In about three days, Ethereum is expected to transition from a proof-of-work (PoW) blockchain network to a proof-of-stake (PoS) version via The Merge. Ahead of the transition, the liquid staking project Lido has seen much more activity as the value locked in the protocol increased by more than 13% this week. Also, the project’s lido dao governance token has traded up 25.4% against the US dollar during the last seven days.

Lido TVL jumps 13% higher this week, the project’s wrapped Ether represents more than 30% of stake Ethereum

Last week, Bitcoin.com News reported on the decentralized finance project (defi) Lido as the project started to see more demand ahead of The Merge. Lido Finance is a liquid staking project that allows people to package cryptoassets to collect a staking return, but the process also allows owners to hold the assets in a non-custodial manner and be able to trade them as well.

Lido offers liquid staking solutions for blockchains such as Ethereum, Solana, Polygon, Polkadot and Kusama. However, most of the value locked in Lido originates from locked ether, as ETH represents $7.61 billion of Lido’s total value locked at $7.81 billion (TVL).

Over the past seven days, defillama.com calculations indicate that Lido’s TVL swelled by 13.08%, and TVL has risen by 2.43% over the past 24 hours. While Makerdao is the largest defi protocol today, in terms of TVL statistics, Lido is the second largest defi protocol on 9/11.

The ether locked in Lido’s application alone represents 12.60% of TVL’s $60.38 billion in defi today. Lido’s wrapped ether derivative token, STETH, is the 13th largest market capitalization of the 12,907 tokens worth $1.1 trillion. Lido’s governance token lido dao (LDO) has gained 25.4% over the past two weeks.

Three major exchanges and 8 Ethereum 2.0 pools

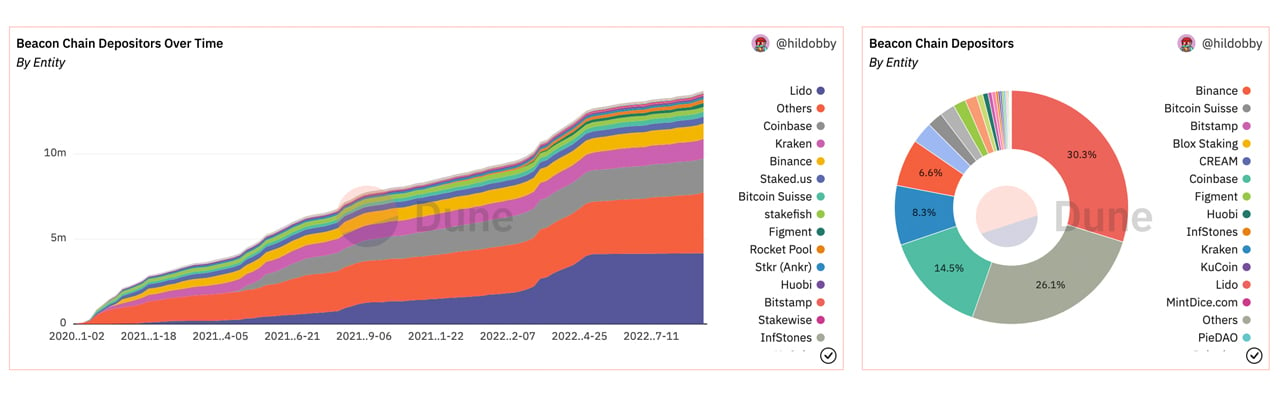

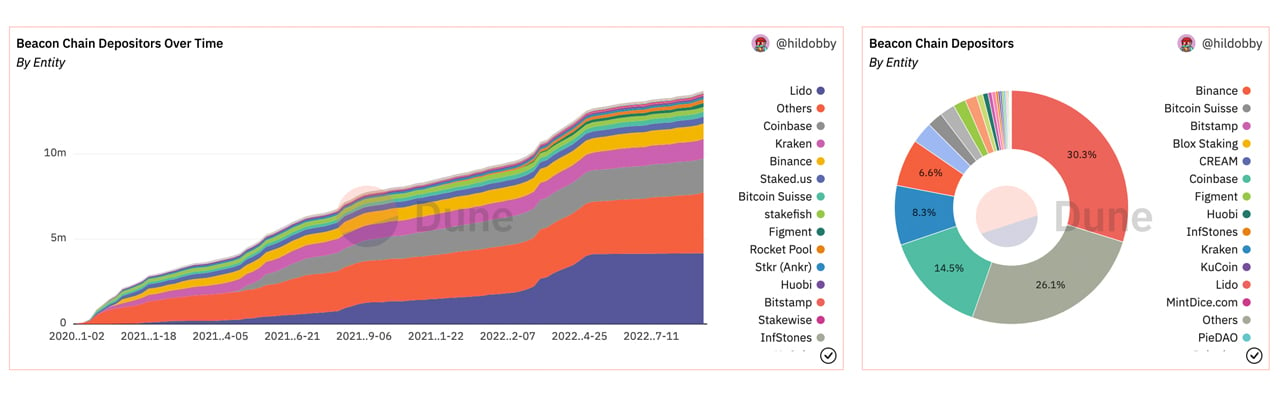

Data from Dune Analytics shows that Lido is the largest Beacon chain depositor with 30.3% of deposits originating from Lido Finance. Coinbase is second behind Lido with 14.5% of Beacon chain deposits and Kraken commands 8.3%.

Coinbase recently launched a liquid staking token called coinbase wrapped ethereum (CBETH), and in mid-August a JPMorgan market analyst said Coinbase could be a significant asset to Ethereum’s Merge transition. At press time, there are 13,638,351 Ether locked into the ETH 2.0 contract, and there are 426,198 validators. 30.49% of the 13.6 million ETH stakes are staked via Lido Finance.

Besides massive exchanges like Coinbase, Kraken and Binance, Lido competes with Stkr, Sharedstake, Stafi, Stakewise, Cream, Stakehound and Rocketpool. Between Lido, Rocketpool, Stakehound, Stakewise, Stafi, Sharedstake and Stkr, there is approximately $8.11 billion in value.

While Lido holds 30.49% of the ETH stake, the aforementioned ETH 2.0 pools represent 33.11% of the stake today. There are 4,585,038 locked Ether between the eight ETH 2.0 pools today.

Tags in this story

13 million ether, Binance, CBETH, Coinbase, coinbase wrapped ether, ETH 2.0, ETH 2.0 Contract, ETH liquid staking, ETH staked, Kraken, LDO, Lido, Lido Finance, Lido wrapped ether, Liquid Staking, liquid staking ETH, Rocketpool, Sharedstake, Stafi, Staked ETH, Stakehound, Stakewise, staking, STETH, Stkr, Validators

What do you think of the recent Lido Finance promotion and the amount of ether eight pools have held? Let us know what you think about this topic in the comments section below.

Jamie Redman

Jamie Redman is the news editor at Bitcoin.com News and a financial technology journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open source and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is directly or indirectly responsible for damages or losses caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.