How Financial Advisors See Crypto in 2023

Dear Bankless Nation,

It’s been an uphill battle to get the establishment to embrace crypto, but despite a rocky 2022, it’s clear that the asset class has become too big to ignore.

To get a deeper understanding of how US financial advisors are thinking about crypto in 2023, after the FTX contagion wreaked havoc last year, we reached out to our friends at Bitwise to unpack their latest report on the subject, done in partnership with VettaFi .

Below, they dig into 6 key findings from the survey of financial advisors’ attitudes towards cryptoassets.

– Bankless team

👉 Immutable powers the next generation of web3 games ✨

Guest writer: Ryan Rasmussen, Bitwise Research Team

The capital allocation decisions of US financial advisors are critical for an emerging asset class like crypto.

Financial advisors control over $20 trillion in wealth – about half of all wealth in America – and play a key role in educating consumers and institutions about the market.

The annual Bitwise/VettaFi survey plays an important role in revealing how advisors are evolving in their understanding and attitudes towards crypto. Now in its fifth year, the survey reveals key trends in how advisors are engaging with crypto, both individually and with their clients, and how they are shaping the crypto investment landscape.

So how do advisors think about crypto today? Despite market volatility, financial advisors are long-term bullish on crypto. Both advisors and their clients remain interested in crypto and continue to allocate to it at near-all-time high levels. At the same time, limited access, regulatory uncertainty and volatility continue to be major barriers to establishment.

The following are the 6 key findings from the Bitwise/VettaFi 2023 Benchmark Survey of Financial Advisor Attitudes Toward Crypto Assets:

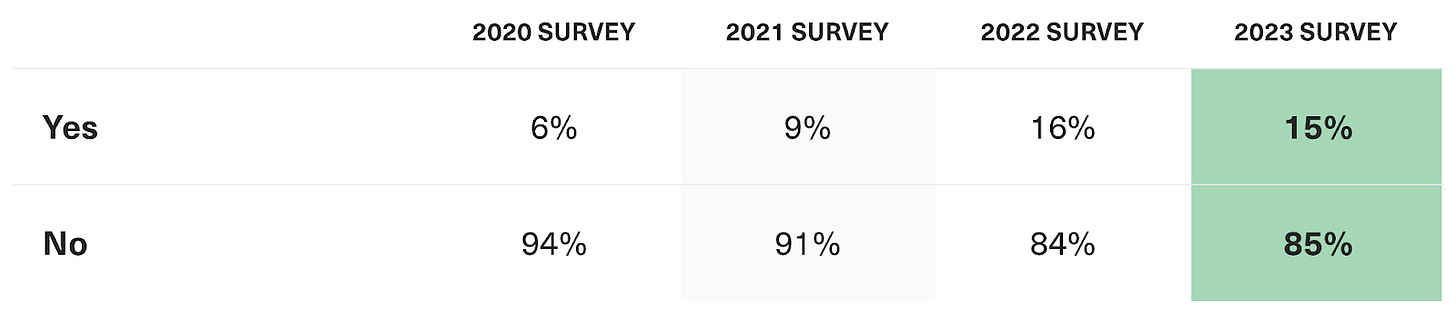

Impressively, given market conditions, the percentage of advisors allocating to crypto in client accounts held roughly steady in 2022, with 15% of respondents reporting advisor-directed allocations for clients. It is about the same as last year (16%) and significantly above 2021 (9%) and 2020 (6%).

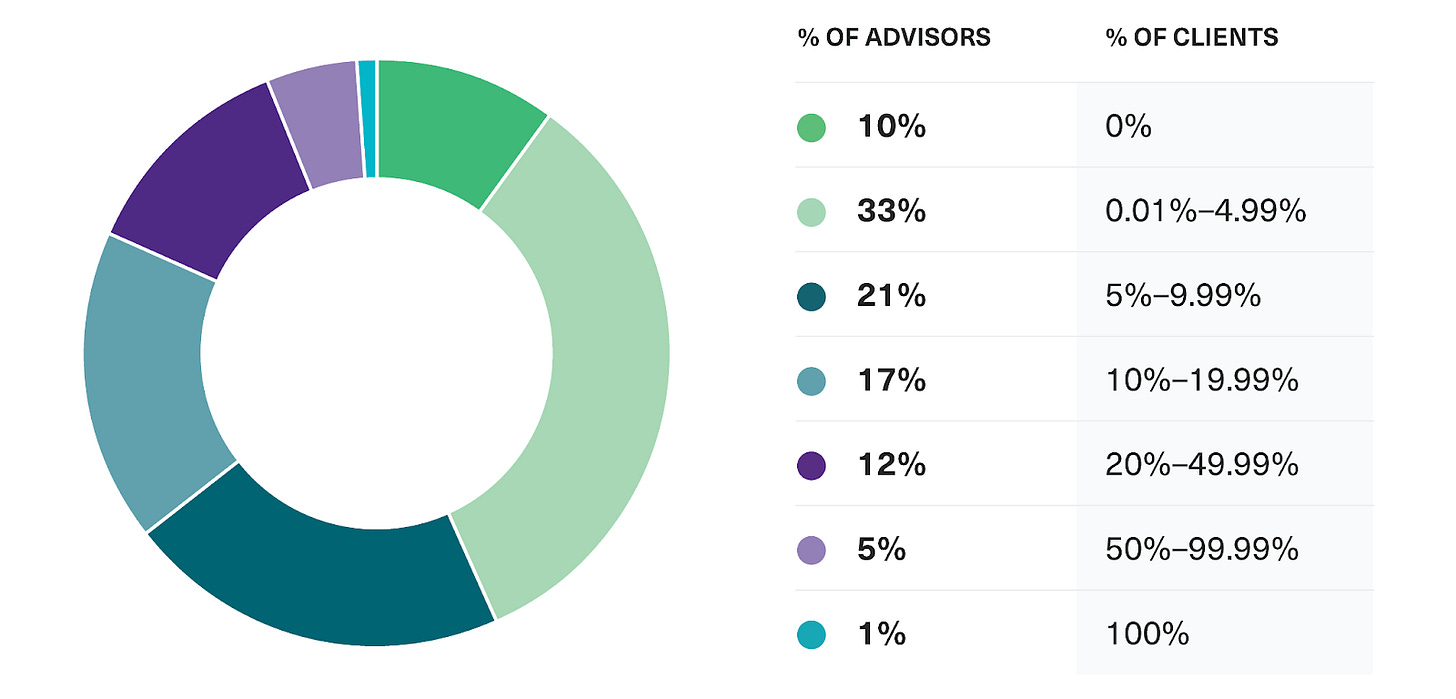

Part of the slow climb is because access is a barrier to adoption – only 29% of advisors said they are able to buy crypto on client accounts. However, among this group, 52% currently allocate on behalf of clients, demonstrating the importance of access.

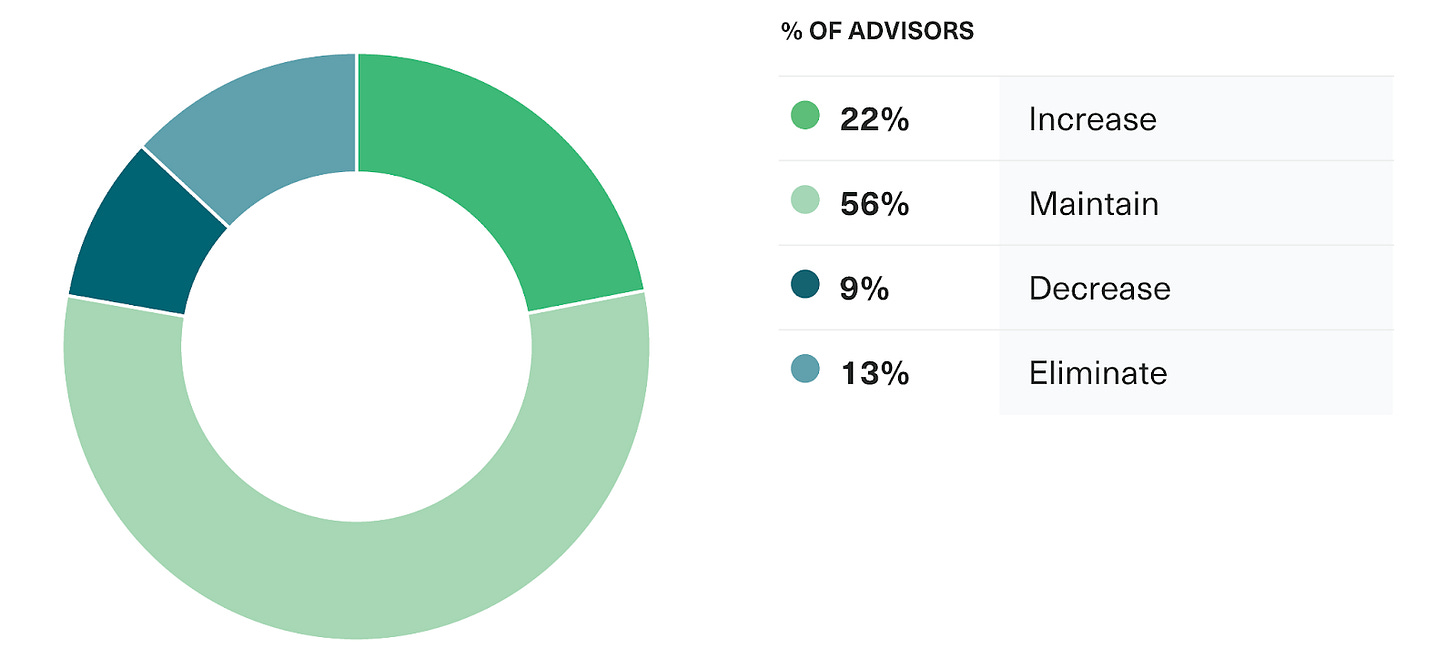

Another important finding was the difference in attitudes between advisors who have already allocated to crypto in client accounts and those who have not. Of those advisors who have not yet allocated to clients, 74% either plan not to add exposure in 2023 or are still evaluating the benefits.

On the other hand, 78% of advisors who have already allocated to crypto in client accounts plan to maintain or increase their exposure. This suggests that advisors who already have exposure may be more knowledgeable and comfortable with crypto’s opportunities and risks, while those who don’t may have been put off by 2022’s crypto winter.

With an abundance of crypto headlines over the past year, client curiosity remained high, and was a significant factor behind advisers’ interest in crypto. 90% of advisors received a question about crypto from clients last year. Although down slightly from 94% in 2021, it was up from 81% in 2020 and 76% in 2019.

When advisors were asked what question they received most from clients, more than half (56%) chose: “Should I consider an investment in crypto?”

Immutable is the developer platform of choice for building and scaling web3 games. Mint millions of assets for freewith frictionless gaming experiences, and increased liquidity through our global order book. Be part of the future with Gods Unchained, Guild of Guardians, Illuvium and many more groundbreaking games.

👉 Visit Immutable.com to start building today.

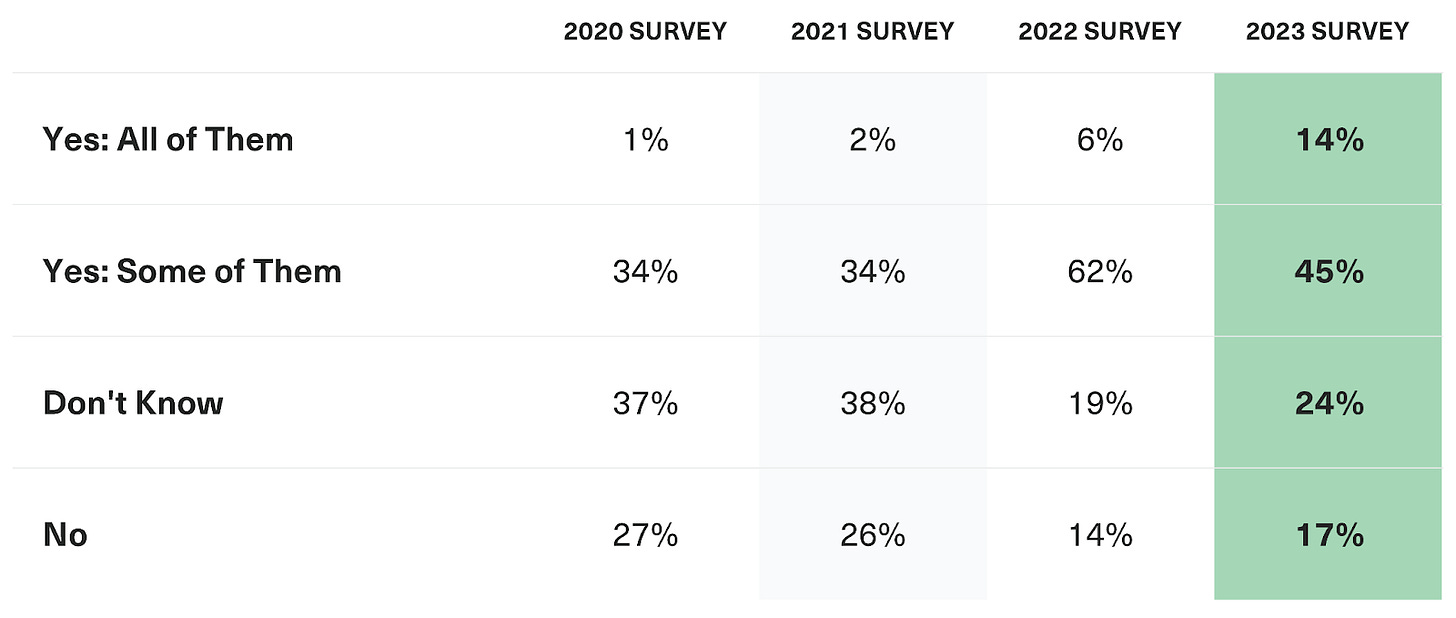

According to respondents, 59% of clients invested in crypto outside of their advisory relationship in 2022, compared to 68% in 2021.

Of the customers who invested on their own, 75% gained exposure via centralized crypto platforms such as Coinbase, while 41% did so directly from their own crypto wallets. Interestingly, only 18% gained exposure through brokerage accounts they manage on their own, preferring more cryptonative approaches.

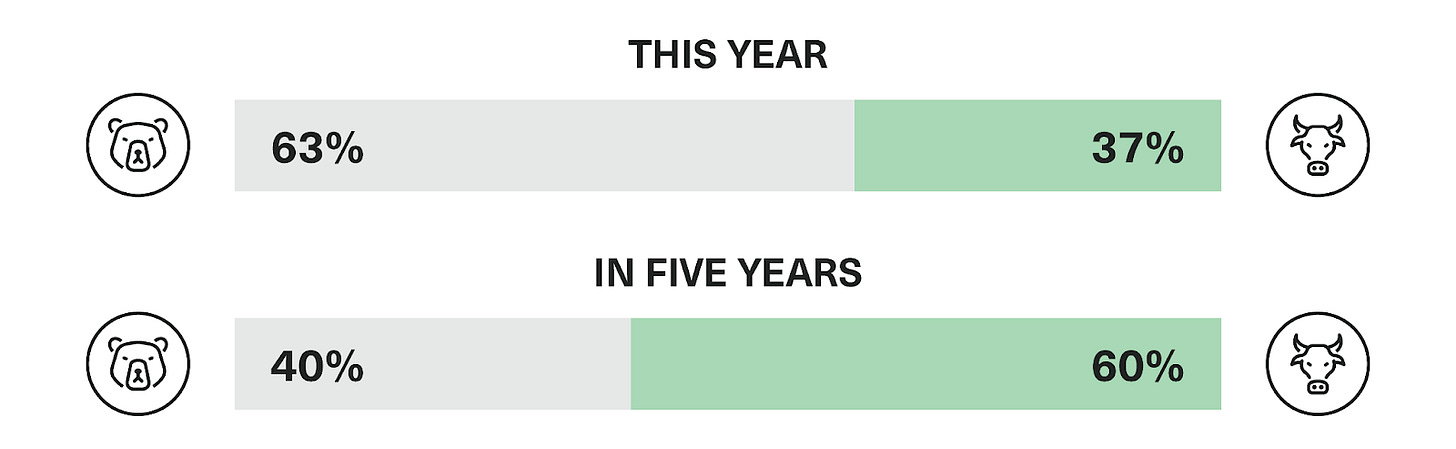

Historically, one of the survey’s most fascinating topics has been the measurement of investor expectations around the price of bitcoin, the largest and most widely used crypto-asset. Here the results reflected a short-term bearish bias.

Less than half (37%) of respondents believe that the price of bitcoin will be higher than it is today within the next year. But those same advisers have long-term confidence in their outlook: 60% believe bitcoin will gain value over the next five years.

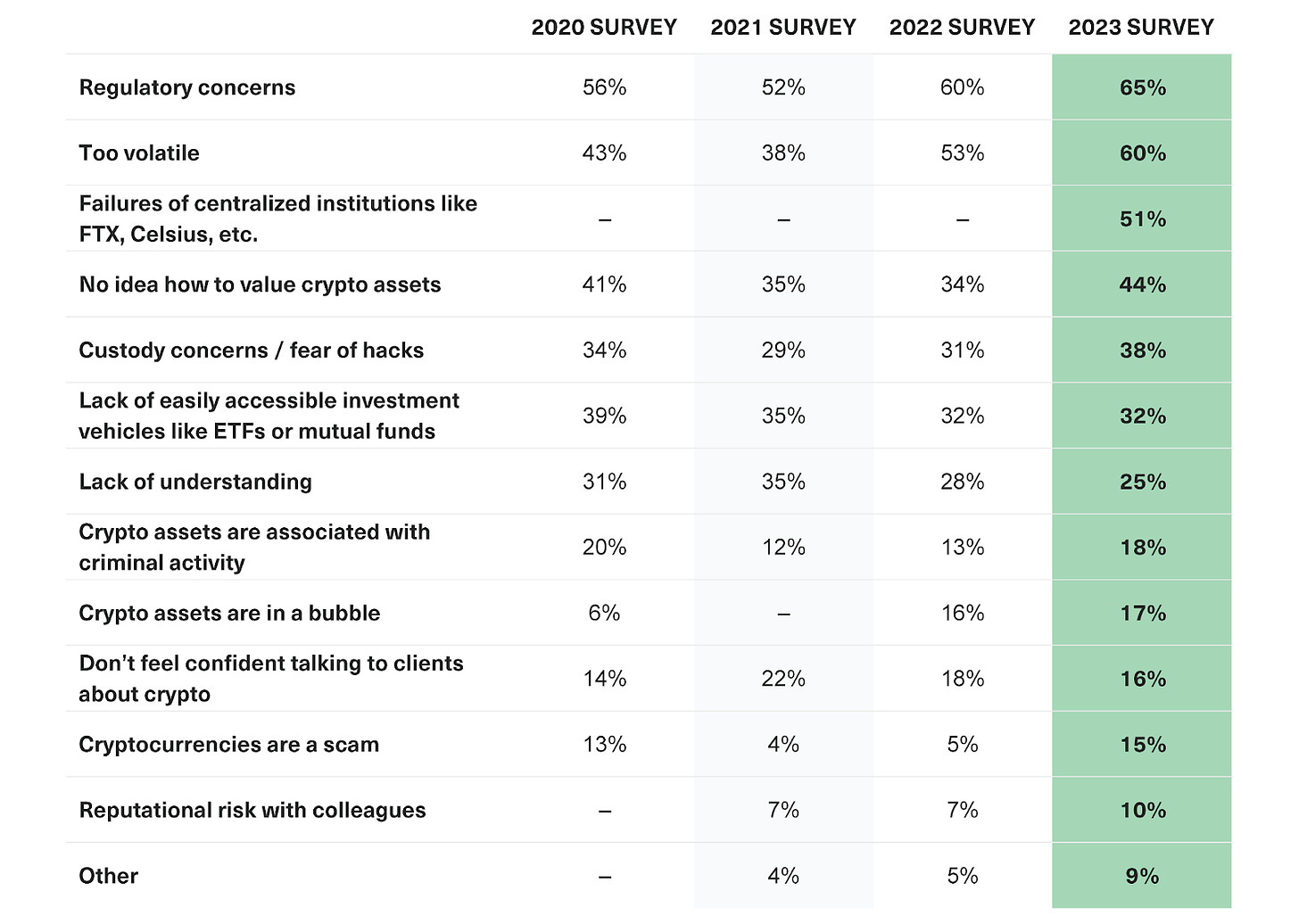

Crypto’s main pain points in 2022 – corporate failure, large price swings and lack of regulatory clarity – were reflected loud and clear as obstacles preventing advisors from starting or increasing their crypto exposure.

The main concern – regulatory uncertainty – remained a perennial source of worry. Sixty-five percent of advisors claimed this was an obstacle to greater crypto adoption, higher than in 2021 (60%), 2020 (52%) and 2019 (56%). One encouraging finding, however, is that advisors’ confidence in their crypto knowledge appears to be growing: Fewer advisors chose “lack of understanding” (25%) or “lack of confidence when talking about crypto” (16%) as roadblocks in 2022.

Note: The choices given in previous surveys were slightly different. Figures may not add to 100% due to rounding and/or survey design.

The survey’s findings confirm what we’ve heard in our daily conversations with thousands of financial professionals across the country throughout 2022: While errors like FTX and the market’s high volatility are cause for concern, advisors and their clients continue to allocate to crypto and interest levels remain high.

Still, institutional investors are not letting the troubles of 2022 slide easily, and fears of crypto’s credit contagion still persist.

Just last month, the FTX collapse and resulting turmoil claimed another victim when Genesis Global, the largest crypto lender, filed for bankruptcy. The company faces billions in potential losses, and the bankruptcy has entangled Gemini, which has hundreds of millions of dollars in customer assets tied up in Genesis; both companies face an SEC lawsuit as a result. Meanwhile, crypto banking giant Silvergate saw a classic run on the bank in Q4, with customers withdrawing 68% of all deposits as people worried about the future. Regulatory issues also arise.

And then there are other idiosyncratic risks for 2023. People are worried about explosions at unregulated institutions like Tether and Binance; there are concerns that we could see significant selling of bitcoin if Mt. Gox bankruptcy is finally being processed this year as planned; and many share similar concerns about price pressure on Ethereum following a planned technological upgrade (Shanghai fork) that will allow staked ETH to begin being withdrawn and sold at the end of Q1.

Against this backdrop, the Fed is still raising interest rates, and fears of a recession linger. So it’s safe to say there’s a lot to worry about this year.

And yet… we’re convinced the bulls will win.

Perhaps not in a straight line – it is too risky to expect prices to march higher without interruption. But looking at the data, we’re increasingly confident about crypto’s long-term trajectory.

For a more in-depth analysis, access the full Bitwise/VettaFi 2023 Benchmark Survey of Financial Advisor Attitudes Toward Crypto Assets here. 👈

Ryan Rasmussen is a crypto research analyst at Bitwise Asset Management, one of the largest and fastest growing crypto asset managers in the world. Prior to joining Bitwise, Ryan managed Financial Planning and Analytics (FP&A) at Cetera Financial Group and was a business analyst at Oakley, Inc.

📝 Research methodology, notes and disclosures

-

Methodology: The goal of the Bitwise/VettaFi 2023 Benchmark Survey of Financial Advisor Attitudes Toward Crypto Assets is to measure how US-based financial advisors think about the crypto market, including whether they believe it is appropriate to allocate client funds to rooms. Our survey aimed to cross-sample various types of advisors from across the country, including independent registered investment advisors (RIAs), broker-dealer representatives, financial planners, wirehouse representatives and institutional investors. Outreach took place from 25 November 2022 to 6 January 2023.

-

Disclosure: Investments in cryptoassets are inherently risky and include possible loss of principal. Nothing in this article is or should be construed as a recommendation to buy or sell securities. Past performance is not an indicator of future performance.

Where will the next airdrop come from? Our team has some ideas… That’s why we created Airdrop guide – This is where we put all our predictions for protocols that are likely to have an airdrop soon.

If you are not already a member of Bankless Premium, upgrade now for instant access.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Mediation. From time to time I may add links in this newsletter to products I use. I may receive a commission if you purchase through one of these links. In addition, the Bankless writers have crypto assets. See our investment information here.