Analyst predicts rally for two of Ethereum’s biggest rivals, says Bitcoin may bounce harder than traders think

A popular analyst predicts if and when three cryptocurrencies may break out of the prolonged market downturn to achieve a short-term rally.

Pseudonym cryptohandler Altcoin Sherpa says his 180,000 Twitter followers, he is not encouraged by altcoins on their one-hour to daily high time frame [HTF] charts, but think there may be a temporary upside potential for certain projects.

Sherpa believes both Cosmos (ATOM) and layer-1 scaling solution NEAR Protocol (NEAR) can do well.

The HTF market structure is still incredibly bearish for many altcoins, but if we see a little more chop / grinding + these bottom types of patterns play out, I think we will see a short-term move up.

Some potential double bottoms /[cup and handle]/ etc. kind of charts out there for now. “

At the time of writing, Cosmos is up 4.33% over the last 24 hours and traded at $ 9.06.

Next Altcoin Sherpa gives a look at Ethereum (ETH) competitor NEAR.

The NEAR protocol is down by only 2% on the day with a price estimate of $ 3.44.

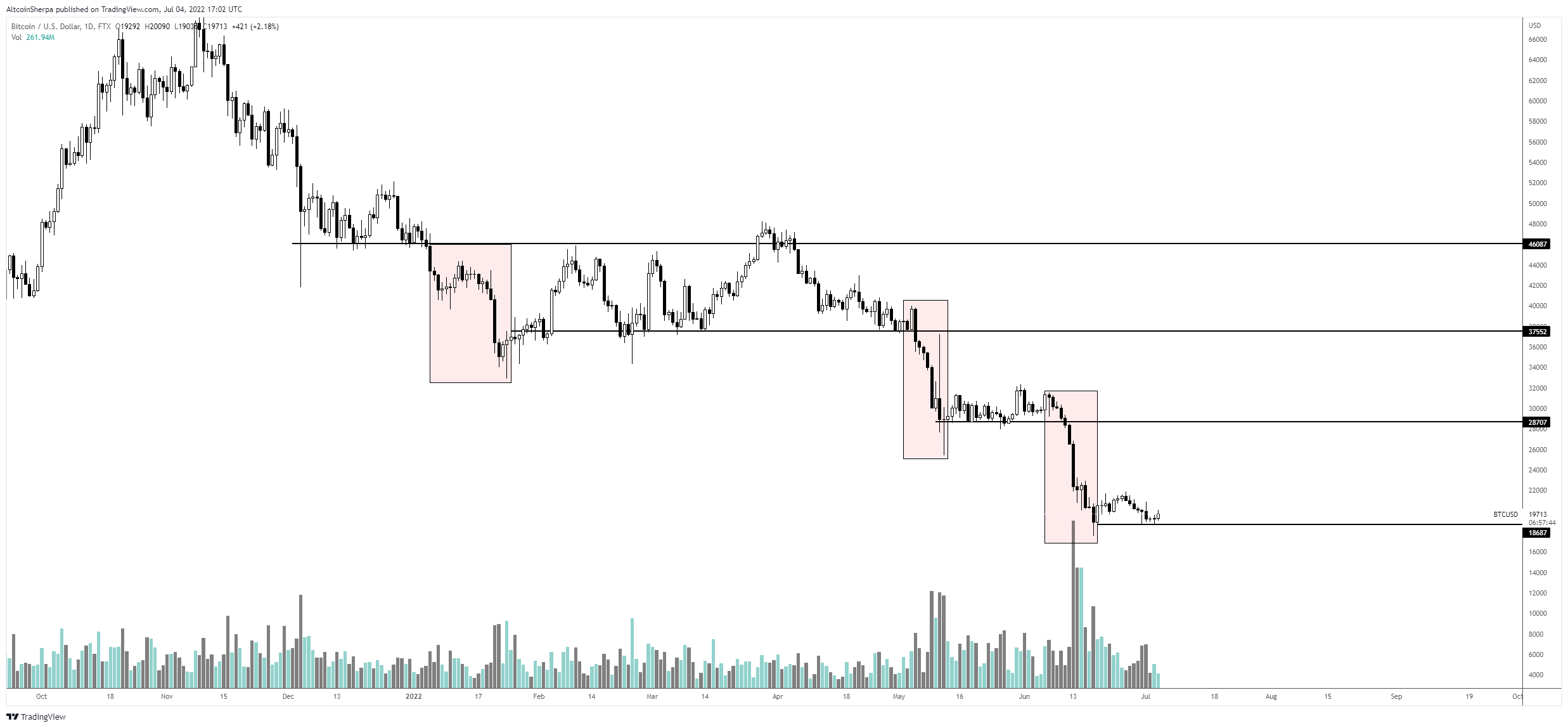

Moves on to the largest crypto asset by market value Bitcoin (BTC), Altcoin Sherpa sier that despite Bitcoin’s six months plus downward trajectory, he predicts another BTC rally reflecting the rise in late March and early April.

“Every single consolidation has resulted in a collapse of high-time chart charts. Will this time be the same?

There will be a new bear market rally similar to March / April 2022; However, I do not know when / where it will happen (or how high). “

The analyst then tells his 10,300 YouTube subscribers that he thinks it is possible Bitcoin could increase as high as $ 30,000 during the next rise.

“You’re really looking for potentially a bear market rally where the price is going to potentially go up harder than you think.

It may look like a move up to $ 30,000. I do not know if it has the strength to get up there, but it is a scenario I am looking at. “

Altcoin Sherpa concludes his remarks by pointing to $ 12,000 as a potential bear cycle low for Bitcoin, before adding that BTC’s price can ultimately be determined by the stock markets instead of its benefits or demand alone.

“This last type of bearish retest that we saw at the end of March, it was in a way the last real bearish retest we saw. Everything else has just been consolidation, collapse, consolidation, collapse. Now we are consolidating.

We could certainly only see another crash for $ 12,000 or anywhere. But there will be a new bear market rally, I do not know what it will look like or how strong it will be, but as I said, it will actually largely depend on shares, in my opinion.

It’s really just its nature, unfortunately. “

Bitcoin is currently up 2.12% over the last 24 hours and has changed hands for $ 20,400.

I

I

Check price action

Don’t miss a beat – Subscribe to have crypto email alerts delivered directly to your inbox

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed by The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment adviser. Please note that The Daily Hodl participates in affiliate marketing.

Selected image: Shutterstock / vvaldmann