully.

The decline in the long-term ownership cost base can be attributed to entities that bought Bitcoin cheap after the FTX collapse, now aging into the long-term ownership cohort.

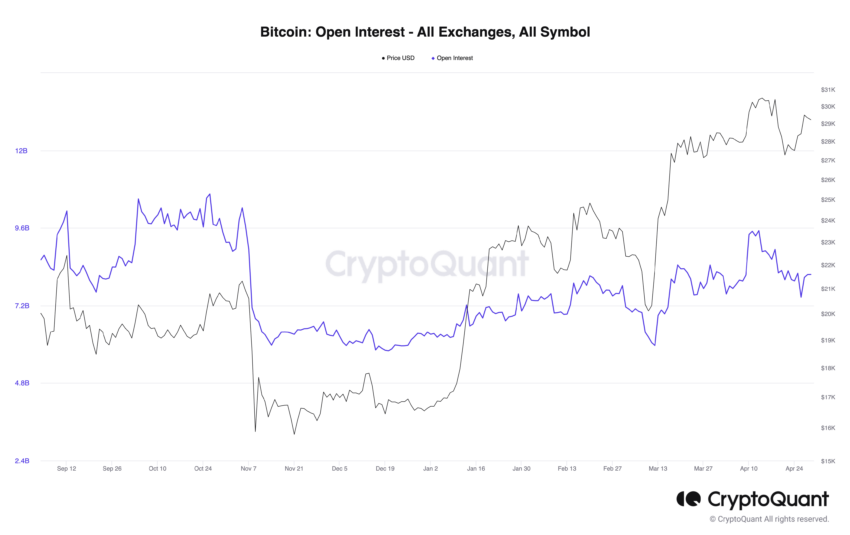

Derivatives markets: Leverage and volatility

Influence played a significant role in this week’s market volatility. In fact, the sharp drop in open interest and an increase in total futures liquidations clearly indicate that.

Interestingly, open interest continued to decline even as Bitcoin’s price rose from $27,000 to $30,000, thus indicating that the rebound could have been driven by spot trading.

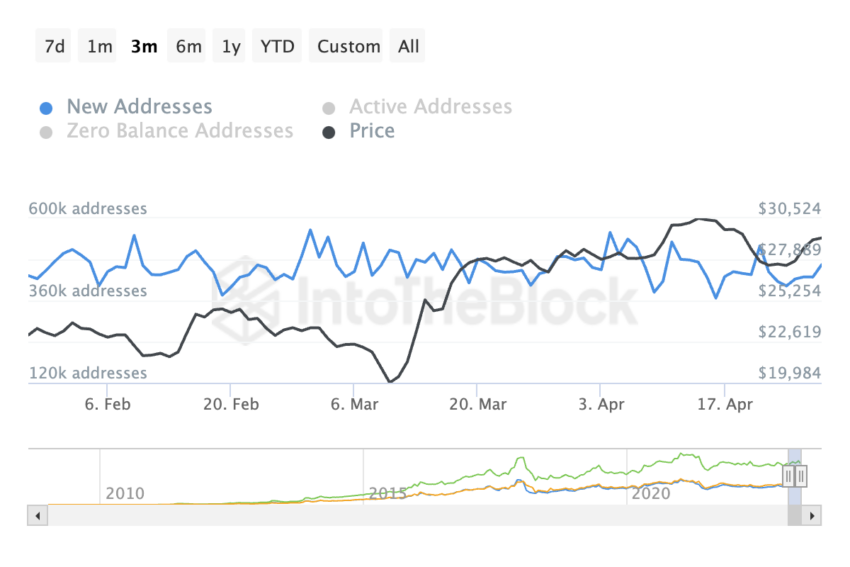

Tightening of supply and increasing demand

In the bigger picture, Bitcoin’s supply continues to tighten, with 54% of the supply remaining untouched for two or more years. This holding pattern demonstrates long-term conviction in the face of market fluctuations.

Additionally, new addresses are being created at an almost historic pace, signaling increasing demand for the Bitcoin price today.

A combination of tighter supply and increasing demand in the chain lays the foundation for potential price increases in the medium and long term.

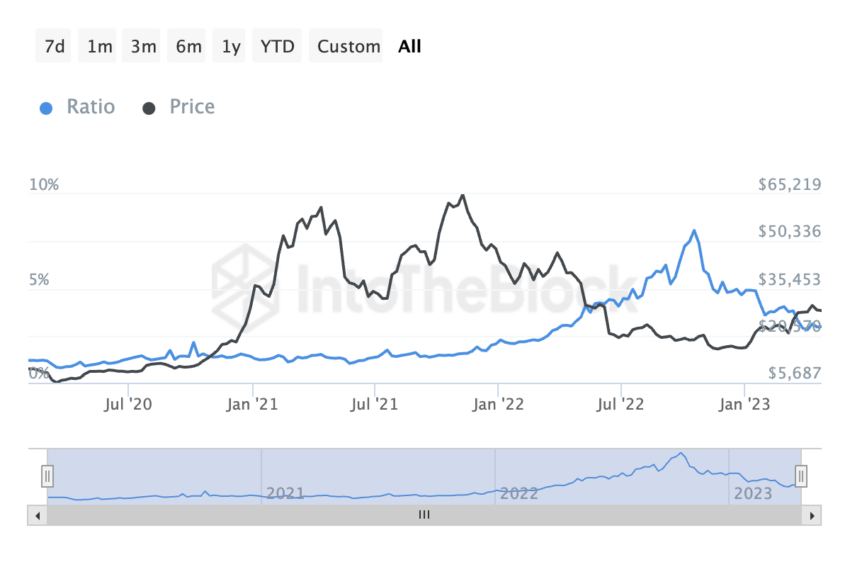

Reducing influence: A trend towards stability

The primary obstacle for Bitcoin in the near term is leverage-induced volatility. However, the overall trend shows a decline in market influence, which can make periods of volatility less impactful.

Measurements such as open interest relative to market value and the percentage of futures contracts margined with BTC can help measure influence and risk appetite in the market.

Both of these metrics are on a downward trajectory, indicating a possible shift towards more stable market conditions.

Bitcoin’s future prospects

Bitcoin’s resilience amid market fluctuations and its ability to recover from short-term setbacks demonstrate its underlying strength. As leverage continues to wane and on-chain demand grows, BTC may be bracing itself for potential price appreciation.

Traders should closely monitor key trends and trends to make informed decisions about Bitcoin’s future prospects.

Disclaimer

In line with Trust Project guidelines, this price analysis article is intended for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, objective reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions.