Bumper bonuses and bullish indicators

Crypto News: We give you an overview of what’s been happening in the crazy world of crypto this week.

Pity poor Jim Cramer (okay, so probably not too bad). The host of Mad Money’s economic forecasts are often far off. So much so that an inverse-tracking exchange-traded fund (ETF) was created on March 2 to track the opposite of Cramer’s economic predictions.

Jim Cramer’s R&D Fund

And guess what? It outperforms the market by 5%. Investor and founder of uInvst, Gurgavin Chandhoke compared the performance of the Inverse Cramer Tracker ETF with the SPDR S&P 500 ETF Trust.

Cramer was also criticized for allegedly advising viewers to buy shares in the Silicon Valley bank’s parent in February. In April 2022, he included the now-defunct Signature bank in his list of four investable financial companies that he believed would be good buys based on earnings growth.

According to the prospectus, the inverse ETF keeps track of Cramer’s stock picks and general market recommendations throughout the trading day. This includes public endorsements via Twitter or his CNBC TV shows – and then it takes the opposite position.

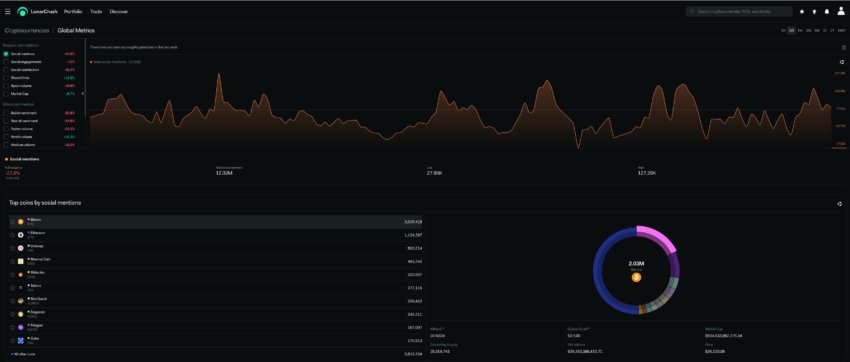

Crypto – socially speaking

Extremely good news?

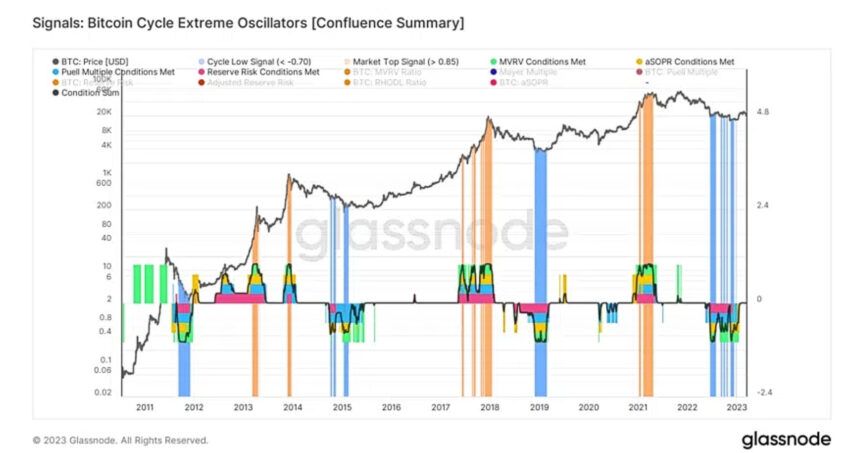

Glassnode has announced a new on-chain analysis tool called the Bitcoin Cycle Extremes indicator. And it claims to be the crypto equivalent of the Philosopher’s Stone. The indicator tries to answer the ultimate question of when the crypto market is peaking or bottoming.

A basic version of the Cycle Extremes indicator was recently presented by Glassnode’s lead analyst @_Checkmatey_ on his Twitter feed. On that occasion, he stated that “confluence is your friend.”

The Cycle Extremes indicator from Glassnode takes into account the four most popular metrics that have historically shown high accuracy in determining the peaks or troughs of BTC cycles.

The chart shows that the extremes of the ongoing bear market appeared between mid-June and late December 2022. But the question remains, how will it perform in the coming months?

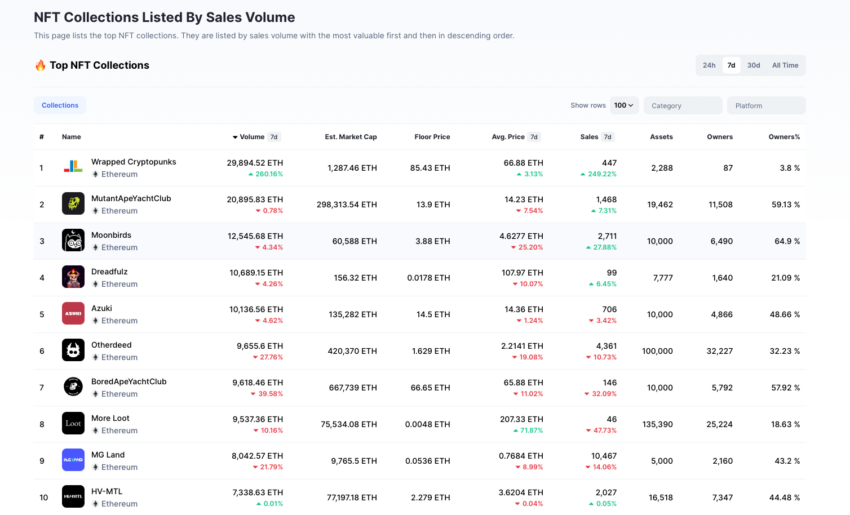

This week in NFT Sales

Banking on a bonus

It’s almost as if top executives at Silicon Valley Bank could see the writing on the wall ahead of the collapse. Just weeks before the bank’s demise, top executives cashed out $4.5 million worth of stock. Although to give them some credit, they also spread the cheer around by paying out annual bonuses to employees as well – just hours before the bank collapsed and the Federal Deposit Insurance Corporation (FDIC) took the keys.

Employees in other countries, unfortunately, were scheduled for payment later in the month. But with the FDIC now in control of the bank, it is unclear whether the payment will go ahead as planned. In the meantime, the authorities have offered to retain some bank employees for 45 days to assist with the transition.

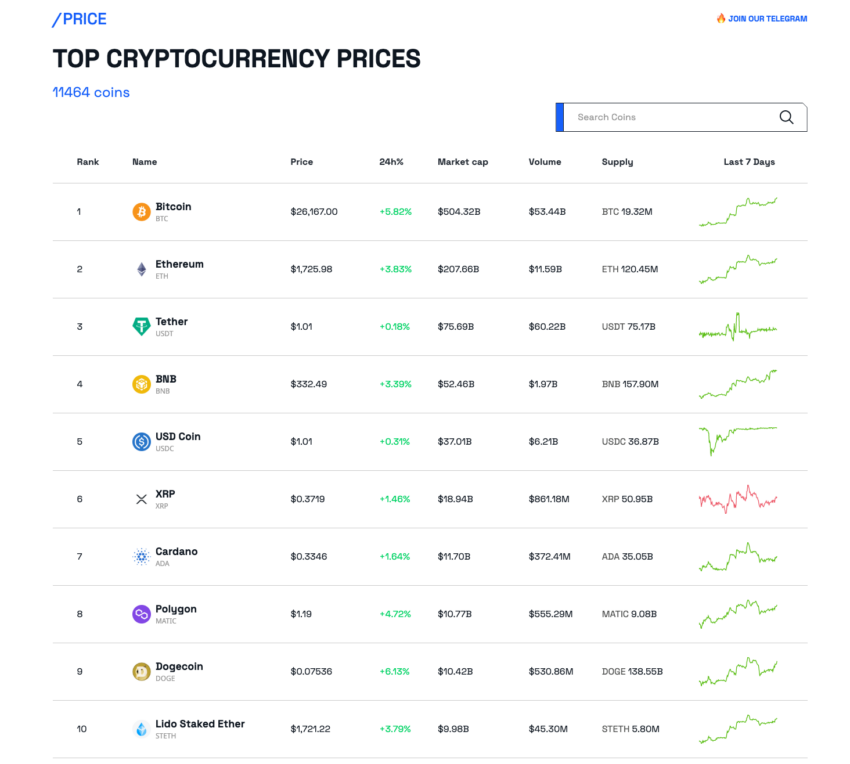

News about crypto coins

A bullish week saw Bitcoin (BTC) rise by more than 25%. Among rising altcoins, Conflux (CFX) doubled in price, Stacks (STX) rose 85% and SingularityNET (AGIX) was up 55%.

The biggest losers included Bone ShibaSwap (BONE), down nearly 17% and Helium (HNT), which fell 15%.

Who will replace Silvergate?

JPMorgan raised an important question about who should fill the void created by the collapse of Silvergate Capital, another bank that failed last week. A research team at Wall Street Titan said crypto firms would be hard-pressed to replace Silvergate Exchange Network’s 24/7 payment rails quickly.

Silvergate announced on March 8 that it would “wind down” operations and refund 100% of customer deposits. The bank was hit hard by several customer withdrawals at the end of last year. It discontinued its Silvergate Exchange Network (SEN) payment rail for “risk” reasons following the departure of several major crypto firms, including Coinbase and Galaxy Digital Holdings.

Make or break for Cardano (ADA)

Our senior analyst Valdrin Tahiri reviews the price action for Cardano (ADA). Can it break through resistance?

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.

![Bitcoin [BTC]: Why a hash rate hike will favor the bears Bitcoin [BTC]: Why a hash rate hike will favor the bears](https://www.cryptoproductivity.org/wp-content/uploads/2023/02/po-2023-02-23T090748.565-1000x600-520x245.png)